Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - The commodities slid into the negative territory on Wednesday after a sell-off rally seen across the board. Commodities were also ...

-

07-25-2013 10:58 AM

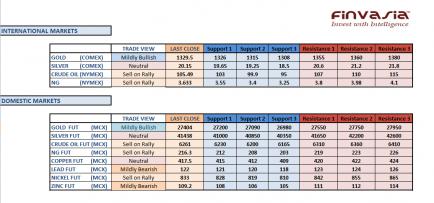

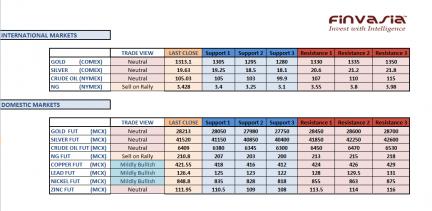

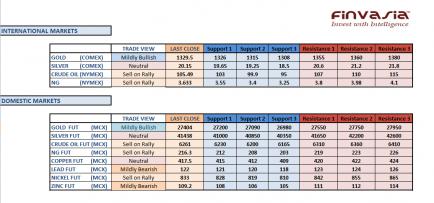

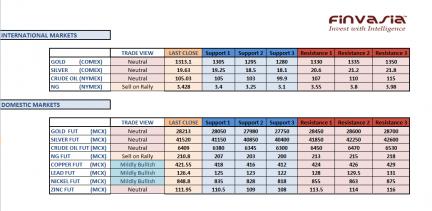

Intraday Tips and Technical Levels for MCX: July 25th

The commodities slid into the negative territory on Wednesday after a sell-off rally seen across the board. Commodities were also pressured down by the appreciation in Rupee. Despite the weakness seen in the previous trade, gold bounced back from USD1216-1217 levels which is acting as a support for gold in the international markets. An opportunity to buy on the dips can be taken in gold. We recommend selling crude oil on rallies. A stronger Rupee would also be of support. We hold a mildly bearish outlook on lead and zinc.

Source: Finvasia Research

-

07-26-2013 10:29 AM

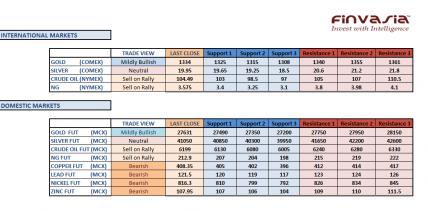

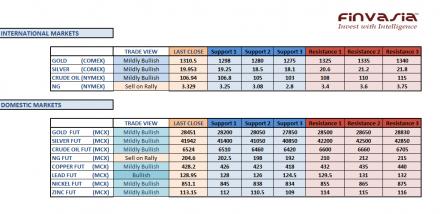

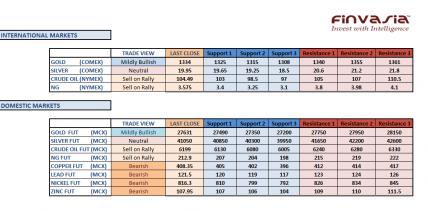

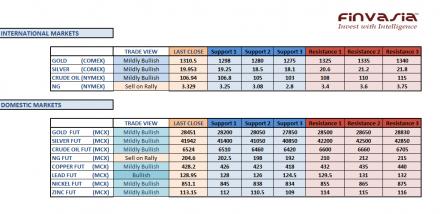

Intraday Tips and Technical Levels for MCX: July 26th

Precious metals have been trading with more of a bullish bias in the international though silver is not trading with much strength in either direction. Appreciation in the domestic markets is likely to limit the gains however we still hold a mildly bullish view in gold. Copper is trading neutral while nickel is a “sell” on rally. Every rally in crude oil should be taken as an opportunity to sell.

Source: Finvasia Research

-

07-29-2013 10:58 AM

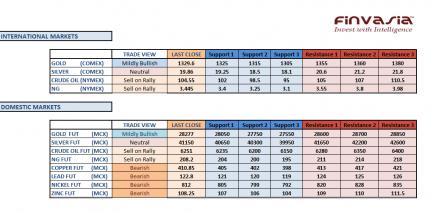

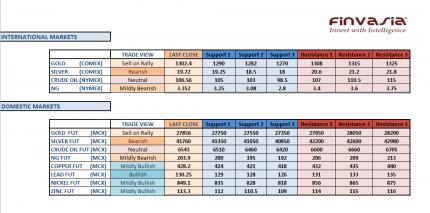

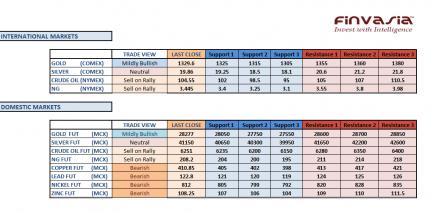

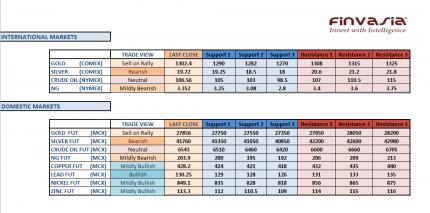

Intraday Tips and Technical Levels for MCX: July 29th

Precious metals continue to trade range bound with more of an upward bias. While gold is seeking its support near USD 1305-1308 levels, Comex silver is trading near a strong resistance at $20 levels. In domestic markets, 27000 and 41000 are the key levels to watch for some significant breakout in gold and silver. Crude oil continues to trade weak and is certainly a "sell on rally". We are bearish across the board in base metals as well.

Source: Finvasia Research

-

07-30-2013 11:04 AM

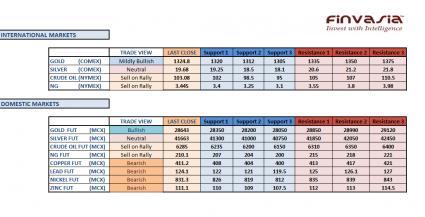

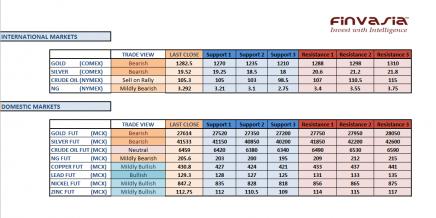

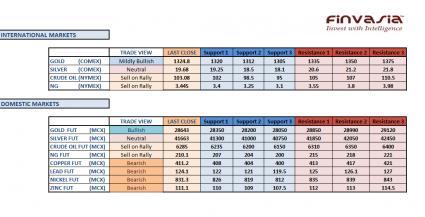

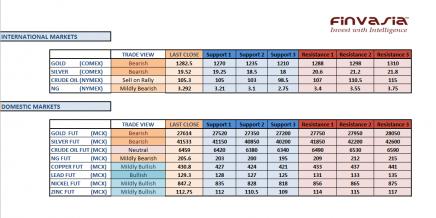

Intraday Tips and Technical Levels for MCX: July 30th

Gold continued to trade strong in the previous session. In the domestic markets, gold gained strength amid hopes of increased demand as the festive season nears, while the gold import regulations might lead to some supply shortages. We continue to hold our bearish view in base metals with copper showing no strength. We recommend selling Crude oil on rallies.

Source: Finvasia Research

-

07-31-2013 11:06 AM

Intraday Tips and Technical Levels for MCX: July 31

In the domestic markets the commodities are being supported massively by the weakness in Rupee. Precious metals continued to surge higher and our view stays bullish in gold. Despite, silver prices trading below the crucial $20 levels in the international markets, silver added some gains in the domestic markets on account of a weak Rupee. Our view continues to stay bearish on copper and other base metals. Watch the currency moves carefully before taking any short positions in commodities. Stay cautious in crude oil ahead of inventories data due at 8:00 pm IST today.

Source:Finvasia Research

-

08-01-2013 10:52 AM

Intraday Tips and Technical Levels for MCX: August 1st

In the international markets, Gold gained strength in the early Asian trading hours on Thursday after the FOMC meet. However, no further clarity of direction is attained. The futures are trading more or less in a range while silver is weak. The white metal has been holding on to its current levels only due to some strength in gold.

In the domestic markets, gold prices look strong. There are also rumors of another duty hike in the yellow metal. Crude oil prices reversed some of its recent losses and traded bullish in today’s early trade. The base metals also turned bullish with the positive Chinese PMI data adding to the metals’ strength. Stay cautious in natural gas ahead of weekly inventories report due at 8:00 pm IST.

Source:Finvasia Research

-

08-02-2013 10:55 AM

Intraday Tips and Technical Levels for MCX: August 2nd

Precious Metals slid lower on account of positive US data and the markets witnessed a sell-off rally in gold prices. However, the yellow metal continues to trade in the lower limit of its recent range. A breakout in either direction should be awaited before entering a trade. Crude oil traded with completely a bullish sentiment and our outlook remains mildly bullish to bullish on crude oil and base metals. Lead is likely to surge further on account of its breakout above 126 levels. Base metals are likely to fetch further optimism on series of positive manufacturing PMI’s reported across the board. Sell natural gas into the rallies.

Source: Finvasia Research

-

08-05-2013 10:46 AM

Intraday Tips and Technical Levels for MCX: August 5th

Precious Metals rebounded on Friday on lower than expected US jobs numbers. The precious metals are likely to stay sensitive to all the indications providing further cues on Fed's tapering plans. The investors are also recommended to watch carefully on the currency moves which can offer a sell on rally opportunity if the currency appreciates significantly from its current levels. Base metals continue to trade with a positive bias as we saw lead and copper giving a technical breakout in the domestic markets. We continue to hold our bullish outlook in crude oil.

Source: Finvasia Research

-

08-06-2013 10:40 AM

Intraday Tips and Technical Levels for MCX: August 6th

Precious metals have not been able to break their near term resistance levels. We recommend selling gold and silver on rallies as the sentiment is bearish for the precious metals as we see not much strength in gold and silver. Weakness in the Indian Rupee can limit the downtrend in the domestic prices. We continue holding our mildly bullish to bullish outlook in precious metals. Copper is seeking some resistance at 3.2 in the international prices while lead is surely a “buy”.

Source: Finvasia Research

-

08-07-2013 10:48 AM

Intraday Tips and Technical Levels for MCX: August 7th

Precious metals are trading with a completely bearish sentiment. In the international markets, gold reversed most of its gains from USD 1315-20 levels while Silver has formed a strong neckline at USD 20 levels. We recommend selling gold and silver into rallies. However, the Rupee weakness might limit the downside to the metals. Base metals are trading with more or less a bullish sentiment. Stay cautious in crude oil ahead of the weekly inventories report today at 8:00 pm IST.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply