Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Gold and Silver are trading with a bullish sentiment in the international markets and the domestic prices are expected to ...

-

08-26-2013 11:12 AM

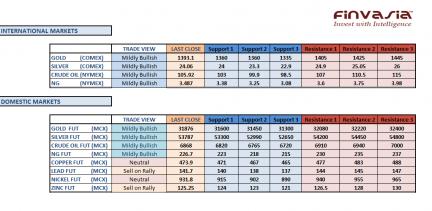

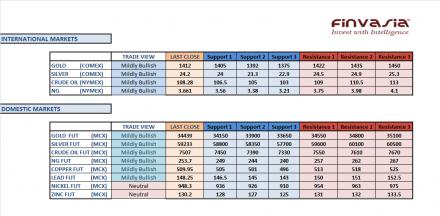

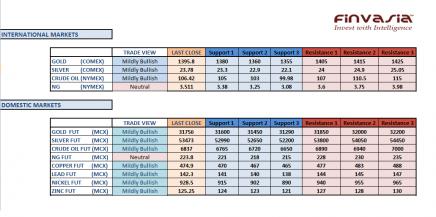

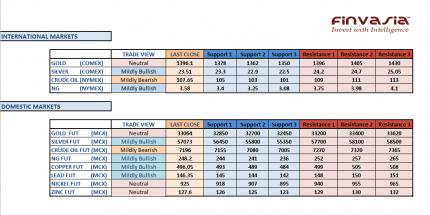

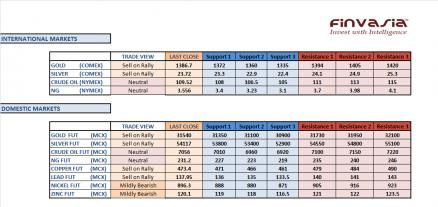

Intraday Tips and Technical Levels for MCX: August 26th

Gold and Silver are trading with a bullish sentiment in the international markets and the domestic prices are expected to follow these moves. However, we recommend our investors to stay cautious as Rupee appreciation can limit the gains to the upside. Also, after the previous session's rally we might see some profit booking coming in precious metals. Crude oil is likely to trade higher on supply concerns. Base Metals continue to trade with a bullish bias. We hold a “mildly bullish” view in Indian Commodities across the board.

Source: Finvasia Research

-

08-27-2013 10:58 AM

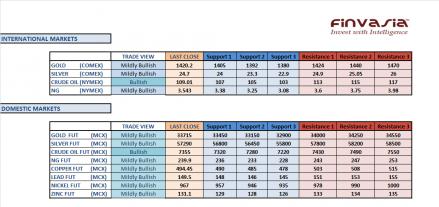

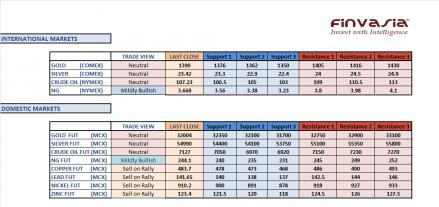

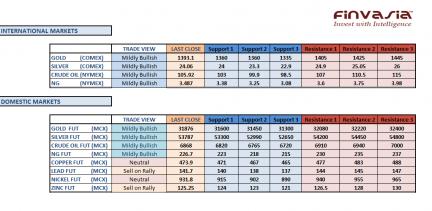

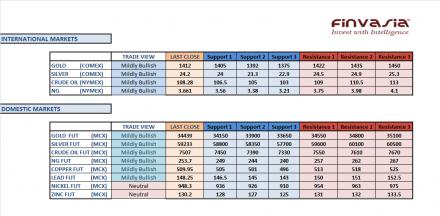

Intraday Tips and Technical Levels for MCX: August 27th

Precious Metals continue to inch higher in the domestic markets though USD 1405 is a very important resistance for the international gold prices. Base metals are likely to witness some selling pressure after its recent rally. However, the downside is expected to remain limited for all the Indian commodities as Rupee trades weaker on the daily charts. We expect all the commodities to open in the positive terrain today. Crude oil prices might gather further support as the supply concerns continue to sustain on Syria’s deepening civil war.

Source: Finvasia Research

-

08-28-2013 11:29 AM

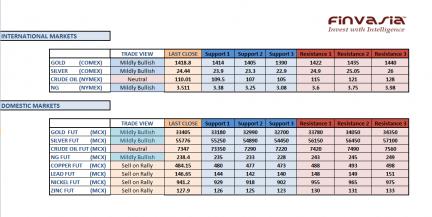

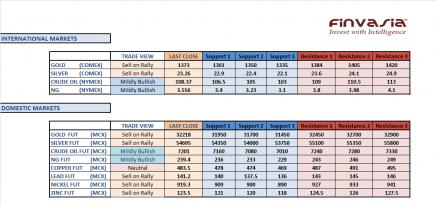

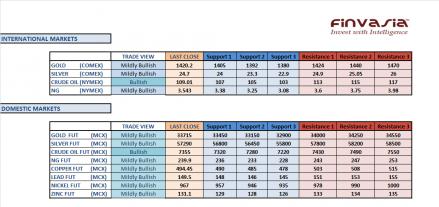

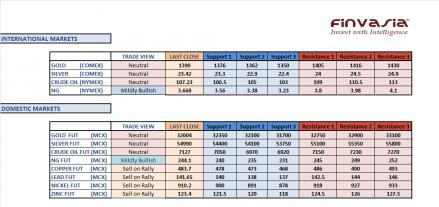

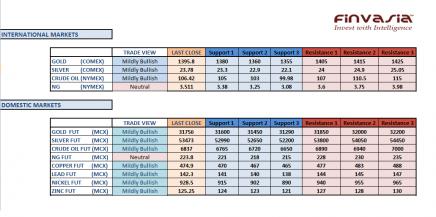

Intraday Tips and Technical Levels for MCX: August 28th

The investors are recommended to stay highly cautious amid the volatile movements in the Indian Rupee. Precious metals certainly seem to have entered the bullish territory while Indian Rupee weakness supports. Crude oil prices witnessed a technical breakout in the international markets which will rally the domestic crude prices further. Base metals are likely to open higher along with all the other major commodities as Rupee weakness sustains. Stay cautious ahead of Crude oil inventories report due at 8:00 pm IST today.

Source: Finvasia Research

-

08-29-2013 11:06 AM

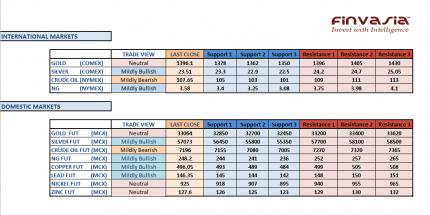

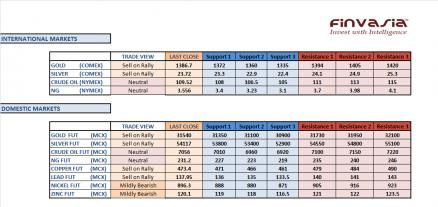

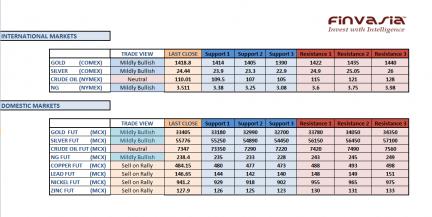

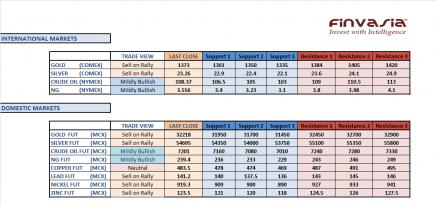

Intraday Tips and Technical Levels for MCX: August 29th

Though the sentiment in precious metals continues to remain positive we might see a sell off rally coming in the Indian commodities. After the Indian Rupee hit its record lows yesterday, it has strengthened by almost 2 rupees today. Therefore, the dollar denominated commodities will remain under a selling pressure due to some strength in the Rupee. Stay highly cautious in gold and silver, which are trading very near to their critical support levels in the international price terms. Natural gas weekly inventories report is due at 8:00 pm IST today.

Source: Finvasia Research

-

09-02-2013 11:04 AM

Intraday Tips and Technical Levels for MCX: September 2nd

Base Metals are likely to trade in the positive terrain, supported by better than expected Chinese PMI data. However, we recommend the investors to stay highly cautious as Indian Rupee is trading higher on Monday which would add selling pressure to all the commodities. Crude oil is expected to trade lower, as the Syrian woes seem to be cooling off. Nymex crude is already down by over 1.5% on the daily charts. Sell on rally is recommended in crude. Stay on the sidelines in gold and silver until a momentum is gathered. The precious metals are more or less trading in a range bound manner for now.

Source: Finvasia Research

-

09-03-2013 01:08 PM

Intraday Tips and Technical Levels for MCX: September 3rd

Gold futures are holding a firm support above USD 1380 levels in the international markets as Silver continues to trade above USD 23.5. Silver is more bullish than gold currently, while weakness in the Indian Rupee supports the metal prices further. We recommend selling crude oil on rallies. As the Syrian concerns ease, oil futures are likely to decline further from its current levels. Copper is likely to trade firm as a lieu of positive manufacturing data was released by China and Europe yesterday. While, other metals can face selling pressure after their recent rally.

Source: Finvasia Research

-

09-04-2013 10:57 AM

Intraday Tips and Technical Levels for MCX: September 4th

Precious metals continue trading with a positive bias and we expect the metal prices to hold gains however, the currency movements are likely to add some volatility. Crude futures edged higher in the previous trade on speculations of a possible US military strike on Syria. The investors are advised to stay cautious in their long term or positional trades as high volatility can be seen in the oil markets. Base metals are expected to stay range bound. Furthermore, economic data and Rupee's direction will guide the price direction.

Source: Finvasia Research

-

09-05-2013 11:32 AM

Intraday Tips and Technical Levels for MCX: September 5th

Indian commodities tumbled in last trading session as Indian Rupee strengthen after RBI new governor announced slew of measures that lifted sentiment in forex market. Indian commodities are expected to open lower on strength in Indian rupee against US dollar. We may see further selling coming in the commodities if Rupee further appreciate.

While in international market, commodities are trading range bound ahead of important economic data and ECB monetary policy meet. We recommend sell on rally in base metals. International gold has strong support at $1380 per ounce and if it breaks that level then we may see further selling coming in precious metals. Trade cautiously in crude and natural gas ahead of weekly inventories data. Natural gas weekly inventories report is due at 8:00 pm IST today while crude weekly inventories report is due at 8:30 pm IST.

Source: Finvasia Research

-

09-06-2013 10:57 AM

Intraday Tips and Technical Levels for MCX: September 6th

Precious metals weakened in last trading session as upbeat US economic data fuels the US Federal Reserve tapering talks. US gold moved below its crucial level of $1380 per ounce and is currently trading at $1373 per ounce. Today, we might see some choppy movement ahead of important US monthly employment data which is due to release at 6pm IST. Stronger US employment data can spark selling pressure in precious metals or vice versa. Trade cautiously in today’s trading session as data can change the market sentiments. We remain mildly bullish on crude as uncertainty remains about the US led military attack on Syria. If US congress on Monday approves the military intervention in Syria then we may see sharp rally coming in crude prices.

- Source: Finvasia Research

-

09-10-2013 11:02 AM

Intraday Tips and Technical Levels for MCX: September 10th

Currently, Precious metals are trading with a mixed bias . However, we are witnessing some short term bearishness in the gold prices. As US gold was unable to sustain above USD 1400 levels, India gold prices also reversed from its all time highs above 35000 levels. We recommend selling precious metals into rallies. Stay cautious in Crude oil as Syria concerns continue to exist. Any US military strike can cause a huge spike in the crude prices. Also, in the domestic markets Rupee appreciation is likely to weigh over the commodity markets. We might see opportunities to sell base metals into a rally.

- Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply