Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - We see a continuous selling pressure on the precious metals. However international silver prices hold a very strong support near ...

-

09-25-2013 10:53 AM

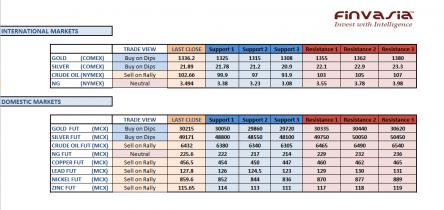

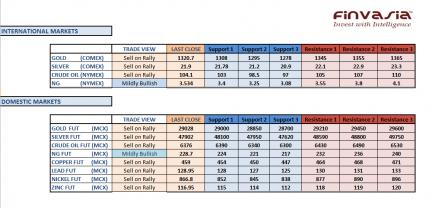

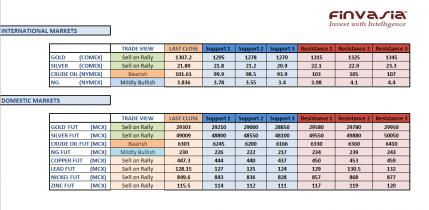

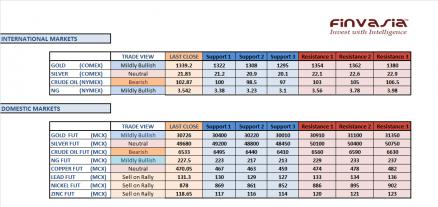

Intraday Tips and Technical Levels for MCX: September 25th

We see a continuous selling pressure on the precious metals. However international silver prices hold a very strong support near USD 20.90 levels. If this support is broken, we might see a strong sell off rally in silver futures. We recommend staying cautious in crude oil trades ahead of the EIA weekly inventory report due at 8:00 pm IST today. We hold a sell on rally view in base metals as well.

Source: Finvasia Research

-

09-26-2013 11:02 AM

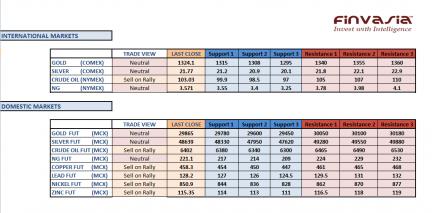

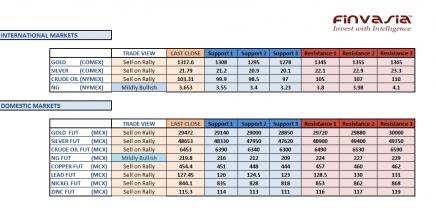

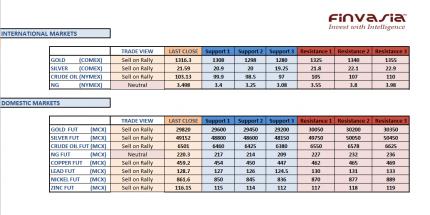

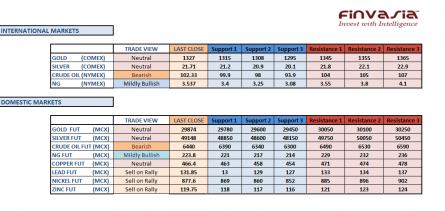

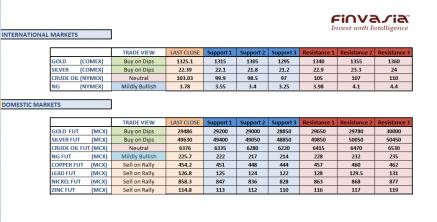

Intraday Tips and Technical Levels for MCX: September 26th

International gold prices have a very strong support near USD 1280 levels while Silver futures have a crucial support near USD 20.90. We recommend our investors to buy precious metals “on dips” till the gold and silver prices continue to hold above their support levels. Crude oil is trading in the bearish terrain. If Nymex crude breaks below $102 levels; we might see a further sell on rally in oil. We continue holding our sell on rally view in crude oil and base metals.

Source: Finvasia Research

-

09-27-2013 11:14 AM

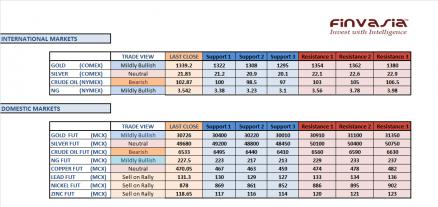

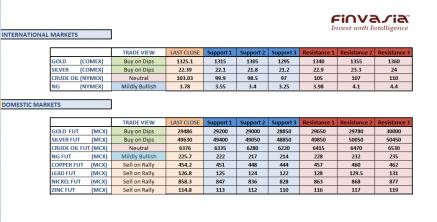

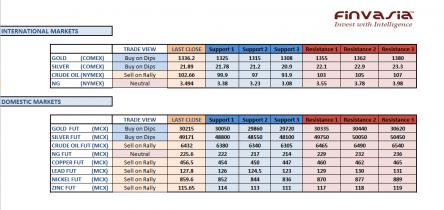

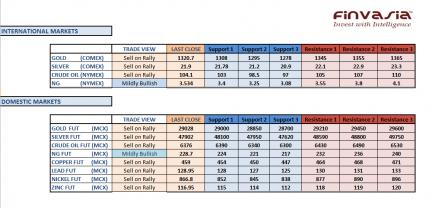

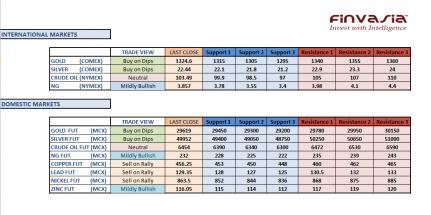

Intraday Tips and Technical Levels for MCX: September 27th

Precious metals are trading within a range with a strong support above USD 1280 levels. The direction is not much clear at the moment, hence we recommend our investors to wait for further clarity of direction before entering into any trades. USD 20.90 is an important support for silver international prices. We continue holding a sell on rally view in crude oil and base metals. Copper in the international markets is trading above its crucial support levels at $3.20.

Source: Finvasia Research

-

09-30-2013 11:10 AM

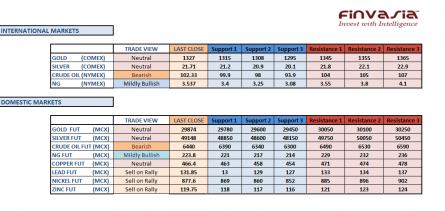

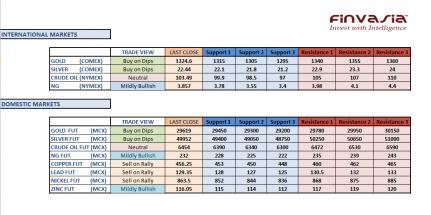

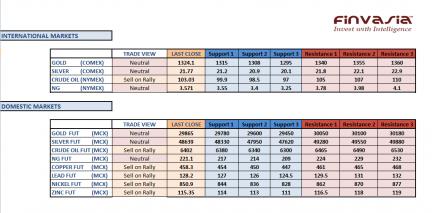

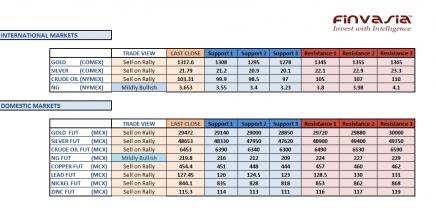

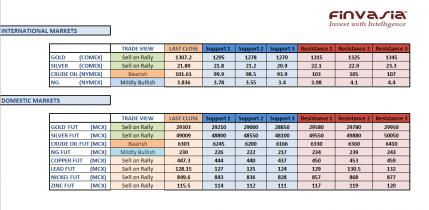

Intraday Tips and Technical Levels for MCX: September 30th

Precious metals gained in last trading session on safe haven investment demand. We hold mildly bullish view in precious metals as concerns regarding US budget impasse continue to provide safe haven support. US lawmakers must pass a budget before Tuesday to avoid a partial shutdown of government. Crude prices are expected to trade with bearish stance. US crude prices have moved below crucial support level of $102 per barrel in today’s trading session after China reported weak manufacturing numbers. Bright supply outlook from Middle East on the back of development liked to Iran & Syria added to negative sentiment in crude market. We continue to hold sell on rally view on base metals.

Source: Finvasia Research

-

10-01-2013 10:56 AM

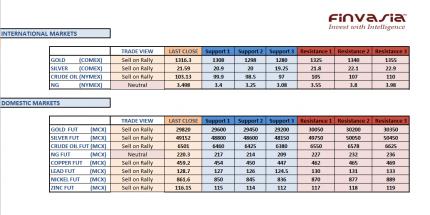

Intraday Tips and Technical Levels for MCX: October 1st

Precious Metals continue to trade with a mixed sentiment and we can see selling pressure coming in at every rally. We recommend staying on the sidelines until a clear direction is achieved. We recommend selling crude oil on rally, the energy prices are likely to remain in the bearish territory if the international crude prices sustain below $102 levels. We continue holding a sell on rally view in base metals as well. Rupee is trading higher on Tuesday hence some selling pressure might also be added by a stronger Rupee.

Source: Finvasia Research

-

10-03-2013 10:57 AM

Intraday Tips and Technical Levels for MCX: October 3rd

We recommend our investors to play from the short side and take opportunities to sell commodities on rallies. Though international precious metal prices are currently trading silent, there can be high volatility in gold & silver prices, as seen in the previous 2 sessions. We recommend entering trades only on some significant movement in the precious metals as the overall trend remains unclear. $1280 continues to act as a strong support for the international gold prices. Stay cautious in natural gas ahead of inventories data due at 8:00 pm IST today.

- Source: Finvasia Research

-

10-04-2013 11:37 AM

Intraday Tips and Technical Levels for MCX: October 4th

Precious metals are trading in a wide but a very volatile range. We recommend our investors to stay highly cautious while trading in gold and silver though we continue holding a sell on rally view on both. If Rupee appreciates further from its current levels, an opportunity to take a sell position in crude oil and base metals can be taken.If the US government continues to remain shutdown, it is likely to have a negative impact on the oil prices on fears of slowing demand from the world’s largest consumer of crude oil. The view on natural gas stays on the bullish side.

Source: Finvasia Research

-

10-08-2013 10:46 AM

Intraday Tips and Technical Levels for MCX: October 8th

Precious metals rallied in the previous session as the US government entered its second week of shutdown. If the political deadlock in Washington does not come to an end it would add further bullishness to the gold and silver prices. We thereby recommend our investors to take an opportunity to buy precious metals on any dips. Crude oil can be traded both ways in a range i.e. buy on dips and sell on rally. We continue holding our sell on rally view in base metals.

Source: Finvasia Research

-

10-09-2013 12:07 PM

Intraday Tips and Technical Levels for MCX: October 9th

We recommend selling the precious metals on dips as the sentiment continues to hold the positive territory for both gold and silver. Our view stays neutral in crude oil as the oil prices are trading in a range. An opportunity can be taken to buy crude oil on dips and sell on rally. Though we hold a sell on rally view in base metals, we recommend our investors to stay cautious towards Rupee movements. Weakness in Rupee can form a strong base for the domestic commodity prices.

Source: Finvasia Research

-

10-10-2013 10:42 AM

Intraday Tips and Technical Levels for MCX: October 10th

The international gold prices have failed to break above USD 1325 levels for a while, facing selling pressure every time it rallies. Therefore, we recommend our investors to sell precious metals on any significant rallies. Crude oil prices broke down significantly below $102 levels entering into the bearish terrain. With continued uncertainty surrounding the US government shutdown we hold a bearish view in crude oil. We recommend selling base metals into rallies.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply