Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - The gold futures traded firm in the previous session with a strong support above 27000 levels ending the session on ...

-

04-30-2013 12:18 PM

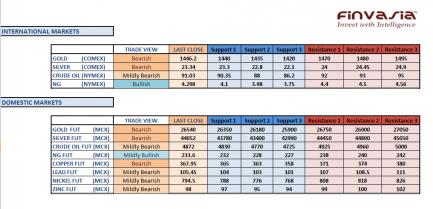

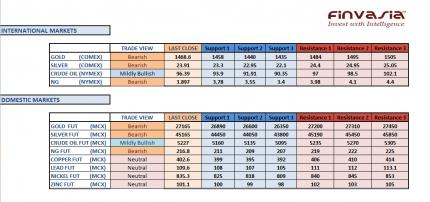

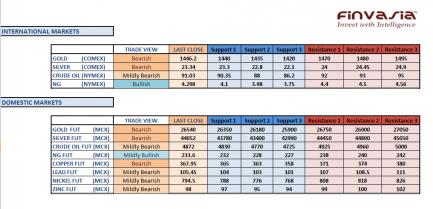

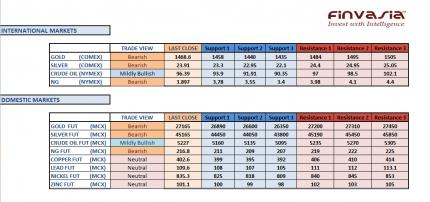

Intraday Tips and Technical levels for MCX: April 30th

The gold futures traded firm in the previous session with a strong support above 27000 levels ending the session on a weak note. Silver tracked the movements in gold but managed to close in the positive territory for the day.

We would recommend a sell on rally call in case of a massive downtrend in the precious metals. We also have a bearish outlook for copper in the near run.

Source: Finvasia Research

-

05-02-2013 11:42 AM

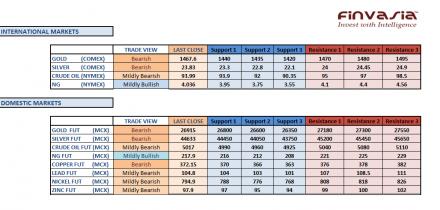

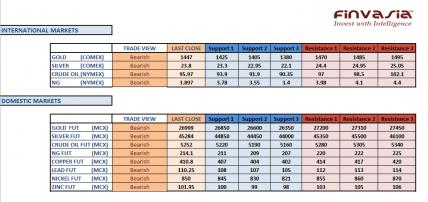

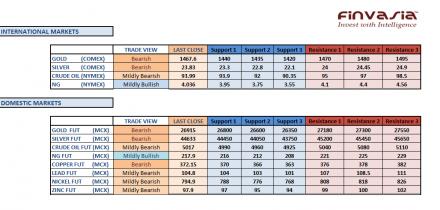

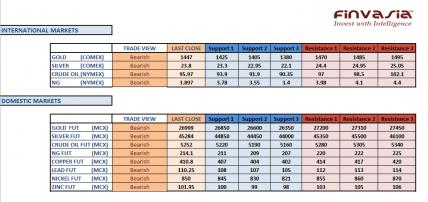

Intraday Tips and Technical Levels for MCX: May 2nd

We gave a total of 6 calls yesterday, out of which we booked FULL PROFITS in Gold and 50% Profits in Silver. We are still holding on to 3 of our calls which last ended in our favor.

We also booked FULL PROFITS in Lead, Copper and Silver for the calls given on Tuesday.

Our outlook continues to stay bearish for the precious metals. We would recommend our investors to stay cautious in Natural Gas ahead of the inventories data due today.

Source: Finvasia Research

-

05-03-2013 11:40 AM

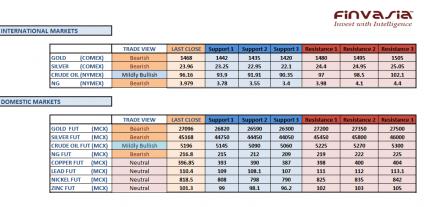

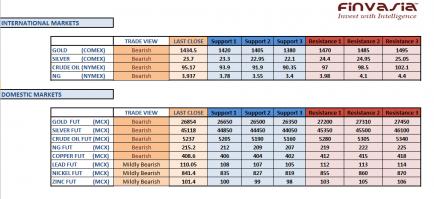

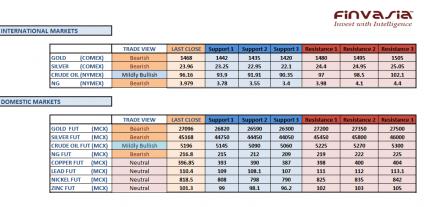

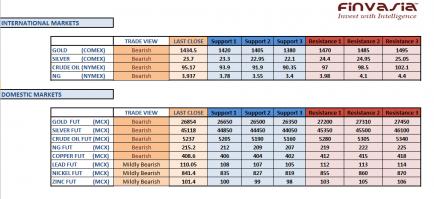

Intraday Tips and Technical Levels for MCX: May 3rd

Gold and Silver ended in the positive territory on Thursday after the ECB meet and interest rate decision. We might see some profit booking coming in at the current prices in Gold and Silver, hence we would recommend a sell on rally strategy for the precious metals.

Natural gas futures slumped almost 6.5% after a US government report showed an increase in the fuel stockpiles.

On Thursday, we hit our target in Nickel and booked FULL PROFITS. We gave 4 calls in the last trading session with 1 positional call in gold. We are still holding on to our carry over positions.

Source: Finvasia Research

-

05-06-2013 11:30 AM

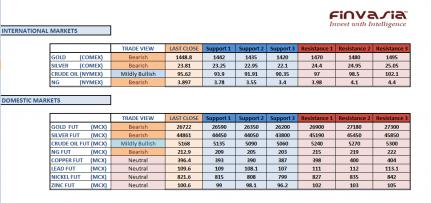

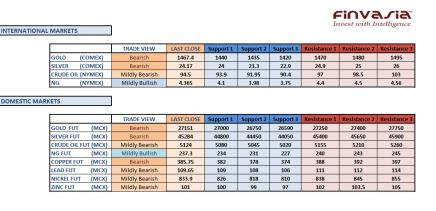

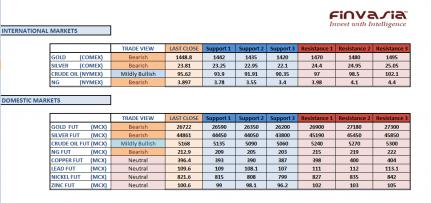

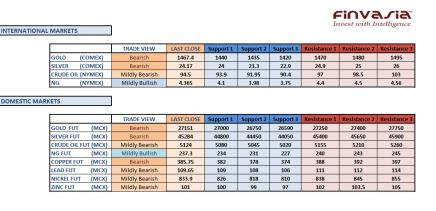

Intraday Tips and Technical Levels for MCX: May 6th

We saw strong retail buying which lifted the Gold and Silver prices higher on Friday. Despite equities trading strong and the base metals picking up, the physical buying supported the gold prices.

Fundamentally, the gold prices should have fallen as the average yield on treasury bonds surged beyond 7%. Hence, we expect a sharp correction coming in gold once this retail buying support softens.

For base metals, we stand neutral while we would recommend a sell on rally in natural gas.

Source: Finvasia Research

-

05-07-2013 12:44 PM

Intraday Tips and Technical Levels for MCX: May 7th

Strong retail buying and a weaker Rupee were major factors in supporting the gold prices on Monday. The Indian wedding season is on, and we might see some physical buying coming further in the domestic markets.

However, tracking the global scenario, we continue to hold a bearish outlook in gold, and would recommend a sell on rally. Also, our outlook continues to stay bearish for natural gas. We stay neutral in base metals ahead of some key macro economic data due from China, which would assure the further direction for copper and the other metals.

Source: Finvasia Reseach

-

05-08-2013 12:40 PM

Intraday Tips and Technical Levels for MCX: May 8th

We gave 3 calls in the previous session, out of which we booked FULL PROFITS in gold and closed the intraday Silver position with a profit of 250 Rupees. We are still holding on to our Lead position.

The Indian commodities were dragged lower in the previous session amid global risk on sentiment and as retail buying in precious metals took some breather.

We are still holding on to our short position in Natural Gas which came significantly in our favor as per the last settlement prices.

Source: Finvasia Research

-

05-09-2013 12:53 PM

Intraday Tips and Technical Levels for MCX: May 9th

Gold futures were seen gaining strength in the previous session on back of increased retail buying from India and Chinese investors. The base metals traded strong after positive data results were reported by China in the previous session.

We continue to hold our bearish view on gold, recommending a sell on rally. Stay cautious in natural gas ahead of the inventories report due at 8:00 pm IST today.

We booked FULL PROFITS in copper on Wednesday and continue to hold our short positions in Gold and Natural Gas.

Source: Finvasia Research

-

05-10-2013 10:49 AM

Intraday Tips and Technical Levels for MCX: May 10th

Gold futures held a firm support above 27000 levels despite some bearish stances seen in the Dollar quoted gold as weakness in Rupee supported the gold prices in India.

Tracking the price trend, silver futures also held well above those 45000 levels it has been testing for a while.

We continue to hold a bearish outlook in the precious metals and would recommend the investors to sell on any rallies seen.

Source: Finvasia Research

-

05-13-2013 11:37 AM

Intraday Tips and Technical Levels for MCX: May 13th

The Indian commodities gained strength in the previous trading session on a weak rupee despite some sell-off witnessed in the international commodity markets.

We continue to stay bearish on the precious metals and recommend a sell on rally in gold and silver. Any upward moves in the gold prices should be taken as an opportunity to sell and not buy gold.

We booked FULL PROFITS in the gold short call on Friday, and continue to hold our positional gold trade. We are also bearish on Natural gas, while our natural gas sell call is nearing the target price.

Source: Finvasia Research

-

05-14-2013 10:52 AM

Intraday Tips and Technical Levels for MCX: May 14th

The Indian commodity markets ended in the negative territory in the previous session. Despite heavy retail buying in the domestic markets, the gold prices edged lower in India tracking the international bullion weakness.

We continue to stay bearish in precious metals and recommend selling on rallies. Our call stays bearish for Crude Oil as well.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply