Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - After our bearish view given in the precious metals and base metals yesterday, we saw a significant drop in the ...

-

05-15-2013 11:10 AM

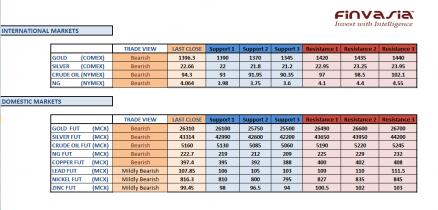

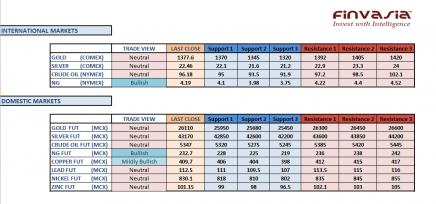

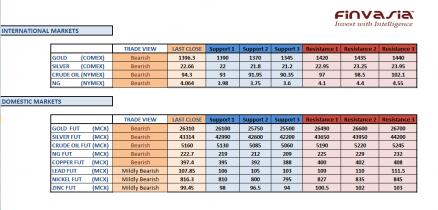

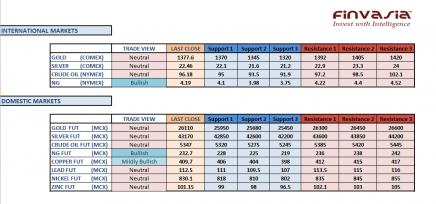

Intraday Tips and Technical Levels for MCX: May 15th

After our bearish view given in the precious metals and base metals yesterday, we saw a significant drop in the Gold, Silver and Copper prices on Tuesday.

We booked FULL PROFITS in Copper and 50% profits in Silver 300 rupees in favor from the entry price.

We are still holding on to our Gold and Natural Gas trades, while Gold is nearing our target price. We continue to stay bearish in precious metals and recommend a sell on rally.

Source: Finvasia Research

-

05-16-2013 10:58 AM

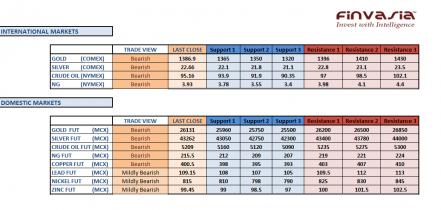

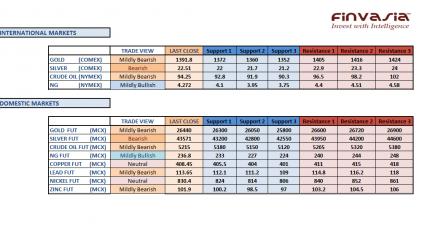

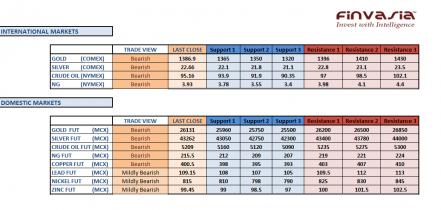

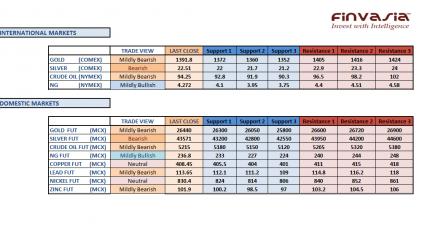

Intraday Tips and Technical Levels for MCX: May 16th

We saw a massive sell off rally in Gold and Silver in the previous trading session. We booked FULL PROFITS in our gold positional call given at 26900 and made 450 rupees per lot.

Also, we booked FULL PROFITS in the zinc sell call given on Tuesday. We continue to hold our bearish call in gold.

Stay cautious in natural gas ahead of the inventories report due today at 8:00 pm IST.

Source: Finvasia Research

-

05-17-2013 11:10 AM

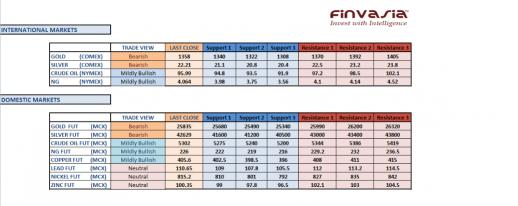

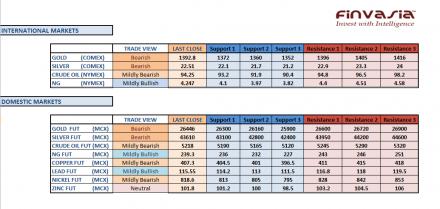

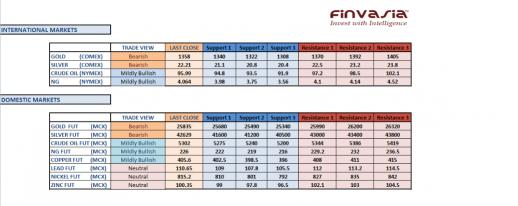

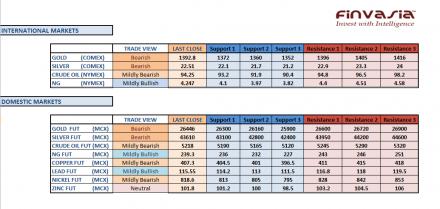

Intraday Tips and Technical Levels for MCX: May 17th

We saw the precious metals losing strength as the session opened on Thursday. The sentiment remained weak for both Gold and Silver until a weak US data lifted these precious metals from its lows.

In yesterday's session, we gave 2 calls out of which we booked "FULL PROFITS" in gold for a target of 200 rupees. As we see gold prices losing strength, we are also nearing our target for the Gold trade idea given previously.

Source: Finvasia Research

-

05-20-2013 11:42 AM

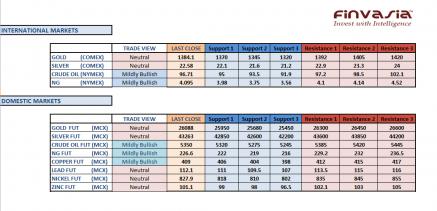

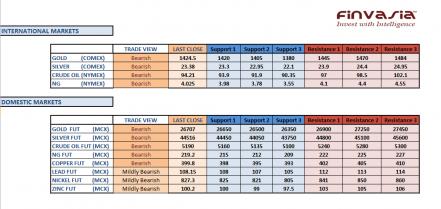

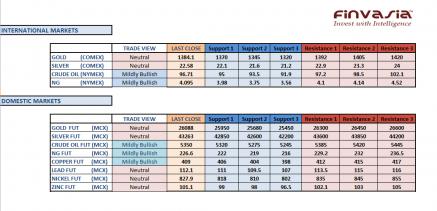

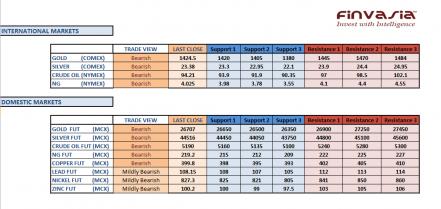

Intraday Tips and Technical Levels for MCX: May 20th

The CFTC data showed that some leading US hedge funds sold $1.4 billion of gold positions this week which added further weight to the gold prices. In the international commodity markets Gold and silver futures are trading lower by 1.30% and 3.4% respectively.

We continue to hold our bearish stance on precious metals. Our gold trade idea is already Rupees 1500 in favor. We also booked FULL PROFITS in the opening session today as gold dropped by almost Rs 400 in the opening session.

Source: Finvasia India

-

05-21-2013 11:06 AM

Intraday Tips and Technical Levels for MCX: May 21st

After the massive downward rally seen in the early opening trade on Monday, the precious metals eventually gained strength on short covering, ending in the positive territory for the day.

Gold prices in the Indian markets ended well above 26000 levels while the silver futures contract closed above 43000 levels, after hitting an intraday low at 40749.

We stand neutral on the precious metals and are slightly bullish for copper and natural gas at present.

Source: Finvasia Research

-

05-22-2013 11:20 AM

Intraday Tips and Technical Levels for MCX: May 22nd

The Indian Commodity Markets traded firm on Tuesday supported by weakness in the Indian Rupee. The international markets traded cautious ahead of Bernanke’s testimony today.

We stay neutral in precious metals as we might see a range bound move in the first half of the trading session before seeking any further clarity in the commodity markets.

Natural Gas is bullish at present while the crude weekly inventories are due at 8:00 pm IST today.

Source: Finvasia Research

-

05-23-2013 11:02 AM

Intraday Tips and Technical Levels for MCX: May 23rd

We saw precious metal losing strength after Fed indicated that it may consider narrowing down the bond buying program in near term. In the international commodity markets gold and silver futures are trading lower by 0.10% and 1.4% respectively.

In yesterday's volatile session we gave 5 calls out of which we booked "FULL PROFITS" in Copper and we continue to hold bearish call on precious metals which closed in our favor.

We are bearish on base metal after China reported contraction in manufacturing activity. Stay cautious in natural gas ahead of the inventories report due today at 8:00 pm IST.

Source: Finvasia Research

-

05-24-2013 11:12 AM

Intraday Tips and Technical Levels for MCX: May 24th

Precious metals are nearing their resistance levels and we recommend sell on rally in precious metals.

In yesterday's session we gave 4 calls out of which we booked 50% profits in two and we continue to hold bearish call on precious metals.

We are neutral to bearish on base metals and crude oil and recommend sell on rally. Natural gas is likely to trade on neutral to bullish tone.

Source: Finvasia Research

-

05-27-2013 11:38 AM

Intraday Tips and Technical Levels for MCX: May 27th

We saw range bound session in precious metals on Friday, with some support gained from Rupee weakness.

The investors traded cautious ahead of the extended weekend in the US, which remains closed today on account of a public holiday. Hence, we might see a range bound session today on lack of any direction from the international commodity markets.

We have bearish outlook on gold and silver, where silver might underperform the yellow metal. We stay neutral on base metals.

Source: Finvasia Research

-

05-28-2013 11:18 AM

Intraday Tips and Technical Levels for MCX: May 28th

The Indian Commodity markets traded in a very range bound manner in the previous session. Gold in the international markets continued to seek resistance below $1400 levels.

Our outlook continues to stay bearish in precious metals where we expect Silver to under-perform gold in the commodity markets. We recommend to sell on rally while natural gas is bullish at present.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply