Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Dear Traders,

Finvasia will be posting Intraday Technical Levels for MCX EVERY DAY here.

Happy Trading!

Regards

Team Finvasia

"Invest ...

-

04-15-2013 01:40 PM

Daily Intraday Technical Levels for MCX by Finvasia

Dear Traders,

Finvasia will be posting Intraday Technical Levels for MCX EVERY DAY here.

Happy Trading!

Regards

Team Finvasia

"Invest with Intelligence"

-

04-15-2013 01:43 PM

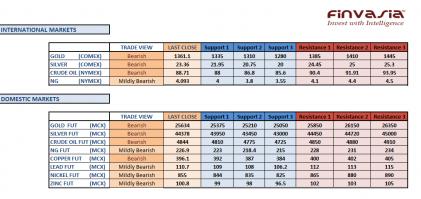

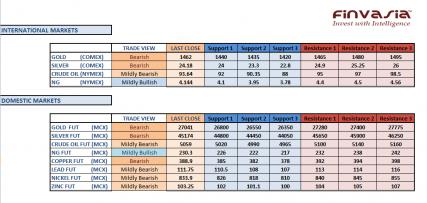

Intraday Technical levels for MCX: April 15th

The Indian commodities bleeded in red on Friday ,on an extreme sell-off rally. Gold and Silver futures dropped to a multiyear low. While copper and crude oil prices were also seen losing strength, though the base metals did not show as much weakness as the bullions did.

We gave 6 commodity calls on Friday out of which, we booked FULL PROFITS in Gold, Silver, Zinc and Brent Crude. We are still holding on to our lead and copper position, which last closed in our favor. We also have a positional call in gold currently fetching profits for us.

Source: Finvasia Research

-

04-16-2013 11:26 AM

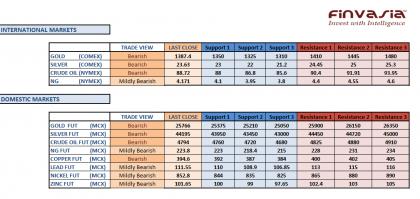

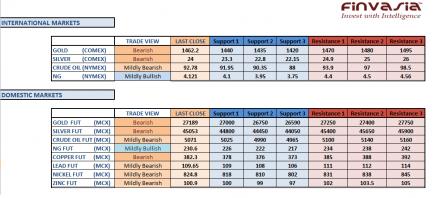

Intraday Technical levels for MCX: April 16th

After our bearish outlook we gave for the precious metals in the previous session, Gold and Silver dropped dramatically by almost 8.9% each.

We booked FULL PROFITS in lead and almost Rs 1100 in each lot for gold. We are still holding on to the copper call which last closed in our favor.

Source: Finvasia Research

-

04-17-2013 11:07 AM

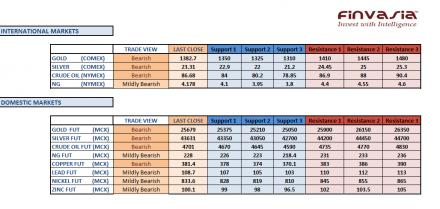

Intraday Technical Levels for MCX: April 17th

The Indian commodity markets showcased a dull trading session on Tuesday. We booked some profits in the copper call and are still holding on to the crude position.

Furthermore, we also saw natural gas prices dropping on Tuesday after we gave a bearish outlook for the energy fuel.

Source: Finvasia Research

-

04-18-2013 11:30 AM

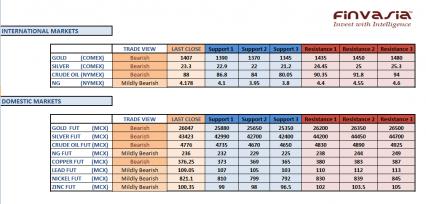

Intraday Technical Levels for MCX: April 18th

Indian commodities posted another lackluster performance on Wednesday. Tracking the price trends in the commodity markets we gave 6 calls in all for the day.

Out of these we ended booking FULL PROFITS in Copper, Lead and Crude Oil. We also booked 50% of our profits in silver and are still holding to crude, silver and nickel positions. All the 3 carried over positions closed in our favor as per the last closing price.

Source: Finvasia Research

-

04-22-2013 11:04 AM

Intraday Technical Levels for MCX: April 22nd

The precious metals gained strength in the short trading session on Saturday, on buying interest coming in from the domestic markets.

However, our near term outlook continues to remain bearish for gold and silver and we recommend a sell on rally, if the prices break their key support levels.

Source: Finvasia Research

-

04-23-2013 01:41 PM

Intraday Technical levels for MCX: April 23rd

Gold prices in India gained strength on back of physical buying in the Indian commodity markets. However, we do not see much of strength in silver as compared to gold. Apart from the very near run outlook, we still remain bearish on the precious metals.

We had given a bearish outlook for natural gas in the previous session and the futures marked their biggest one day decline in 9 weeks on Monday.

Source: Finvasia Research

-

04-25-2013 12:12 PM

Intraday Technical levels for MCX: April 25th

Crude futures gained strength on Wednesday after EIA reported a bigger drop in gasoline. Gold prices in India gained strength on back of physical buying in the Indian commodity markets.

However, we do not see much of strength in silver as compared to gold. Apart from the very near run outlook, we still remain bearish on the precious metals.

Source: Finvasia Research

-

04-26-2013 11:22 AM

Intraday Technical Levels for MCX: April 26th

Gold and Silver prices made a massive upward rally in the previous session supported by increased physical demand after the recent slump seen in the commodity prices.

We are likely to see a short term bounce in the gold prices seeking some resistance at $1500 levels. If the prices do not break these levels, we might see a massive sell-off rally coming again in the gold prices on profit booking by those who bought at the recent lows.

Source: Finvasia Research

-

04-29-2013 11:15 AM

Intraday Technical Levels for MCX: April 29th

We saw some volatile moves in the gold and silver prices on Friday in the Indian Commodity markets. Our outlook for the precious metals continues to remain bearish seeing a strong resistance for dollar quoted gold at 1530 levels.

We would recommend a sell on rally as the markets are likely to witness profit booking at every new high, which the gold prices record henceforth.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread