Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Bullions and Crude prices had rallied in the recent past due to massive depreciation in the Rupee and as fears ...

-

09-11-2013 11:03 AM

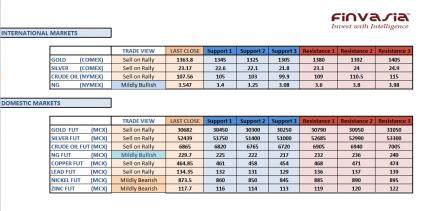

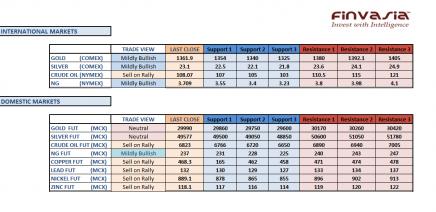

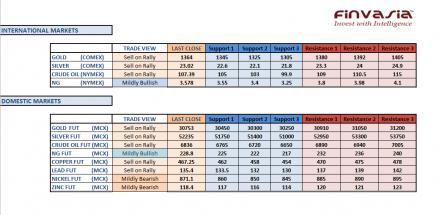

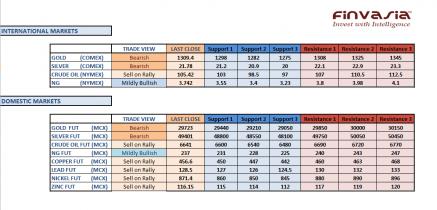

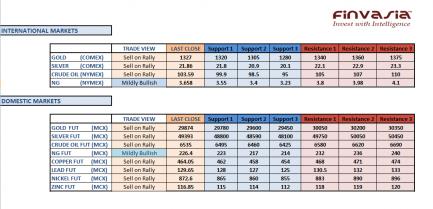

Intraday Tips and Technical Levels for MCX: September 11th

Bullions and Crude prices had rallied in the recent past due to massive depreciation in the Rupee and as fears of a possible US military strike on Syria existed. Now as the Indian Rupee on its journey to strengthen towards 60 levels while the Syria concerns are easing, we are witnessing heavy selling pressure in commodities across the board. We recommend selling precious metals and crude oil on any significant rallies. Also watch for the weekly crude inventories report due at 8:00 pm IST today.

Source: Finvasia Research

-

09-12-2013 12:59 PM

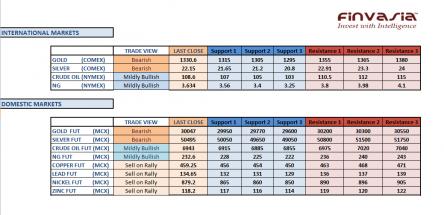

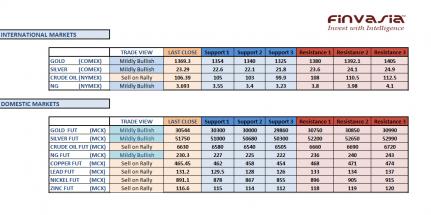

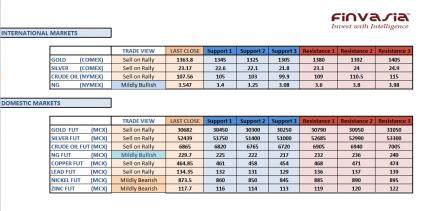

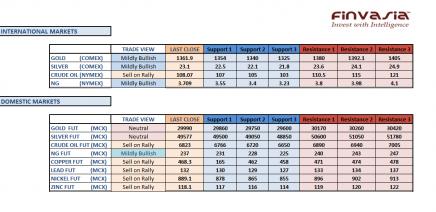

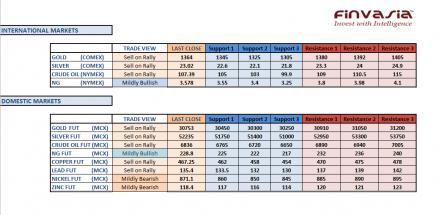

Intraday Tips and Technical Levels for MCX: September 12th

Precious Metals are trading steady with more of a negative bias in the international markets. The metal prices are likely to remain sensitive towards Fedís tapering plans. We recommend our investors to sell gold and silver on any significant rallies. Take an advantage of Rupee appreciation which is negative for the dollar quoted commodity prices. Crude oil inventories are trading steady after the EIA inventory report. Base metals are facing a selling pressure due to currency appreciation amid no major movement in the international markets. Stay cautious in natural gas ahead of the inventories report due at 8:00 pm IST today.

Source: Finvasia Research

-

09-13-2013 11:01 AM

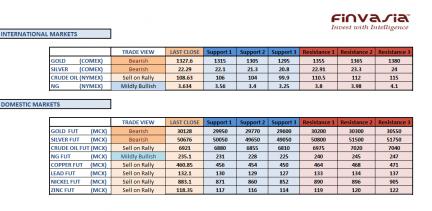

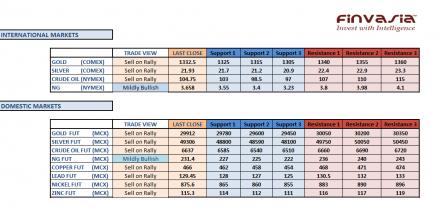

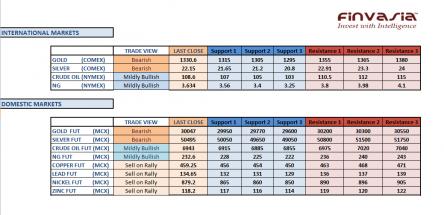

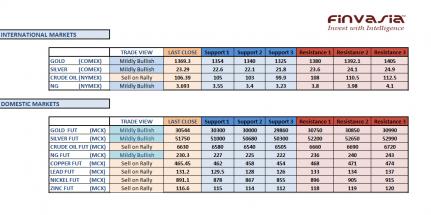

Intraday Tips and Technical Levels for MCX: September 13th

Gold and Silver have been following a continuous downward trend on increased possibility of the US central bank trimming off its ultra loose policy in its upcoming FOMC meeting on Sept 17-18. Any tapering news is going to be highly bearish for the precious metals. In silver, 21.65 is an important support. If this level is broken we might see a complete trend reversal. Our view is bearish in precious metals. We recommend selling base metals on rally while we hold a mildly bullish view on Crude oil. If crude oil prices do not sustain below $108 levels, the trend is likely to stay positive for the energy prices.

Source: Finvasia Research

-

09-16-2013 10:38 AM

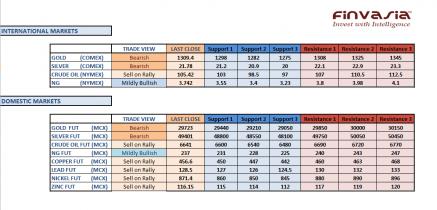

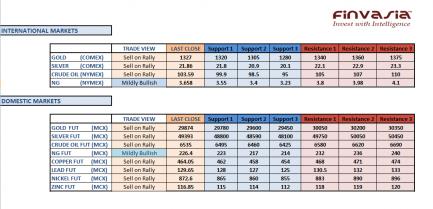

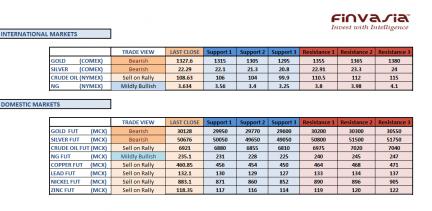

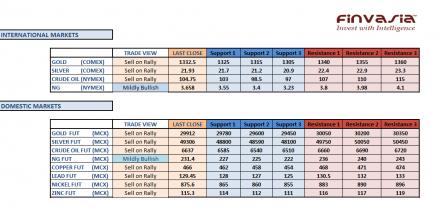

Intraday Tips and Technical Levels for MCX: September 16th

We recommend our investors to stay cautious in commodity markets as an important US central bank meeting is due tomorrow which can cause high volatility in the markets. Rupee is up by almost 1.3% from its previous close which is likely to add significant pressure on the Indian commodity prices. We recommend our investors to sell gold and silver on rally. The view on base metals continues to remain on the bearish side. Sell crude oil on rally.

Source: Finvasia Research

-

09-17-2013 10:52 AM

Intraday Tips and Technical Levels for MCX: September 17th

Precious metals continue to trade with a bearish sentiment. The investors are expecting FOMC to announce some tapering plans in todayís session. If such plans are announced we recommend selling gold and silver into the rally, though the movements can be very volatile. We continue holding our mildly bearish view in base metals and therefore recommend selling the metals and crude oil on rally. The Indian Rupee opened weaker in todayís trade which will support the domestic metal prices in the opening session.

Source: Finvasia Research

-

09-18-2013 11:05 AM

Intraday Tips and Technical Levels for MCX: September 18th

Precious metals have been inching lower as there are increased speculations of the US central bank announcing some tapering in its policy meeting. The two day policy meet is set to conclude today. We recommend selling precious metals and crude oil on rally. Crude oil is likely to face selling pressure on account of tepid US data and weak inventories report released by the API. Also watch the Rupee before entering into any trades. Stay cautious in crude oil as EIA inventory report is due at 8:00 pm IST today.

Source: Finvasia Research

-

09-19-2013 11:06 AM

Intraday Tips and Technical Levels for MCX: September 19th

The sentiment in commodity markets has changed after an important policy announcement made by the US Federal Reserve. The markets saw the international gold and silver prices rallying as Fed stated to maintain its stimulus plan and the dollar got weaker. The sentiment is mildly bullish for the precious metals however we recommend our investors to watch the market movements carefully before entering into any trades. The upside is likely to remain limited on account of a stronger Rupee. We recommend selling crude and base metals on significant rallies. Stay cautious in Natural gas ahead of inventory data due at 8:00 pm IST today.

Source: Finvasia Research

-

09-20-2013 11:00 AM

Intraday Tips and Technical Levels for MCX: September 20th

Precious metals are likely to face some selling pressure on account of profit booking after previous day rally however we continue to remain bullish on precious metals as the fundamentals support the same. Stay cautious in crude oil as the movement remains unclear. Despite positive economic data we can see crude prices dropping. However, the investors are recommended to sell crude and base metals on rally. The MCX remains closed on Saturdays now on for Precious metals, base metals and Crude oil trading as per the new guidelines released.

Source: Finvasia Research

-

09-23-2013 10:41 AM

Intraday Tips and Technical Levels for MCX: September 23rd

We recommend selling the precious metals on rally after gold and silver prices are facing selling pressure on renewed fears of Fed tapering. If Fed tapers in the next month, as per the statements made, the precious metals are likely to rule in the negative terrain. Crude oil prices face selling pressure as Libyan output expands. We continue holding our sell on rally recommendation in crude oil and base metals as well. Stay cautious while playing from the long side. Copper might fetch some support on account of positive Chinese manufacturing reported today.

Source: Finvasia Research

-

09-24-2013 10:36 AM

Intraday Tips and Technical Levels for MCX: September 24th

Precious metals are trading in a very tight range and we recommend selling gold and silver on rally. Bullions were unable to hold gains after Fed announced to maintain its stimulus plans. Therefore hopes of tapering coming in this year might continue adding a selling pressure on the precious metal prices. Crude is trading weak as no supply disruptions exist currently. Increased oil supply by Libya and cooling off concerns from Syria has been adding selling pressure to the oil prices. We continue to hold a mildly bearish view on base metals as well.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply