Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Commodities are trading with a bullish bias in the international markets today. Wait for further clarity of direction in precious ...

-

08-08-2013 10:52 AM

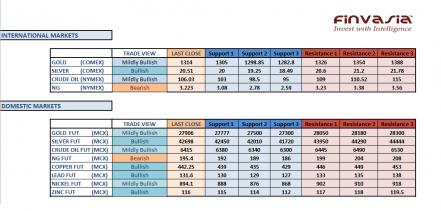

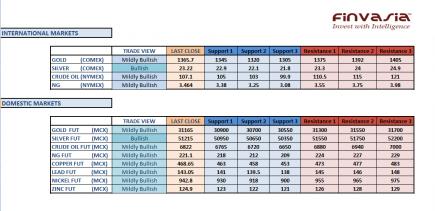

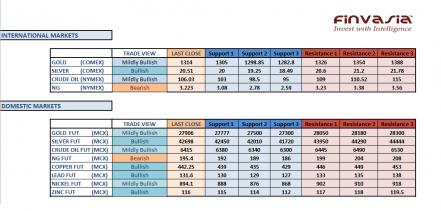

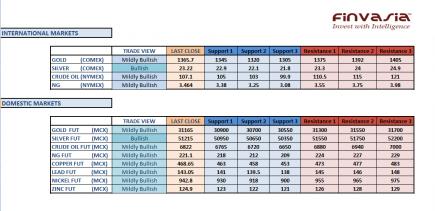

Intraday Tips and Technical Levels for MCX: August 8th

Commodities are trading with a bullish bias in the international markets today. Wait for further clarity of direction in precious metal prices before entering into a trade. A rally in the silver prices should be taken as an opportunity to go “long” silver. We hold our bullish outlook in base metals. Copper, Nickel and Lead are expected to rally in the domestic markets today, unless a significant appreciation in the Rupee limits gains. Natural gas is bearish, we recommend staying on the sidelines ahead of natural gas inventories report due today at 8:00 pm IST.

Source: Finvasia Research

-

08-12-2013 11:15 AM

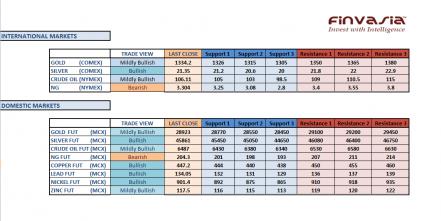

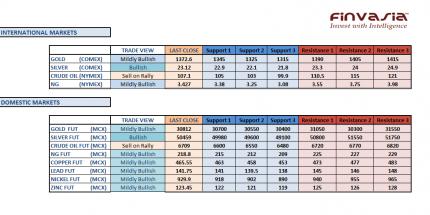

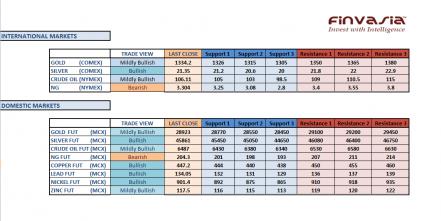

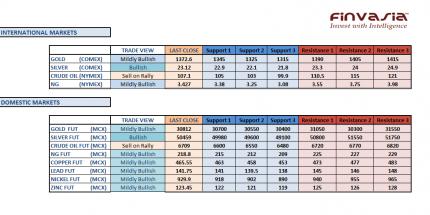

Intraday Tips and Technical Levels for MCX: August 12th

Commodities are trading with a bullish bias in the international markets today. Silver futures are trading sharply higher in international market after it gave technical breakout above $20.3 per ounce. We hold our bullish outlook in base metals. Copper, Nickel, Zinc and Lead are expected to trade with bullish stance today, unless a significant appreciation in the Rupee limits gains.

Source: Finvasia India

-

08-13-2013 11:18 AM

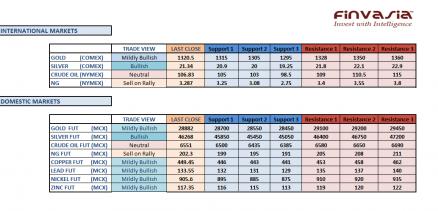

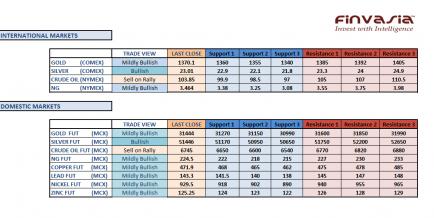

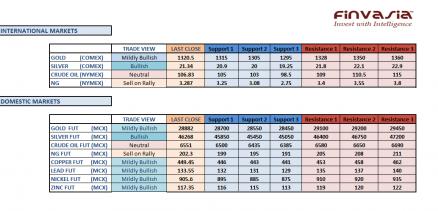

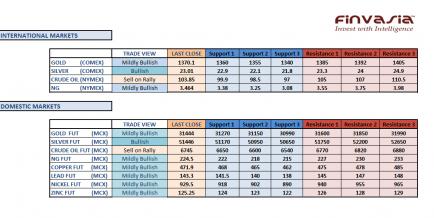

Intraday Tips and Technical Levels for MCX: August 13th

Precious Metals rallied in the previous session as we saw the commodities trading with a bullish sentiment across the board. Silver is likely to continue outperforming gold. There are also rumors of an import duty hike in gold from its current duty rate of 8%. We hold our bullish outlook in base metals on account of a technical breakout which has been witnessed across the board in all metals. Rupee is trading weak in the opening hours today, which would add further support to the metals' prices. Any significant breakouts should be taken as an opportunity to go "long" in precious and base metals.

Source: Finvasia Research

-

08-14-2013 11:04 AM

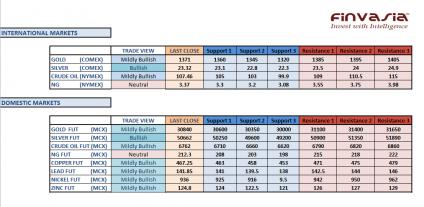

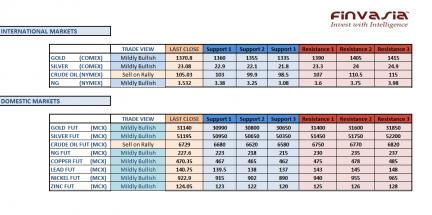

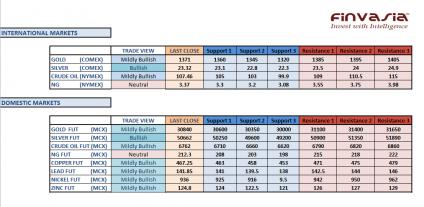

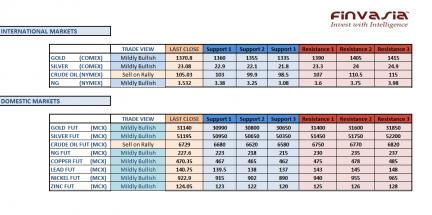

Intraday Tips and Technical Levels for MCX: August 14th

Precious Metals in the domestic markets have been trading with a positive bias due to sustained weakness in the Rupee. The Indian government also hiked the import duty hike on Gold and Silver which spurred the metals’ prices. Our outlook is more bullish in silver than gold. If silver sustains above its current levels of 46000, we might see another upward rally coming in silver. The sentiment stays slightly bullish for base metals too. Stay cautious in crude oil ahead of its weekly inventories report due at 8:00 pm IST today. Sell natural gas on any significant rallies as the overall sentiment is bearish for this energy fuel.

Source: Finvasia Research

-

08-16-2013 10:58 AM

Intraday Tips and Technical Levels for MCX: August 16th

We have a bullish view in Precious metals. Silver is likely to outperform gold till the bullish run sustains. Watch for US economic data and the Rupee movements for further direction in gold and silver. Weak economic data will certainly be a push for the precious metals. We also have a mildly bullish view in Crude oil as the increased violence in Egypt is likely to add to the supply disruption concerns. We continue holding our bullish sentiment in base metals across the board.

Source: Finvasia Research

-

08-19-2013 11:14 AM

Intraday Tips and Technical Levels for MCX: August 19th

Precious metals surged higher to multi month high last week and we expect this uptrend to continue in near term. Silver is likely to outperform gold till the bullish run sustains. Watch for US economic data and the Rupee movements for further direction in gold and silver. Weak economic data will certainly be a push for the precious metals. We also have a mildly bullish view in Crude oil as the increased violence in Egypt is likely to add to the supply disruption concerns. We continue holding our bullish sentiment in base metals across the board.

Source: Finvasia Research

-

08-20-2013 11:30 AM

Intraday Tips and Technical Levels for MCX: August 20th

The Indian commodities, despite seeking weak signals from the international commodities, surged due to lower Rupee. Currently, Rupee is moving in one direction which has added a strong support to both precious and base metals. Gold is trading above 31000 while Silver surged beyond 51000 levels. Watch very carefully for the currency moves. The sentiment continues to stay on bullish side for all the commodities. However, some profit booking can be seen in the very short run.

Source: Finvasia Research

-

08-21-2013 11:11 AM

Intraday Tips and Technical Levels for MCX: August 21st

We saw some sell-off in the precious metals in the previous session after its recent rally. In the international markets gold and silver surged on Tuesday and are trading in the positive territory. However, we recommend the domestic investors to stay cautious in precious metals as the currency might play its role. Wait for further clarity of direction before entering into any trades. The sentiment continues to stay mildly bullish in based metals. Stay cautious in crude oil ahead of inventories report at 8:00 pm IST.

Source: Finvasia Research

-

08-22-2013 11:00 AM

Intraday Tips and Technical Levels for MCX: August 22nd

Rupee weakness has been the major factor supporting the Indian commodities. While gold and silver in the international markets are trading within a range. Watch carefully for the currency moves before entering into any trades. The sentiment continues to stay on a bullish side for gold and silver. Base metals especially copper, is likely to rally further on Chinese PMI data which came in better than the expectations. As China stands out to be copper’s largest consumer in the world, we will see copper futures rallying. Crude oil futures dropped further on the Comex below $104 per barrel. Stay cautious in natural gas ahead of its weekly inventories due at 8:00 pm IST today.

Source: Finvasia Research

-

08-23-2013 11:09 AM

Intraday Tips and Technical Levels for MCX: August 23rd

Precious metals are trading with a bullish sentiment. However, an appreciation in the Indian Rupee can lead to heavy selling pressure in the MCX metals. Base metals are likely to remain in the positive terrain after positive manufacturing data was released by China & Europe. Our outlook continues to remain mildly bullish in natural gas.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply