Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Indian commodities traded in the green terrain in the last trading session amid an overall bullishness seen in the commodities. ...

-

07-11-2013 10:58 AM

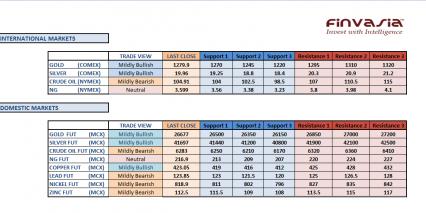

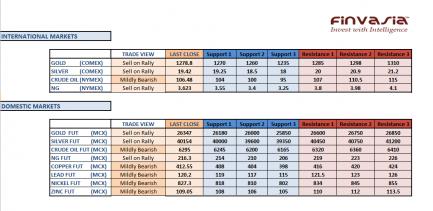

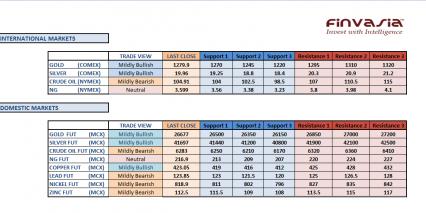

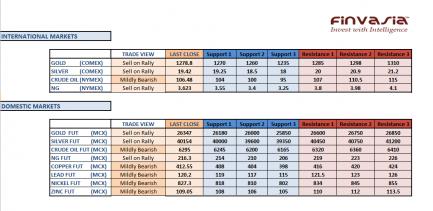

Intraday Tips and Technical Levels for MCX: July 11th

Indian commodities traded in the green terrain in the last trading session amid an overall bullishness seen in the commodities. After Bernanke’s statements which came in yesterday, we are expecting the precious metals to trade with a bullish sentiment. Fed’s policy to remain accommodative in the near run means higher attraction for gold and silver. Crude oil is trading higher after the inventories were reported to have shrunk more than twice in the previous week. We hold our bullish view in crude oil. The base metals are likely to open higher and we recommend selling on the rallies. We are expecting a gap up opening in the commodity markets today, however we would recommend staying on the sidelines before further clarity of action. Stay cautious in natural gas ahead of inventories data due at 8:00 pm IST.

Source: Finvasia Research

-

07-12-2013 11:08 AM

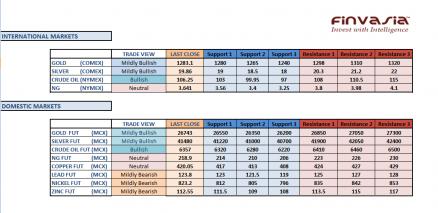

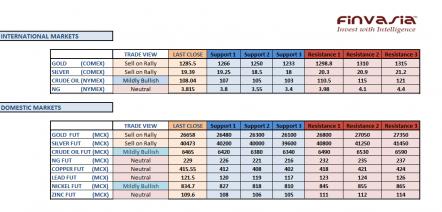

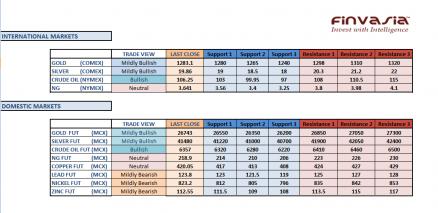

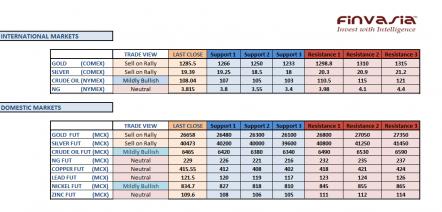

Intraday Tips and Technical Levels for MCX: July 12th

Precious metals strengthened in the last trading session after Fed backed stimulus program. After yesterday’s rally, we are expecting precious metals to trade with neutral to bullish stance. Fed’s policy to remain accommodative in the near run means higher attraction for gold and silver.

Crude price moved lower from 15 month high in the last trading session amid profit booking. US crude has strong resistance zone near $106-$108 zone. We expect crude to trade with a slightly bearish stance. Base metals are expected to trade with mildly bearish stance except copper. We recommend selling on rallies in base metals.

Source: Finvasia Research

-

07-15-2013 10:58 AM

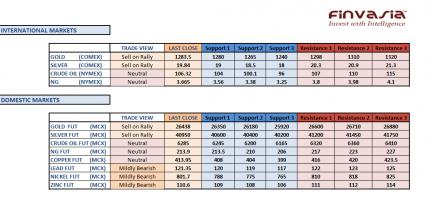

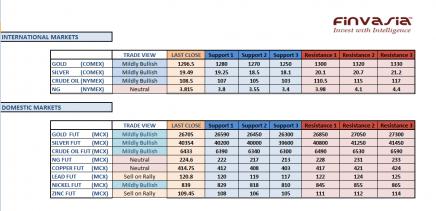

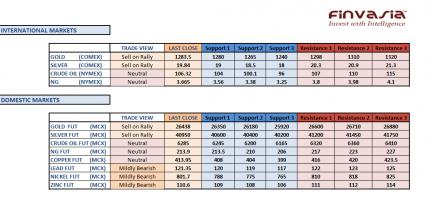

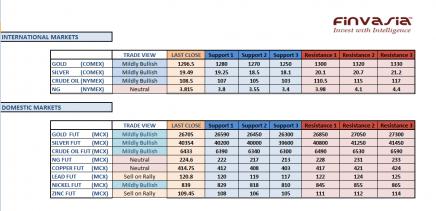

Intraday Tips and Technical Levels for MCX: July 15th

Precious Metals are trading with a bullish sentiment and the international prices are pointing towards a higher start to gold and silver prices in today’s trade. Some key Chinese data was reported early morning on Monday. A lower than expected industrial production from China was expected to have a negative impact on copper prices, but since there was not much downside seen in the copper international prices, we recommend staying on the sidelines and waiting for further clarity of direction before entering into any trades. We hold our mildly bearish view on the other base metals and recommend selling into the rallies.

Source: Finvasia Research

-

07-16-2013 11:13 AM

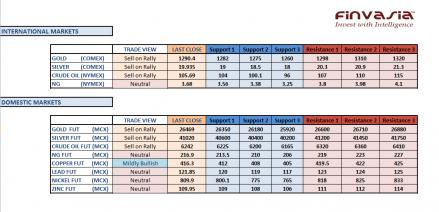

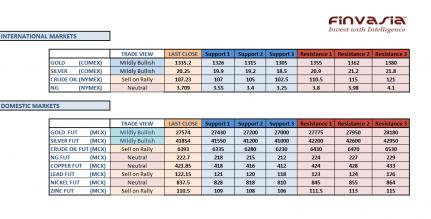

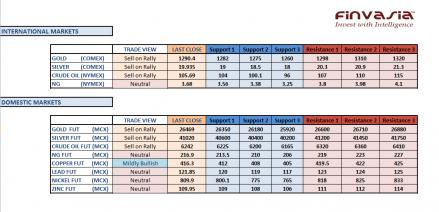

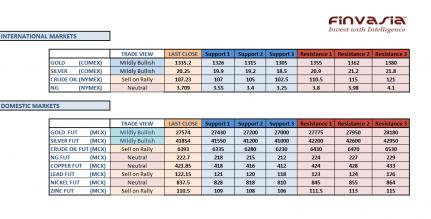

Intraday Tips and Technical Levels for MCX: July 16th

An important macroeconomic event is awaited this week in lieu of which the markets are likely to trade cautious in today’s trading session. US Fed chairperson is due to testify on Wednesday & Thursday. Precious metals are seeking resistance at crucial levels, which if broken the view would be mildly bullish for gold and silver. Crude oil is also trading with bulls reining strong for this energy fuel. However, we recommend selling the precious and base metals into the rallies. Watch the movement in the Indian Rupee carefully as a major appreciation seen in the currency last night had been a major reason for the commodities to end in the negative territory across the board.

Source: Finvasia Research

-

07-17-2013 11:07 AM

Intraday Tips and Technical Levels for MCX: July 17th

Gold and Silver continue to trade in a range bound manner ahead of Bernanke's two days testimony, which begins today. Fed chief's testimony can cause volatile movements in the US dollar, hence influencing the commodities across the board. $1295 has been acting as a near term resistance for gold while silver has a thick neckline drawn on the upside at $20 levels, which if broken would add bullish stance to the bullion. However, we would recommend selling precious metals on rallies. Stay cautious in crude oil ahead of inventories data due at 8:00 pm IST today. If some bearish stance is seen, we would recommend selling into the rally till the next support near $100. Copper is taking support at its current levels; wait for further clarity of direction before entering any trades in base metals. An appreciation in the Rupee from its current levels should be taken as a fair chance to take short position in base metals.

Source: Finvasia Research

-

07-18-2013 10:55 AM

Intraday Tips and Technical Levels for MCX: July 18th

Gold and Silver have a strong resistance at $1295 and $20 levels. Failing to break above these crucial levels, we saw precious metals sliding lower in the international markets yesterday. However, the commodity prices in the domestic markets will be supported by the sustained weakness in Rupee. As the Indian Rupee depreciated in today’s session, we would recommend selling only on significant rallies. The base metals are trading with a bearish stance and our view for crude oil is also mildly bearish. Stay cautious in natural gas ahead of the weekly inventories data due today at 8:00 pm IST.

Source: Finvasia Research

-

07-19-2013 11:01 AM

Intraday Tips and Technical Levels for MCX: July 19th

Crude oil futures surged further in the previous trading session on account of technical breakout above $106.50 levels in the international markets. The sentiment remained optimistic on account of positive economic data. We recommend selling precious metals on rally and the view on base metals is neutral as for now. We suggest waiting for further clarity in base metals before entering into a trade.

Source: Finvasia Research

-

07-22-2013 10:47 AM

Intraday Tips and Technical Levels for MCX: July 22nd

Precious Metals are trading with a bullish sentiment for now as we saw the international gold prices breaking above USD1300 levels. Silver has a strong neckline resistance at USD20 which if broken would add further bullishness to the white metal, which has been underperforming gold for a while now. However, currency moves in the domestic markets should be watched carefully. An appreciation in the Rupee would certainly give an opportunity to sell on the rally, limiting the upside to the precious metals. Copper is trading within a range and we recommend further clarity of direction before entering into any trades. Our outlook continues to remain mildly bullish in Crude oil.

Source: Finvasia Research

-

07-23-2013 10:43 AM

Intraday Tips and Technical Levels for MCX: July 23rd

Precious Metals traded with a bullish sentiment in the last trading session on account of technical breakout at levels which gold and silver had been testing for a while now. Gold broke above USD1308-1310 levels while silver broke above its crucial resistance at USD20 in the international markets. Crude oil reversed some of its gains after the expiry in the foreign markets. We are likely to see further profit-booking in crude oil. Copper traded with a mildly bullish sentiment, we continue holding our mildly bullish view in nickel .

Source: Finvasia Research

-

07-24-2013 11:00 AM

Intraday Tips and Technical Levels for MCX: July 24th

Gold traded with a bullish sentiment in the previous session however, the moves were more or less range bound. The precious metals have had a technical breakout and the bullishness might sustain for a while. We are seeing profit booking in Crude oil; hence it is recommended to sell on the rallies. Though the base metals have been trading in a steady manner, the weak Chinese manufacturing data released today is likely to add some bearish stance to the base metals. Watch carefully for the currency moves as fundamentally the Rupee should get stronger in today’s session after the RBI announced some liquidity curb measures on Tuesday. Stay cautious in crude oil ahead of inventories data at 8:00 pm IST.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply