Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - We saw a broad sell off coming in gold and silver in the first half of the trading session yesterday. ...

-

06-27-2013 11:05 AM

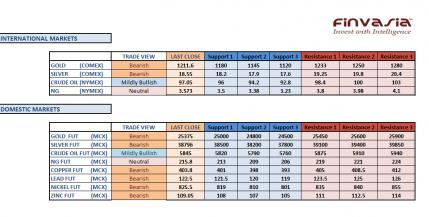

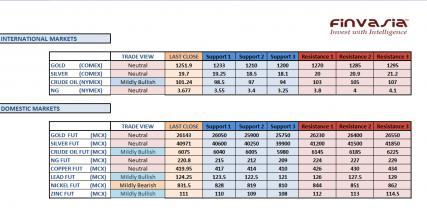

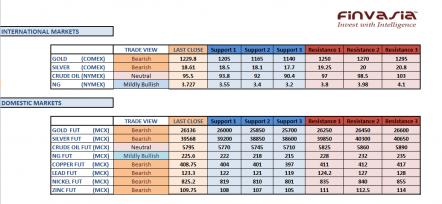

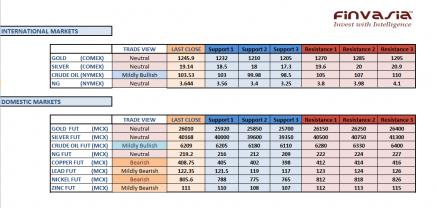

Intraday Tips and Technical Levels for MCX: June 27th

We saw a broad sell off coming in gold and silver in the first half of the trading session yesterday. The sentiment remained bearish for the precious metals until some rebound was seen on Rupee weakness and weak US gross domestic product revealed yesterday.

Gold in the international markets is trading near its crucial support area at $1200-$1210. The investors are recommended to sell into the rallies. Watch carefully for the currency moves which can have a significant impact on the commodity price direction. We continue to hold our bearish outlook in base metals. Stay cautious in natural gas ahead of inventories due at 8:00 pm IST today.

We gave an intraday short call in gold, in which we booked “FULL PROFITS” yesterday.

Source: Finvasia Research

-

06-28-2013 11:41 AM

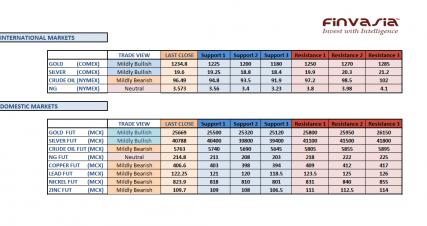

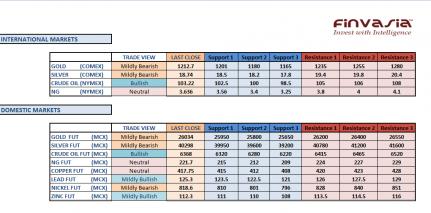

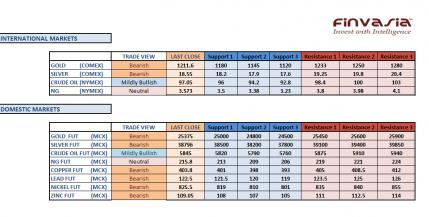

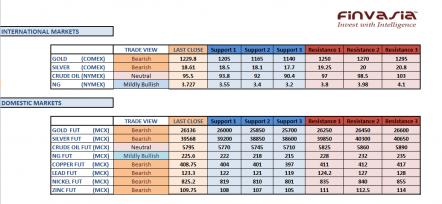

Intraday Tips and Technical Levels for MCX: June 28th

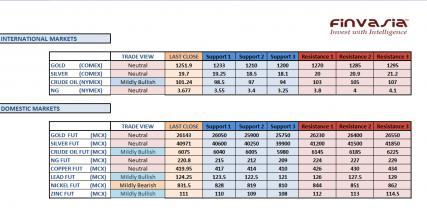

Precious metals extended rout in last trading session with the gold prices falling to its three year low. The sentiment remains bearish for precious metals and we recommend selling on rally. Gold in the international markets is trading near its crucial support area at $1180-$1200 and if it breaks below, we might see a sharp fall in the metal prices. Watch carefully for the currency moves which can have a significant impact on the commodity price direction. Base metals are expected to trade with bearish stance.

We gave two calls in previous trading session and booked "FULL PROFITS" in intraday short call given in gold.

Source: Finvasia Research

-

07-01-2013 11:11 AM

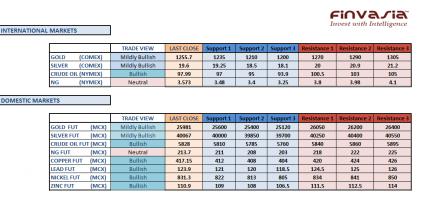

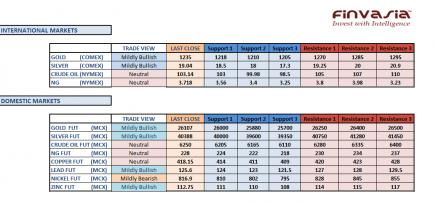

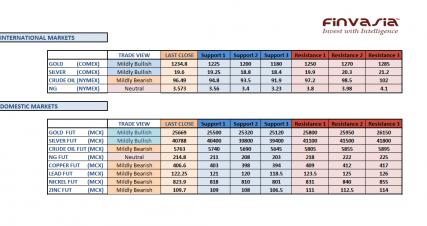

Intraday Tips and Technical levels for MCX: July 1st

Gold and silver have been moving between losses and gains recently. After hitting the lowest levels in 3 years, the precious metals gained some strength. In the domestic markets, the commodity markets will also fetch their direction from the Indian Rupee. Crude oil is trading weak on account of dollar strength amid speculations of Fed tapering with its massive bond purchasing program. We continue to hold our mildly bearish view in base metals.

Source: Finvasia Research

-

07-02-2013 10:47 AM

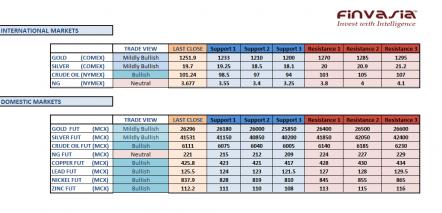

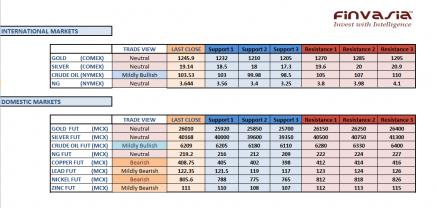

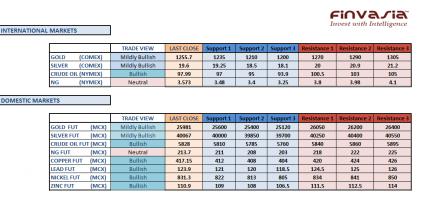

Intraday Tips and Technical levels for MCX: July 2nd

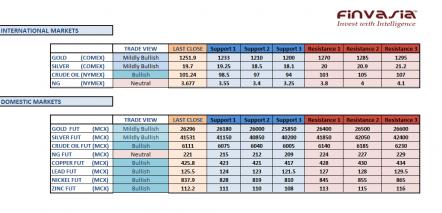

After the incessant sell off seen in the commodities across the board recently, the sentiment seems to have returned to the bullish territory. Gold and silver are trading positive in the international markets. We expect some bullishness to sustain in the domestic markets unless the domestic currency appreciates significantly from its current levels. We have a bullish view on the base metals as well.

We gave 2 calls in the previous trading session and booked “FULL PROFITS” in both. Stay cautious in Crude oil ahead of the weekly inventory data today.

Source: Finvasia Research

-

07-03-2013 10:53 AM

Intraday Tips and Technical Levels for MCX: July 3rd

Precious metals traded in more or less a range bound fashion in the previous trading session. The outlook continues to remain mildly bullish for gold and silver unless Rupee appreciates further from its current levels. We recommend staying on the sidelines in precious metals until any major moves are seen. Crude oil is completely bullish and certainly a “buy” at present. In the international markets crude oil is trading 2% higher on the daily charts. We continue to hold our bullish outlook in base metals as well.

Source: Finvasia Research

-

07-04-2013 10:44 AM

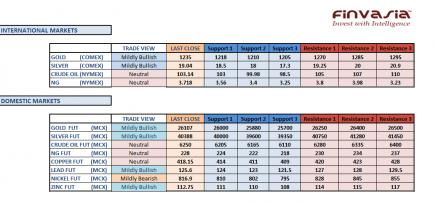

Intraday Tips and Technical Levels for MCX: July 4th

Precious metals continue to trade within a range but with more of an upward bias. Our outlook continues to stay mildly bullish in gold and silver. Crude oil in the international markets is completely bullish trading well above 101 levels. We continue holding our bullish outlook in base metals as well. We are expecting further clarity of direction as an important US data is awaited on Friday. The US markets are closed on Thursday hence; we might not see much volume in the markets today. We gave 3 calls yesterday of which, we booked "FULL PROFITS" in gold.

Source: Finvasia Research

-

07-05-2013 10:53 AM

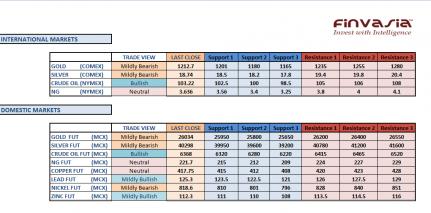

Intraday Tips and Technical Levels for MCX: July 5th

Precious metals are trading in a very tight range seeking further clarity of direction. The investors are recommended to stay sidelines in gold and silver as a major macro economic data is due today at 6:00 pm IST which can cause high volatility in the markets. Our sentiment remains neutral to mildly bullish for base metals. Natural gas continues to remain range bound.

Source: Finvasia Research

-

07-08-2013 11:11 AM

Intraday Tips and Technical Levels for MCX: July 8th

Precious metals fell Friday as upbeat US economic data raised the Fed tapering concerns. However, in today’s trading session US gold and silver recovered from crucial level zone. The investors are recommended to go short in precious metals on rally. Currency will play important role in today’s trading session as it is trading at life time low levels. Base metals are expected to trade with neutral stance as concerns remain in the market about the slowdown in China. Crude is expected to continue with its bull run after it broke above crucial resistance levels.

We gave 3 calls in the Friday’s trading session and booked “FULL PROFITS” in Crude.

Source: Finvasia Research

-

07-09-2013 10:50 AM

Intraday Tips and Technical Levels for MCX: July 9th

Precious Metals bounced back from crucial support zone in the previous trading session. In the international markets the bullion is trading with a bullish sentiment however strong Rupee is likely to limit the upside in the domestic markets. An extreme rally can be taken as an opportunity to sell. We currently stand neutral in crude oil and natural gas. Our outlook remains mildly bullish for zinc and lead.

Source: Finvasia Research

-

07-10-2013 10:39 AM

Intraday Tips and Technical Levels for MCX: July 10th

Precious metals inched lower in the previous session as a stronger Rupee added some pressure to the commodities. In the international markets, gold and silver are trading in the negative territory close to its crucial support levels. We recommend selling bullion on any significant rallies seen. We have a mildly bearish to bearish view on the base metals while crude oil is likely to trade higher tracking the equity gains and the Egypt concerns. Stay cautious ahead of crude oil inventories due at 8:00 pm IST.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply