Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Precious metals are expected to face continued selling pressure after previous day’s price movements. A positive set of US data ...

-

11-28-2013 09:53 AM

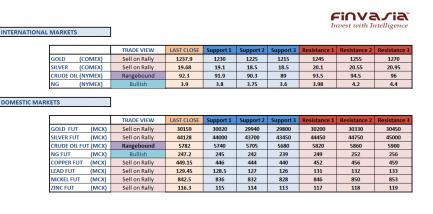

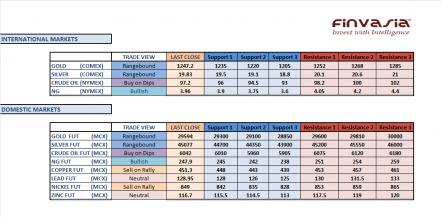

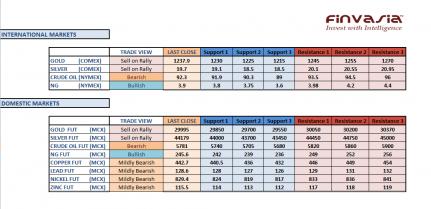

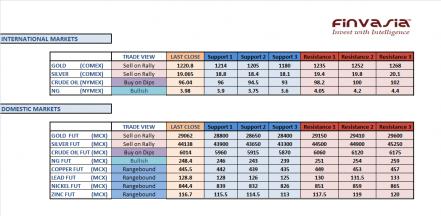

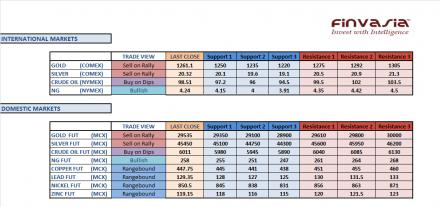

Intraday Tips and Technical Levels for MCX: November 28th

Precious metals are expected to face continued selling pressure after previous day’s price movements. A positive set of US data released in the previous session raised fears of sooner than expected tapering by the US Fed. We recommend our investors to sell gold and silver on rallies. We continue holding a negative outlook in crude oil, though the price movement might remain range bound after the bearish inventory results were released. We hold a mildly bearish view in base metals, while natural gas is expected to continue its upward journey. Watch Rupee movements carefully, as appreciation in the domestic currency from its current levels can give additional opportunities to sell base metals.

Source:FINVASIA Research

-

11-29-2013 09:55 AM

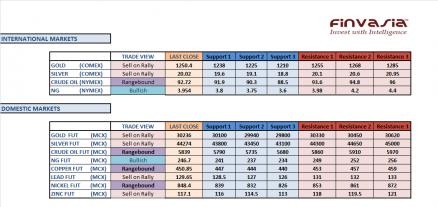

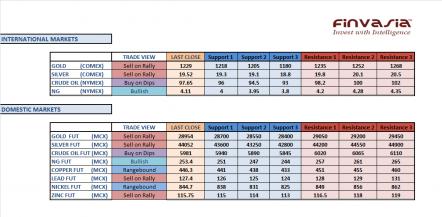

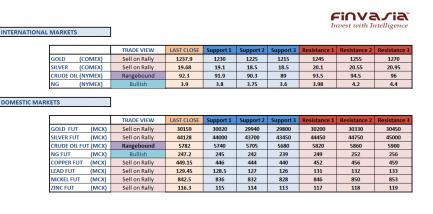

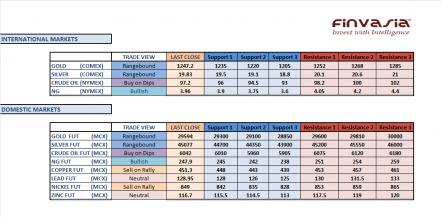

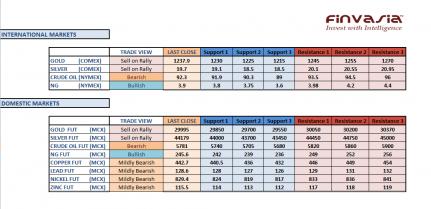

Intraday Tips and Technical Levels for MCX: November 29th

The current gold futures contract has been holding a strong support above 29700 levels. Though we hold a sell on rally view in precious metals, we recommend our investors to stay cautious in India gold ahead of futures expiry. We expect crude oil to trade in a range bound manner waiting for further clarity of direction. Our view remains negative for base metals, watch the Rupee movements carefully. An appreciation in the domestic currency would give additional opportunities to sell base metals on rally. We hold a bullish view in natural gas as forecast of cold temperatures in the coming weeks is likely to support the seasonal demand for this energy fuel.

Source: FINVASIA Research

-

12-02-2013 09:54 AM

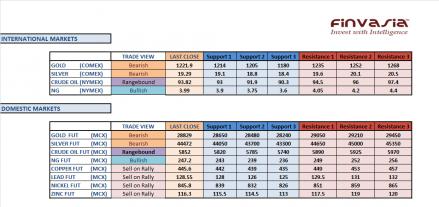

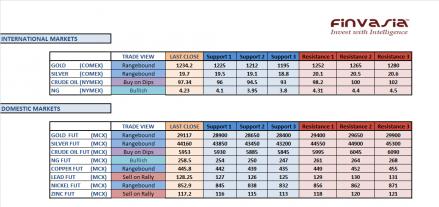

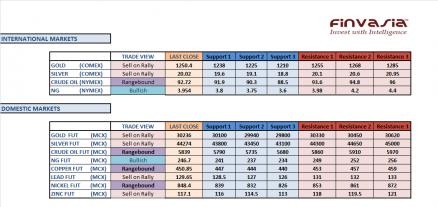

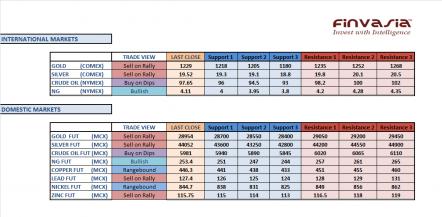

Intraday Tips and Technical Levels for MCX: December 2nd

We recommend our investors to sell precious metals on rally. The sentiment for gold and silver continues to remain on the bearish side. Stronger Rupee is likely to add further pressure on commodities across the board. Crude oil is expected to trade within a range. Economic data will be eyed for further clarity of direction. The base metals are likely to trade in a range with more of a negative bias. Any significant rallies should be taken as an opportunity to sell. We continue holding our bullish view in natural gas.

Source: FINVASIA Research

-

12-03-2013 09:54 AM

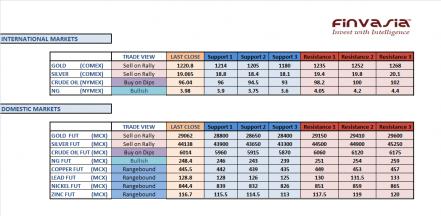

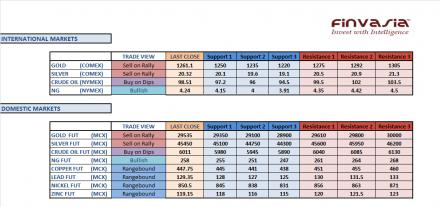

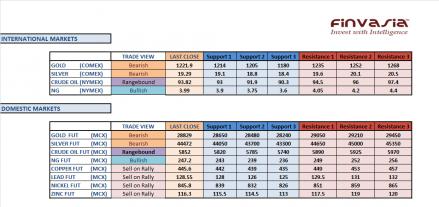

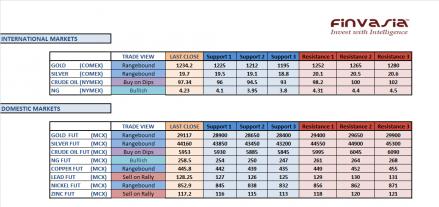

Intraday Tips and Technical Levels for MCX: December 3rd

With the market participants raising speculations on Fed tapering sooner than expected, we hold a bearish view in precious metals. Every rally should be taken as an opportunity to sell while the macro economic data set is likely to cause volatility in gold and silver markets. Crude is likely to trade in a range bound manner ahead of weekly inventory results. We continue holding our bullish view in natural gas. Colder than expected temperatures are expected to raise the seasonal demand for this heating fuel. Base metals are likely to take some support after US and China reported better than expected manufacturing PMI numbers however the gains are likely to remain short lived. Therefore we continue holding our sell on rally view in base metals. Carefully track the Rupee movements before entering into any trades.

Source: FINVASIA Research

-

12-04-2013 09:48 AM

Intraday Tips and Technical Levels for MCX: December 4th

Domestic silver futures continued to underperform gold for yet another session. With the investors doing some value buying in gold, we saw domestic gold prices trading in the positive terrain. However, we continue holding our negative view in precious metals. Every rally should be taken as an opportunity to sell gold and silver. Stay cautious in crude oil ahead of inventory report due at 8 pm IST, wait for further clarity of direction as a lieu of US economic data is due today. Base metals are likely to trade within a range though Rupee movement might give some specific direction. We continue holding our bullish view in natural gas.

Source: FINVASIA Research

-

12-05-2013 09:57 AM

Intraday Tips and Technical Levels for MCX: December 5th

Market participants are seeking to bargain hunting in precious metals. In the international markets, gold is likely to trade in a range seeking further direction from economic data. However, domestic demand and movement in Indian Rupee is likely to dominate the MCX gold and silver prices. Stay cautious until any clear direction is obtained. Crude futures are likely to trade in a range gathering some optimism from bullish inventory report and positive US data. We recommend our investors to sell base metals on rally. Stay cautious in natural gas ahead of inventory data due at 9 pm IST today, though the broader view stays bullish in natural gas.

Source: FINVASIA Research

-

12-06-2013 09:53 AM

Intraday Tips and Technical Levels for MCX: December 6th

Precious metals are highly sensitive towards US Fed's tapering plans. Tightening of liquidity in the markets sooner than the expectations is likely to cause heavy selling pressure in precious metals. With a key jobs data due on the US calendar today, we recommend our investors to stay highly cautious in gold and silver. As the US economy has been giving continuous signs of improvement for the past few sessions, crude is likely to trade strong though the movement might stay range bound. Base metals are expected to trade with a bearish stance while we continue holding our bullish view in natural gas.

Source: FINVASIA Research

-

12-09-2013 09:57 AM

Intraday Tips and Technical Levels for MCX: December 9th

We continue holding a sell on rally view in precious metals. With the US data coming in better than the expectations, the investors have raised their expectations of Fed tapering sooner than the expectations. Crude oil is likely to track support from positive market sentiment thereby giving opportunities to buy crude oil on price dips. Base metals are likely to trade range bound while we continue holding our bullish view in natural gas.

Source: FINVASIA Research

-

12-10-2013 10:07 AM

Intraday Tips and Technical Levels for MCX: December 10th

Indian commodities are expected to open higher following the depreciation in Indian rupee. US gold futures rebounded in last trading session as investors sought value buying after metal prices declined to five month low. Precious metals are expected to trade in range bound ahead of US Federal Reserve policy meet next week, which would give further clues about when fed will start reducing its commodity friendly asset purchase program. Crude prices are likely to track support from positive market sentiments thereby giving opportunities to buy crude oil on price dips. US crude has strong resistance zone in the range of $98-$99 per barrel and breach above this levels would spur further buying movement in crude oil. Base metals are likely to trade in range bound while we continue to hold bullish stance in natural gas.

Source: FINVASIA Research

-

12-11-2013 09:51 AM

Intraday Tips and Technical Levels for MCX: December 11th

Precious metals have depicted a strong performance in the past two sessions however every rally in gold and silver should be taken as an opportunity to sell. Investors were seen raising their bullish bets in crude expecting a drop in weekly crude stockpiles. We recommend our investors to buy crude on dips. Stay cautious ahead of EIA report due at 9 pm IST today. Expecting the heating demand for natural gas to stay strong, we expect natural gas to continue trade with a positive bias. Base metals are likely to trade range bound.

Source: FINVASIA Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply