Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Precious metals have formed a strong base in the international markets thereby diminishing the bearish stance in gold and silver. ...

-

12-27-2013 09:51 AM

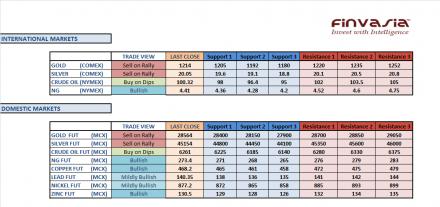

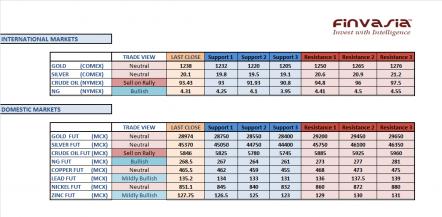

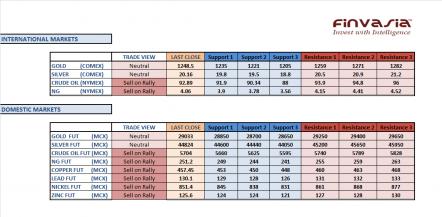

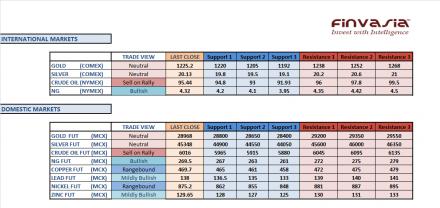

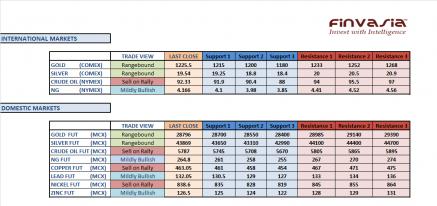

Intraday Tips and Technical Levels for MCX: December 27th

Precious metals have formed a strong base in the international markets thereby diminishing the bearish stance in gold and silver. Though the fundamentals do not support bullions in the current scenario and every rally should be taken as an opportunity to sell, we recommend our investors to stay cautious until further clarity of direction is attained. Crude is expected to trade firm and every dip can be taken as an opportunity to buy crude oil. A decisive breakout above USD 100 levels will add further bullishness to the oil prices. We hold a mildly bullish to bullish view in base metals as the global picture looks healthier. Cold weather forecasts and increased heating demand is likely to cause further rally in natural gas prices.

Source: FINVASIA Research

-

12-30-2013 10:00 AM

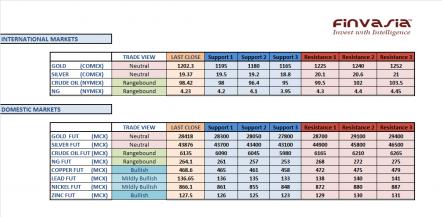

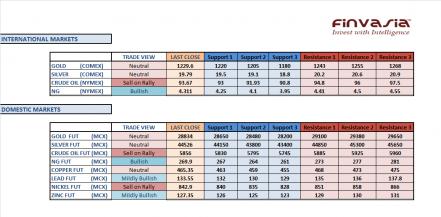

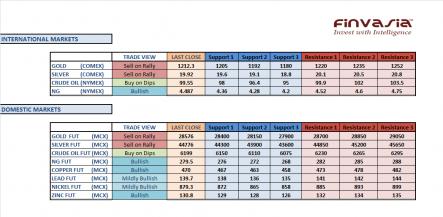

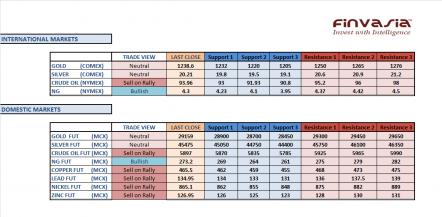

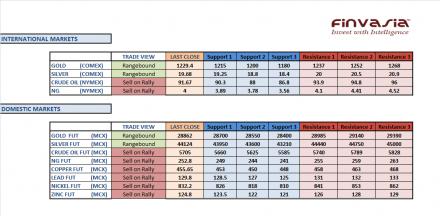

Intraday Tips and Technical Levels for MCX: December 30th

US gold futures have formed a strong base near $1200 levels thereby diminishing bearish stance. Though the fundamentals do not support any sharp upward move in bullions and we continue to hold sell on rally view in precious metals. Crude futures are expected to trade firm on prospect of economic growth recovery in US and investors can go long on every dips. We hold mildly bullish to bullish view in base metals as global pictures looks healthier. Natural gas is expected to trade with bullish stance on seasonal cold weather demand.

Source: Finvasia Research

-

01-02-2014 10:03 AM

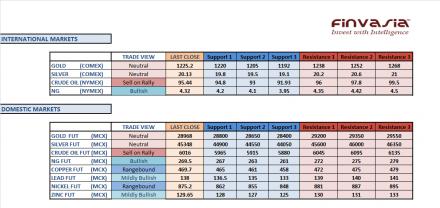

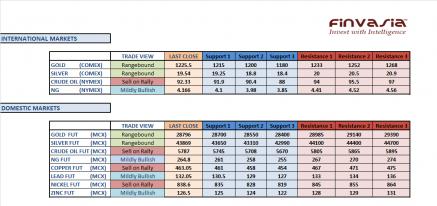

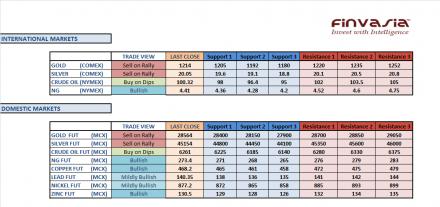

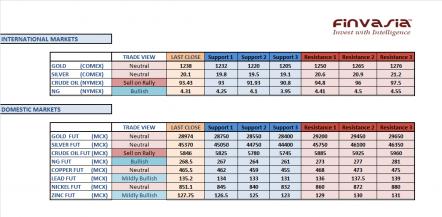

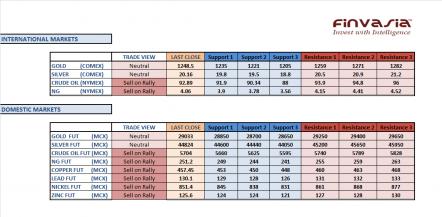

Intraday Tips and Technical Levels for MCX: January 2nd

Precious metals are likely to open significantly higher on Thursday tracking the strength in international gold and silver. We recommend our investors to watch the price movements carefully before entering into any trades. If gold and silver sustain its opening gains, it would be positive for the precious metals. Crude is likely to trade range bound as the upside is likely to remain capped on expectations of increased supply. We continue holding our mildly bullish view in base metals while natural gas is likely to trade within a range. Stay cautious amid the Jobless Claims and manufacturing data due from US today.

Source: FINVASIA Research

-

01-03-2014 09:55 AM

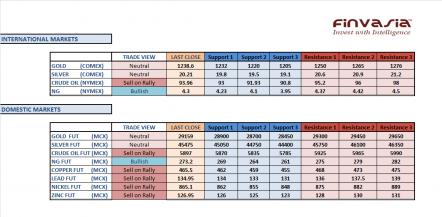

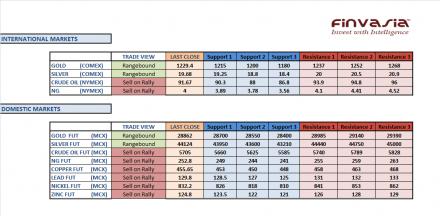

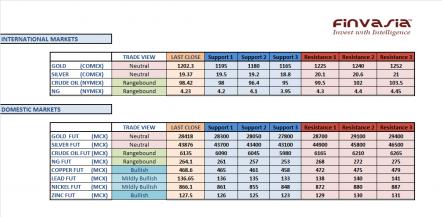

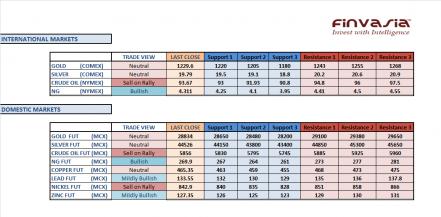

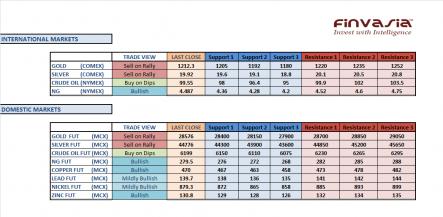

Intraday Tips and Technical Levels for MCX: January 3rd

We recommend our investors to wait for further clarity of direction before entering into any trade in precious metals. In the international markets, gold is trading near its crucial resistance levels of USD 1230-1235. Crude oil is likely to face selling pressure on every rally while we continue holding our mildly bullish view in base metals. Also track the Rupee movements carefully as an appreciation from its current levels can limit the upside in domestic commodity prices. Natural gas is expected to stay bullish as power winter storms in US are likely to increase demand for this heating fuel.

Source: FINVASIA Research

-

01-06-2014 10:07 AM

Intraday Tips and Technical Levels for MCX: January 6th

The commodity markets are expected to get a boost in terms of volumes this week hence we might see some volatile moves in gold and silver. Precious metals have been depicting a strong performance with Comex gold forming a very strong base near USD 1200 levels. We recommend our investors to stay cautious while trading bullions. Crude oil is likely to face selling pressure on rallies as prospects of rising oil supplies from Libya weigh over the oil prices. We hold a flat to mildly bearish view in base metals though Rupee appreciation from its current levels can limit the upside. Natural gas is likely to extend its winning streak amid chilly US weather.

Source: FINVASIA Research

-

01-07-2014 10:07 AM

Intraday Tips and Technical Levels for MCX: January 7th

As seen in the previous trading session, precious metals are trading in a highly volatile fashion. International bullions are trading with a positive bias while the movement in Indian Rupee is likely to vary the price movements in domestic gold and silver. We recommend our investors to sell crude oil on rallies as prospects of strong supplies across the globe are likely to weigh over the oil prices. We hold a flattish to mildly bullish view in base metals. We continue holding our bullish view in natural gas as colder temperatures support the heating demand for this energy fuel.

Source: FINVASIA Research

-

01-08-2014 10:15 AM

Intraday Tips and Technical Levels for MCX: January 8th

With a lieu of economic events lined up on the calendar we hold a neutral view in precious metals. The investors are recommended to stay cautious of the expected volatile moves in gold and silver though you might get opportunities to sell bullions on significant rallies. We continue holding our sell on rally view in crude oil while base metals are likely to trade mixed. Some positive bias might be seen in base metals but stay cautious with rupee movements. Natural gas is likely to trade with a bullish sentiment as fundamentals continue to support.

Source: FINVASIA Research

-

01-09-2014 10:16 AM

Intraday Tips and Technical Levels for MCX: January 9th

Precious metals have formed a broad range within which it is trading. We expect the price movement to remain similar before a decisive breakout in either direction is seen. Stronger Dollar has been weighing over the international gold prices tracking which the domestic gold futures are also facing selling pressure. However, 28700 continues acting as a strong support zone for MCX gold prices. We continue holding our sell on rally view in crude oil while base metals are likely to trade mixed. We hold a mildly bullish view in natural gas.

Source: FINVASIA Research

-

01-10-2014 09:56 AM

Intraday Tips and Technical Levels for MCX: January 10th

Precious metals have formed a broad range failing to break in either direction. We expect the precious metals to trade in a range ahead of nonfarm payrolls data due today. Stay cautious as volatility can be seen during the evening session. Crude futures continue trading weak and we recommend our investors to take every opportunity to sell crude oil on rallies. Base metals are expected to continue facing selling pressure with a stronger Rupee. Sell natural gas on rally as weak inventory report and thawing trend in weather forecasts can cause profit booking in this energy fuel.

Source: FINVASIA Research

-

01-13-2014 09:59 AM

Intraday Tips and Technical Levels for MCX: January 13th

Much awaited US jobs data which came in much lower than the expectations gave a sudden boost to the precious metals. International gold is trading at crucial levels near USD 1250, a breakout above which is likely to add further bullish stance in precious metals. We hold our sell on rally view in crude oil and base metals. A stronger Rupee is likely to add selling pressure to the commodities basket. Natural gas is also expected to face some profit booking selling pressure after the recent massive Bull Run it had recorded. Bearish inventory reports and snapping cold weather forecast is likely to add some negative bias to this energy fuel.

Source: FINVASIA Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply