Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Crude futures inched lower from six weeks high in last trading session after EIA reported much higher than expected build ...

-

12-12-2013 10:00 AM

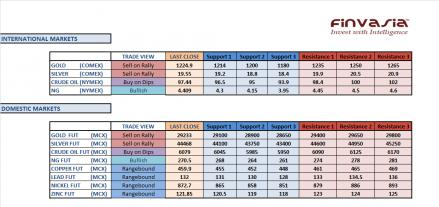

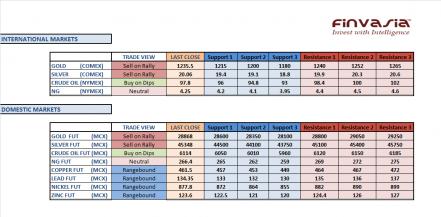

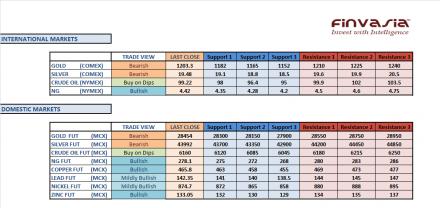

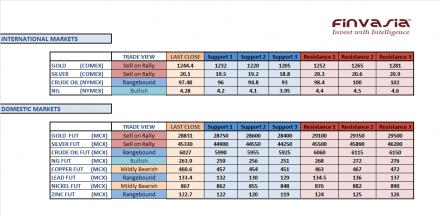

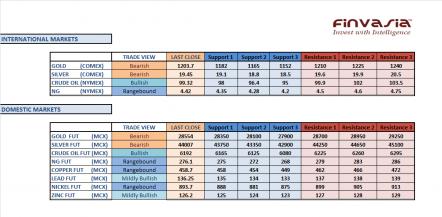

Intraday Tips and Technical Levels for MCX: December 12th

Crude futures inched lower from six weeks high in last trading session after EIA reported much higher than expected build in gasoline inventories. We expect crude prices to trade firm on strong economic recovery in US and recommend our investors to buy crude on dips. We continue to hold sell on rally view on precious metals. US gold futures are currently trading near crucial level of $1250 per ounce and breach below this level may trigger selling pressure. Natural gas further extended its upward move in last trading session due to strong seasonal demand. We hold our bullish view on natural gas, but stay cautious ahead of weekly inventories report due to release today at 9 pm IST. Base metals are expected to trade in range bound.

Source: Finvasia Research

-

12-13-2013 09:55 AM

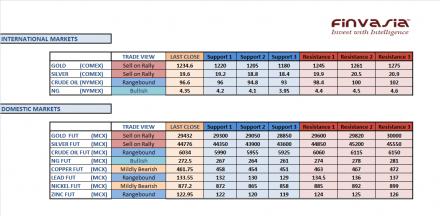

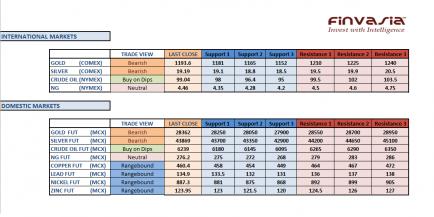

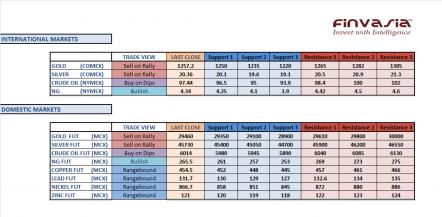

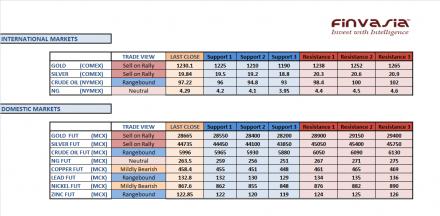

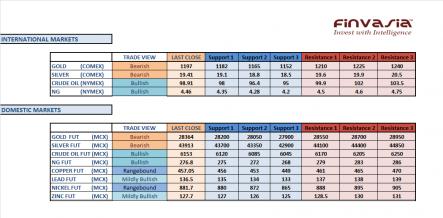

Intraday Tips and Technical Levels for MCX: December 13th

Precious metals are likely to continue trading with a negative bias pricing in the fears of Fed tapering. We continue holding our sell on rally view in gold and silver. After better than expected US retail sales reported on Thursday, crude oil is expected to trade firm though the upside might remain limited on lingering uncertainty in the markets. Opportunities to buy on dips should be taken in crude oil. Base metals are likely to trade in a range while we continue holding our bullish view in natural gas. Though some profit booking might be seen after a bearish supply data reported in the previous session.

Source: FINVASIA Research

-

12-16-2013 09:53 AM

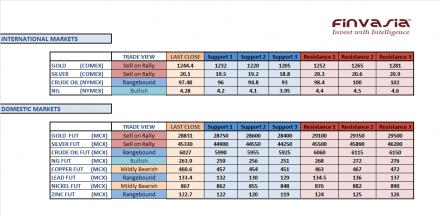

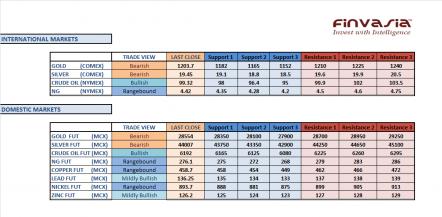

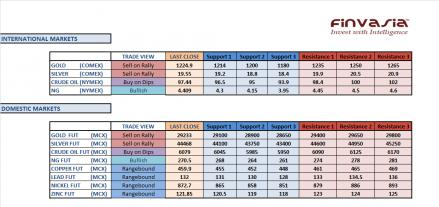

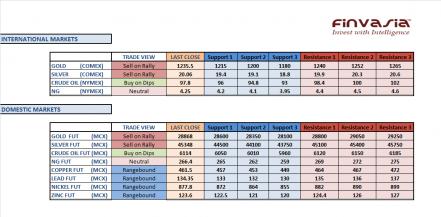

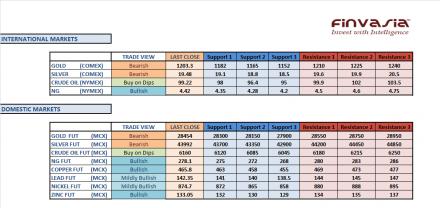

Intraday Tips and Technical Levels for MCX: December 16th

Precious metals are expected to trade in a range with higher selling pressure on the upper band of the range. Sentiment is likely stay cautious ahead of key US Fed meet this week. We recommend the investors to sell precious metals on rally. Crude oil is expected to trade in a range with some negative bias after the HSBC Chinese manufacturing came in slightly lower than the expectations. Some volatility is expected in the evening session with US reporting its manufacturing and industrial activity data. We continue holding our bullish view in natural gas amid raised heating demand for the fuel on falling temperatures. Base metals are likely to trade mildly bearish during the day.

Source: FINVASIA Research

-

12-17-2013 10:05 AM

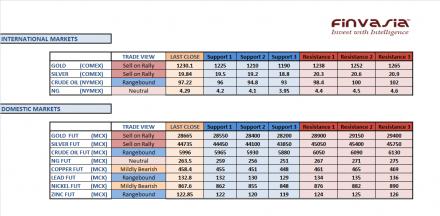

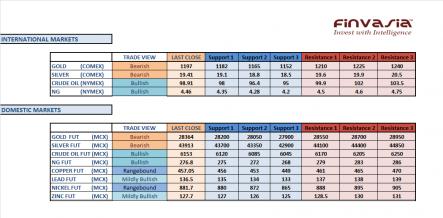

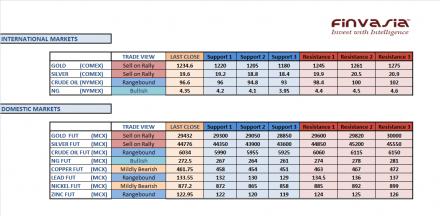

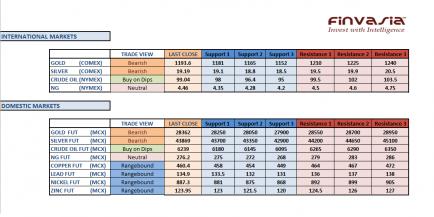

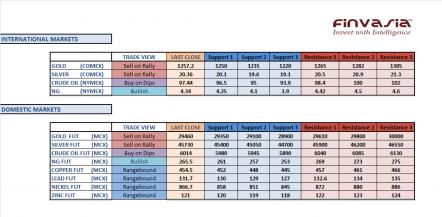

Intraday Tips and Technical Levels for MCX: December 17th

Cautious sentiment prevails in commodities market ahead of US Federal Reserve policy meeting outcomes on Wednesday. US gold futures are trading in the range of $40 from $1220 to $1260 per ounce from last few days as investors seek further clarity regarding futures course of fed's asset purchase program. Indian gold prices moved lower in last trading session as Indian gold premium over international gold prices narrowed to Rs 1400 per kg from above Rs 2000 last week. We continue to maintain sell on rally view in precious metals. Crude prices are expected to trade in range bound with positive bias on continued supply disruption concerns from Libya. We continue holding our bullish view in natural gas amid raised heating demand for the fuel on falling temperatures. We expect base metals to trade in range bound.

Source: Finvasia Research

-

12-18-2013 09:57 AM

Intraday Tips and Technical Levels for MCX: December 18th

The investors are recommended to stay highly cautious ahead of two important economic events today. RBI is due to release its interest rate decision at 11 am IST which can cause high volatility in Indian Rupee. Also, the US FOMC meeting will be held today. In broader terms, we continue holding a sell on rally view in precious metals. After the API report showing a drop in crude stockpiles the sentiment is likely to stay cautious ahead of EIA inventories due at 9 pm IST today. Base metals are likely to trade in a range with negative bias. Copper is currently trading near its key technical resistance levels. Natural gas is expected to face some selling pressure on profit booking and mild temperature forecasts. However, in the international markets natural gas is trading near its multi months high and a breakout above such levels would be technically very bullish for natural gas.

Source: FINVASIA Research

-

12-19-2013 10:10 AM

Intraday Tips and Technical Levels for MCX: December 19th

Overnight, US Federal Reserve Chairman Ben Bernanke announced that central bank is reducing its asset purchase program by $10 billion to $75 billion per month. Precious metals to open lower tracking sharp fall in international prices. However, depreciation in Indian rupee likely to provide some support on downside. We continued to maintain our sell on rally view in precious metals. Crude futures inched higher in last trading session after EIA reported fall in weekly inventories report for third consecutive week, indicating strengthening demand in world’s largest economy. We expect crude prices to trade firm and investors can go on long on every dips. Sentiments remain cautious in Natural gas ahead of weekly inventories report due to release today at 9 pm IST. Base metals are expected to trade in range bound.

Source: FINVASIA Research

-

12-20-2013 10:03 AM

Intraday Tips and Technical Levels for MCX: December 20th

Gold and silver is likely to continue trading with a negative outlook. Technically, precious metals are trading in its bearish terrain. Any small rallies should also be taken as an opportunity to sell gold and silver. On hopes of increase demand for fuel and energy from the world’s largest economy, crude oil is likely to trade firm. We hold a buy on dip view in crude oil. Base metals and natural gas are likely to trade in a range. Though our view in natural gas remains bullish, yet some profit booking is likely to cap the upside after the bullish inventory report released yesterday.

Source: FINVASIA Research

-

12-23-2013 09:56 AM

Intraday Tips and Technical Levels for MCX: December 23rd

Precious metals are likely to continue trade with a negative sentiment. Fed's tapering and robust US economic data is likely to continue weighing over precious metal prices. We also recommend our investors to watch the Rupee movements carefully as appreciation in Rupee can add further selling pressure on gold and silver. The view on crude oil stays on the bullish side. Every dip in crude prices should be taken as an opportunity to go long in crude. Base metals are expected to trade with a positive bias while natural gas futures are likely to trade within a range. A break in the cold to mild weather is likely to add further profit booking pressure in natural gas.

Source: FINVASIA Research

-

12-24-2013 10:00 AM

Intraday Tips and Technical Levels for MCX: December 24th

Precious metals are likely to trade with a negative sentiment with no major buying support coming in to rescue the decline in gold and silver. We continue holding a bearish view in precious metals. Some profit booking weighed on the crude prices previously however; our view stays bullish in crude oil on signs of robust US recovery. Base metals are expected to trade mixed. Where copper and nickel are likely to trade in a range, we hold a mildly bullish view in lead and zinc. Natural gas is certainly bullish with cold weather forecasts expected to add further strength in demand for this energy fuel.

Source: FINVASIA Research

-

12-26-2013 10:10 AM

Intraday Tips and Technical Levels for MCX: December 26th

No major price movements are expected in precious metals as the volumes are likely to remain thin amid New Year holiday season. We continue holding our bearish view in precious metals and any rally should be taken as an opportunity to sell. Crude futures are likely to hold gains and trade with a positive bias amid hopes of robust US recovery. We hold a mildly bullish to bullish view in base metals. Cold weather forecasts are expected to further support natural gas prices. We continue holding our bullish view in this energy fuel. Stay cautious with Rupee movements as further appreciation from its current levels can cause selling pressure in domestic commodities.

Source: FINVASIA Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply