Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Precious metals in the domestic markets are trading with a mixed sentiment. Gold outperformed silver for yet another session as ...

-

11-13-2013 09:55 AM

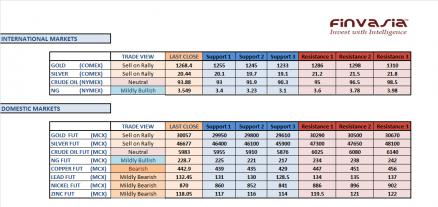

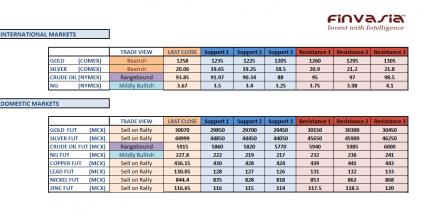

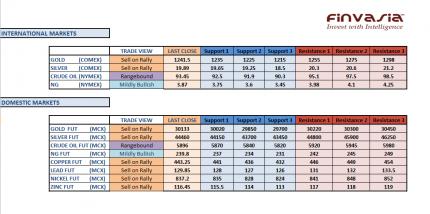

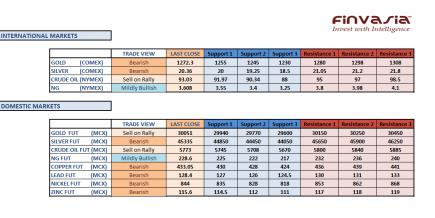

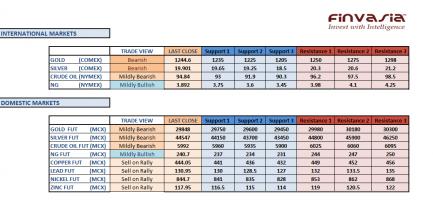

Intraday Tips and Technical Levels for MCX: November 13th

Precious metals in the domestic markets are trading with a mixed sentiment. Gold outperformed silver for yet another session as India gold has been witnessed trading on a strong footing. Weakness in Rupee has also supported the metalsí prices. We thereby recommend the investors to keep a close eye on the currency moves though we hold a sell on rally view in gold and silver. Investors are likely to stay cautious in crude oil trading ahead of the API report due after the markets close today. We continue holding a mildly bullish view in copper against other major base metals.

Source: FINVASIA Research

-

11-14-2013 10:07 AM

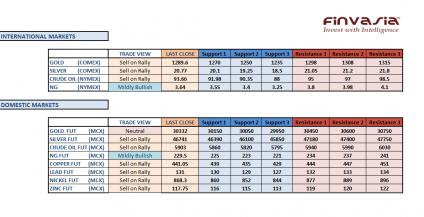

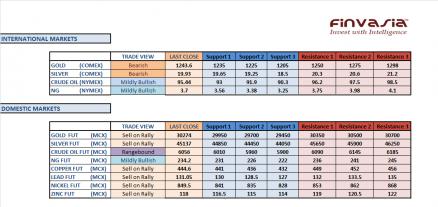

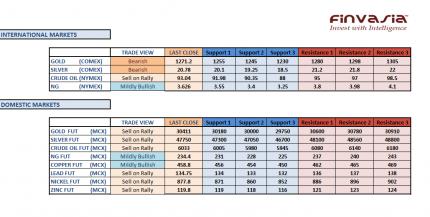

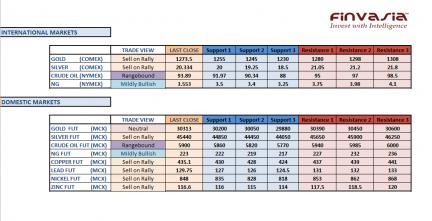

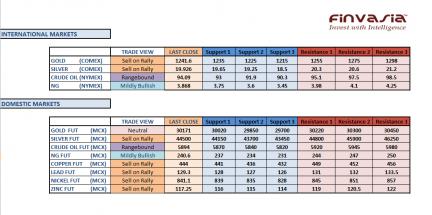

Intraday Tips and Technical Levels for MCX: November 14th

The investors are recommended to trade with a sell on rally view in precious metals. Though, US Federal Reserveís vice chairperson made some dovish comments on Wednesday thereby lifting the international gold and silver futures higher. Crude oil is likely to trade in a range awaiting the Trade Balance and Jobless claims data today. We continue holding a mildly bullish view in natural gas while the investors are recommended to stay cautious ahead of weekly inventory report due at 9 pm IST today. Base metals are likely to trade with a negative bias

Source: FINVASIA Research

-

11-18-2013 10:03 AM

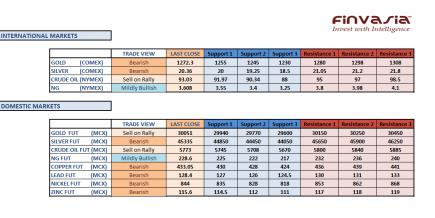

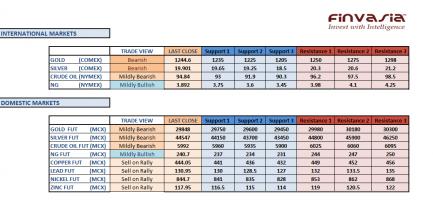

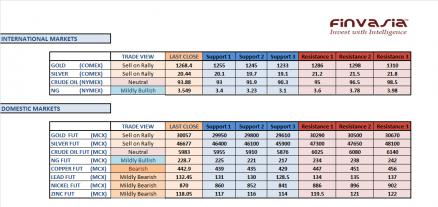

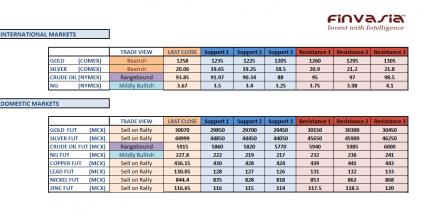

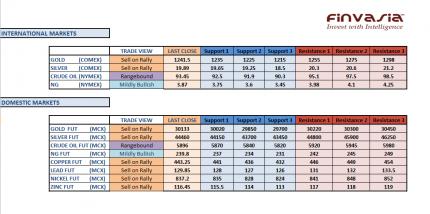

Intraday Tips and Technical Levels for MCX: November 18th

Gold in the domestic markets has been depicting a very strong performance. We recommend our investors to stay cautious until further clarity of direction as international precious metals are trading in a range. We hold a sell on rally view on Silver while the view stays the same in crude oil. Technically the crude futures are trading weak and the consolidating inventories in the US have added further selling pressure. Base metals had been trading with a bearish sentiment however some relief rally might be seen as China comes up with some reforms. An opportunity to sell on the rallies must be taken.

Source: FINVASIA Research

-

11-19-2013 09:54 AM

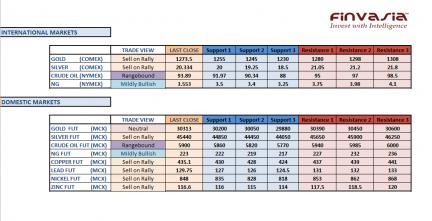

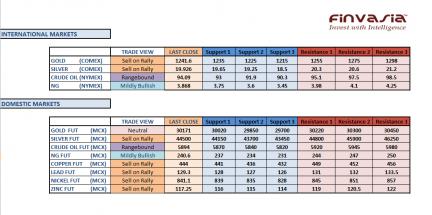

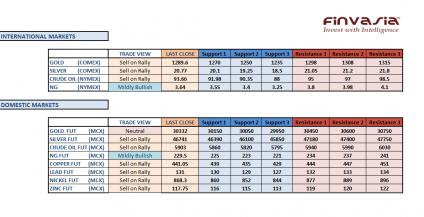

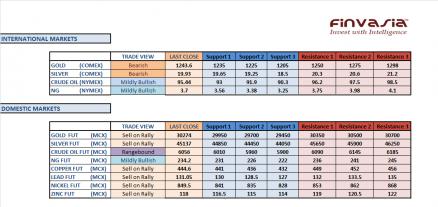

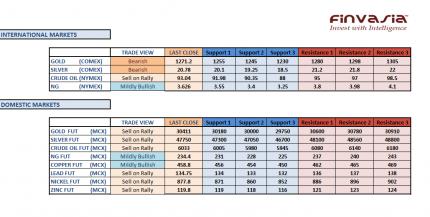

Intraday Tips and Technical Levels for MCX: November 19th

The premium on India gold surged beyond 1800 levels as the domestic gold prices closed above 30000 despite international gold futures trading with a negative bias. Silver continued underperforming the yellow metal. The precious metals are likely to trade with a bearish stance. We hold a negative view in crude as well; opportunity to sell on rallies should be taken. Watch carefully for the Rupee movements, while our view is bearish in base metals across the board.

Source: FINVASIA Research

-

11-20-2013 10:02 AM

Intraday Tips and Technical Levels for MCX: November 20th

US Federal Reserve will be releasing its policy minutes today which might give some further direction to the commodity markets. The most important economic factor which stays of the highest concern to the investors is Fedís tapering plan. In the domestic markets, gold is trading with a very strong footing hence we recommend our investors to stay cautious as even more volatility can be seen. Crude oil is likely to trade in a range while the weekly inventory report is due at 9:00 pm IST today. We continue holding a negative bias on base metals.

Source: FINVASIA Research

-

11-21-2013 10:43 AM

Intraday Tips and Technical Levels for MCX: November 21st

Gold and silver faced heavy selling pressure in the previous session as Fed stated in its policy minutes that it could begin tapering its asset purchases program in the coming months. The sentiment is completely bearish for the precious metals; however some weakness in the Rupee might limit the losses in India bullions market. Sentiment stays mixed for crude oil as the inventories were positive for crude however Iran talks are likely to weigh over the oil prices. We recommend selling base metals on rallies. Stay cautious in natural gas ahead of inventory data due at 9:00 pm IST today.

Source: FINVASIA Research

-

11-22-2013 10:03 AM

Intraday Tips and Technical Levels for MCX: November 22nd

Gold and silver witnessed selling pressure in previous trading session after fed indicated that it may start scaling down its bond buying program in the coming month. US gold prices are trading below key support level of $1250 & it could witness further technical selling pressure. We hold bearish view on precious metals; however some weakness in the rupee and rising gold premium in domestic market might limit losses for yellow metal in MCX. Crude prices are expected to trade with mildly bullish stance and currently, US crude is holding very well its key support level of $93 per barrel. We recommend buy on dips in crude oil. Natural Gas is expected to trade with mildly bullish stance due to seasonal demand. We recommend selling base metals on rallies.

Source: Finvasia Research

-

11-25-2013 10:01 AM

Intraday Tips and Technical Levels for MCX: November 25th

We hold a mildly bearish view in domestic precious metals looking for the high premium in India gold to narrow down further from its current levels. We also hold a negative view in crude oil amid prospects of increased crude supply from Iran after a deal struck over this weekend. Our view in natural gas stays on the bullish side, an opportunity to buy on dips can be taken. However, the base metals are likely to face selling pressure on rallies. Rupee strength is also likely to weigh over the metalsí prices.

Source: FINVASIA Research

-

11-26-2013 09:46 AM

Intraday Tips and Technical Levels for MCX: November 26th

Precious metals which had been trading with a negative bias erased all of their intraday losses in the previous session with the India gold premium surging to almost 2400 rupees. Though our view in precious metals stays selling on rallies, we recommend our investors to stay cautious in India gold. For a significant period of time we have seen 29700 acting as a very strong support zone for the yellow metal prices. Crude is likely to trade in a range ahead of inventory results and a series of economic data due this week. The outlook for crude oil would still be on the bearish side. Base metals are likely to face selling pressure on rallies while our view continues to stay positive for natural gas. Colder than expected temperatures in the next two weeks, are likely to increase the heating demand for natural gas.

Source: FINVASIA Research

-

11-27-2013 09:49 AM

Intraday Tips and Technical Levels for MCX: November 27th

We continue holding our sell on rally view in precious metals. With the gold premium in India trading at an all time high of 2500, we expect some profit booking which can be taken as an opportunity to sell into the rally. Our view in crude oil stays on the bearish side, though some range bound moves might be seen ahead of inventories report. We recommend our investors to sell base metals on rally. An appreciation in the Rupee is likely to cause further pressure on the domestic commodity prices. We hold a mildly bullish view in natural gas; however the investors are advised to stay cautious ahead of storage data due on the calendar today.

Source: FINVASIA Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply