Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Gold futures have been trading with an optimistic sentiment. The demand is likely to stay strong in the domestic markets ...

-

10-29-2013 11:03 AM

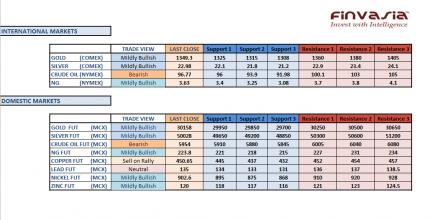

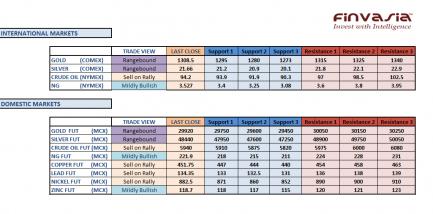

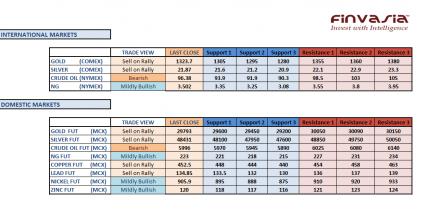

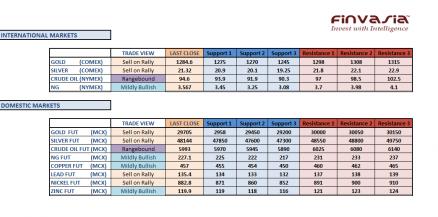

Intraday Tips and Technical Levels for MCX: October 29th

Gold futures have been trading with an optimistic sentiment. The demand is likely to stay strong in the domestic markets till Diwali in the upcoming week. Despite strong physical demand in the domestic markets, Silver has been facing a strong neckline resistance at 50000 levels. In broader terms, we continue holding a mildly bullish view in precious metals. We are looking to a very range bound movement in crude oil after the recent sell off pressure which was seen. Base metals are trading with a positive bias, while copper is recommended to short on rallies.

Source: Finvasia Research

-

10-30-2013 01:18 PM

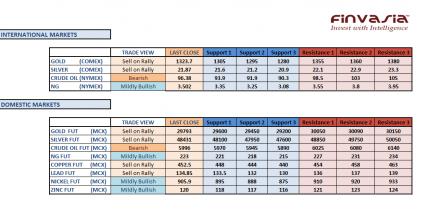

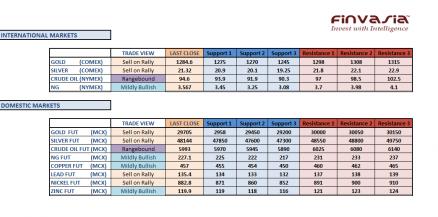

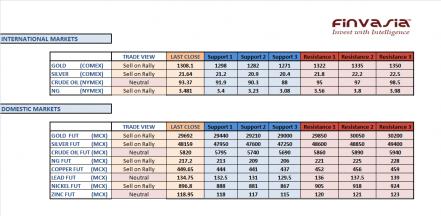

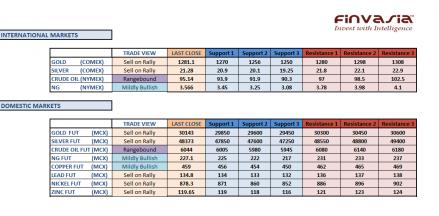

Intraday Tips and Technical Levels for MCX: October 30th

We hold a mildly bullish view in precious metals as the festive demand is likely to support the bullions till Diwali. Though we can see some volatility in the bullions market today as the FOMC meeting is set to conclude late Wednesday. Despite crude oil trading in the bearish terrain, we are likely to see more of a range bound movement in crude as investors stay cautious. We recommend our investors to sell copper on rally while zinc and nickel are trading strong in the base metals basket.

Source: Finvasia Research

-

10-31-2013 02:41 PM

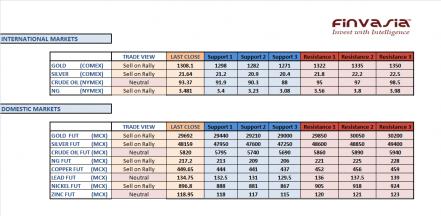

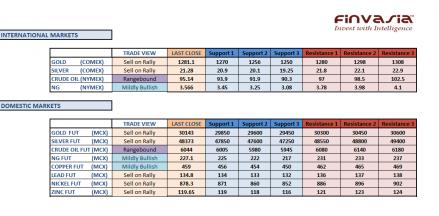

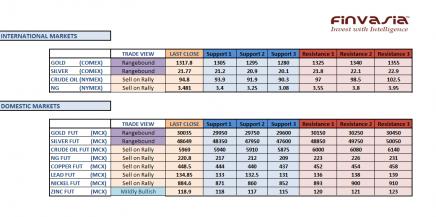

Intraday Tips and Technical Levels for MCX: October 31st

With the occasion of Dhanteras marked on the calendar tomorrow, the precious metals are likely to limit losses ahead of Diwali. Silver continues to outperform gold, a convincing breakout above 50200-50300 levels, will be bullish for the precious metals. Crude oil continues to trade in the bearish terrain while base metals have gathered some strength. No major global event is awaited while the investors are recommended to stay cautious in natural gas ahead of inventory data due at 8 pm IST.

SOURCE: FINVASIA Research

-

11-01-2013 11:07 AM

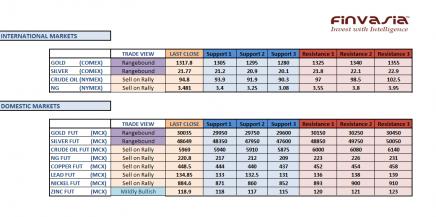

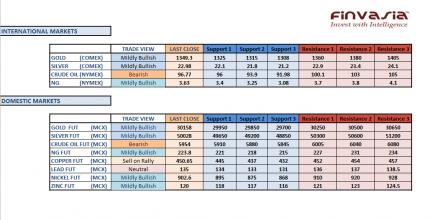

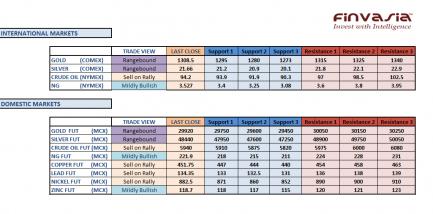

Intraday Tips and Technical Levels for MCX: November 1st

Precious metals faced heavy selling pressure in the previous session as USD 1350 levels acted as a strong resistance zone for the yellow metal in the international markets. Hopes on US tapering wavered with a lieu of positive economic data released by the US. Dollar traded strong versus the euro which also weighed over the dollar quoted commodities. We hold a sell on rally view in precious metals. We continue to hold a bearish view in crude. Base metals are trading with a mixed bias. We expect Nickel and Zinc to outperform lead and copper.

Source: FINVASIA Research

-

11-05-2013 02:15 PM

Intraday Tips and Technical Levels for MCX: November 5th

We hold a sell on rally view in precious metals. Now as the festive season ends, the physical demand which had been supporting the domestic bullion, is likely to soften. In the international markets, gold and silver had been unable to break convincingly above its key resistance zone. Crude oil continues to trade in the bearish terrain. Watch for key macro economic indicators for further direction. Base metals trade mixed while we might see some selling pressure in natural gas as well.

Source: Finvasia Research

-

11-06-2013 10:03 AM

Intraday Tips and Technical Levels for MCX: November 6th

Crude prices are expected to trade with cautious stance near crucial support zone. US crude has strong support near at $93 levels & if it breaches below this level then we may see crude prices moving below $90 levels. Crude prices will take further clue from weekly crude inventories report, which is due to release at 8 pm today. We hold a sell on rally view in precious metals on signs of weak physical demand. Now as the festive season ends, the physical demand which had been supporting the domestic bullions, is likely to soften. Base metals are expected to trade in range with slightly bearish stance. We hold mildly bearish view on natural gas.

Source: Finvasia Research

-

11-07-2013 10:01 AM

Intraday Tips and Technical Levels for MCX: November 7th

We recommend our investors to stay cautious in precious metals ahead of macro economic data and ECB rate decision today. The GDP growth rate will be released on Thursday while the US nonfarm payrolls data is due on Friday. Ahead of the data release, the price movements are likely to remain range bound. After a bullish inventory report, we saw the crude oil prices bouncing back from its extended downward run however we continue holding a sell on rally view in crude oil. Base metals are likely to trade mixed ahead of Chinese trade balance data. Stay cautious in natural gas ahead of inventory data due at 8 pm IST today.

Source: FINVASIA Research

-

11-08-2013 01:35 PM

Intraday Tips and Technical Levels for MCX: November 8th

Precious metals are likely to trade in a range ahead of an important US data lined up on the daily calendar today. During the Asian trading hours, the international gold and silver futures took some support trading firm. Nonfarm payrolls and Personal income data will be released by the US at 7:00 pm IST today. Crude oil took some support from a better than expected GDP growth data released previously while the investors might get opportunities to sell crude on rallies. Base metals trade mixed while natural gas is likely to trade with a positive bias after the supply data released on Thursday.

Source: FINVASIA Research

-

11-11-2013 10:35 AM

Intraday Tips and Technical Levels for MCX: November 11th

Precious metals depicted a weak performance in the last trading session however the markets saw no major buying support from the domestic markets. After the US nonfarm was reported better than the expectations, the investors raised hopes of Fed tapering its asset purchase program sooner than expected. We recommend our investors to sell gold and silver on rallies. Crude oil is likely to remain range bound with no major moves anticipated in either direction. Copper is likely to hold some support and we have a slightly bullish view in the red metal.

Source: FINVASIA Research

-

11-12-2013 10:01 AM

Intraday Tips and Technical Levels for MCX: November 12th

Despite international gold and silver futures trading in a subdued manner, the domestic gold futures rallied in the previous session. We continue holding a sell on rally view in precious metals but the investors are recommended to stay cautious towards USD/INR movement. Weakness in the Rupee is likely to push the commodity prices higher across the board. Crude oil is likely to trade range bound; the investors might get an opportunity to sell crude futures on rally. We hold a mildly bullish view in Copper.

Source: FINVASIA Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply