Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - We saw some pressure coming in the precious metals in the early trading hours on Wednesday. However, the losses were ...

-

06-13-2013 11:03 AM

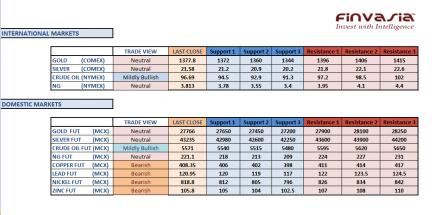

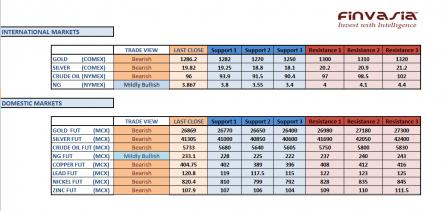

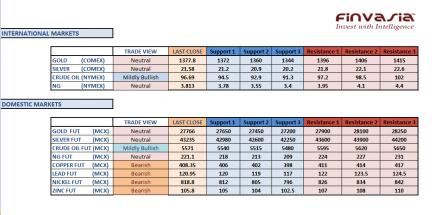

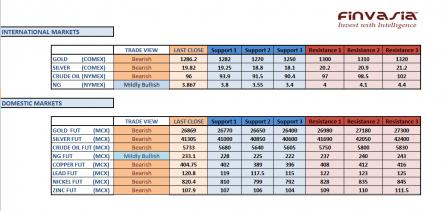

Intraday Tips and Technical Levels for MCX: June 13th

We saw some pressure coming in the precious metals in the early trading hours on Wednesday. However, the losses were reversed in the second half of the trading session with gold and silver seeking support near its current levels.

We continue to hold our mildly bearish outlook in precious metals and base metals. Due to supply concerns from Indonesia, copper is likely to trade neutral to firm. We recommend selling on rallies in gold and silver.

Source: Finvasia Research

-

06-14-2013 11:18 AM

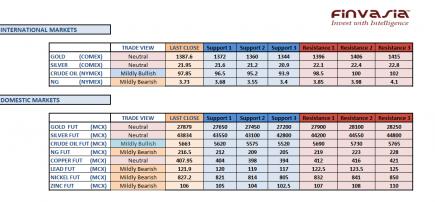

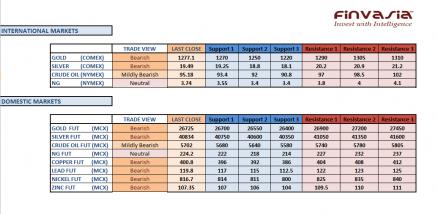

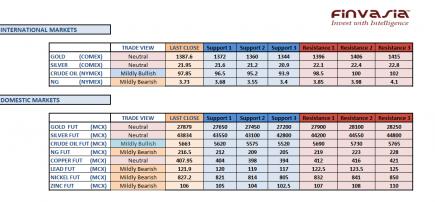

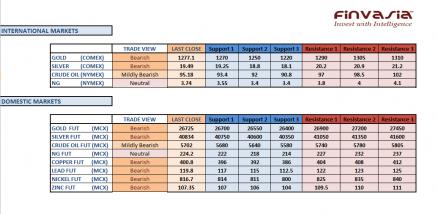

Intraday Tips and Technical Levels for MCX: June 14th

Gold and Silver are trading firm in the current scenario. We do not see much of a downside to the precious metals. However, if the Indian Rupee appreciates from its current levels, we recommend selling into the precious metals.

We are bearish in base metals and mildly bullish for Crude oil. We gave 2 calls in the previous session and booked "FULL PROFITS" in both lead and copper.

Source: Finvasia Research

-

06-17-2013 11:22 AM

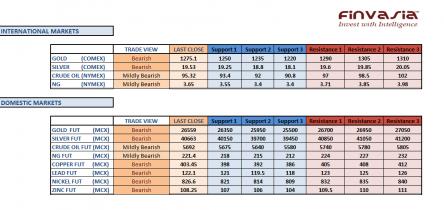

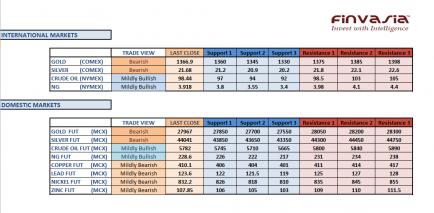

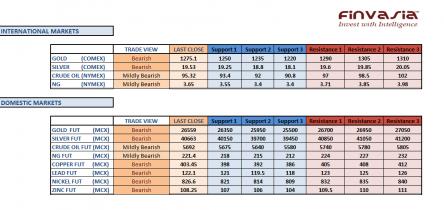

Intraday Tips and Technical Levels for MCX: June 17th

Precious metals in the international markets have been consolidating in the same range. In the Indian markets, the currency factor has caused high volatility in the gold and silver prices. We stay mildly bullish in crude oil as the Middle East supply concerns continue to exist. We recommend selling base metals on rallies.

Source: Finvasia Research

-

06-18-2013 11:04 AM

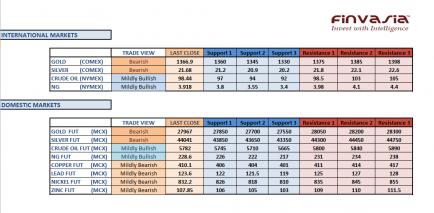

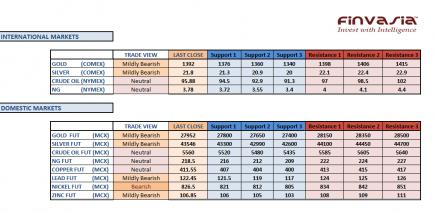

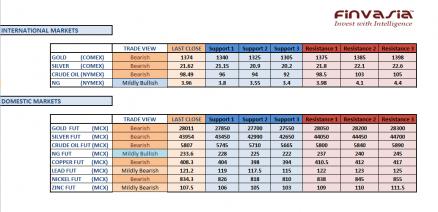

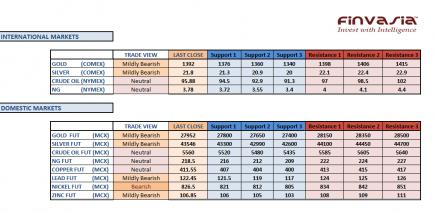

Intraday Tips and Technical Levels for MCX: June 18th

Precious metals were seen trading in a very range bound manner in the previous session. We recommend staying sidelines in gold and silver before further clarity in price movement is seen. An important US fed meeting is awaited tomorrow which can cause high volatility in the markets.

Our view for the base metals is mildly bearish across the board while currency factor will have a significant impact on the commodity prices. We are mildly bullish on crude oil and natural gas. API crude oil inventories report is due today.

Source: Finvasia Research

-

06-19-2013 11:04 AM

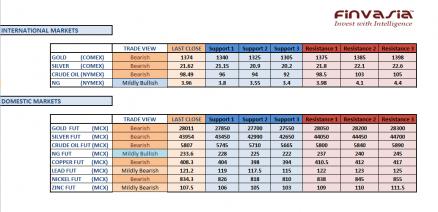

Intraday Tips and Technical Levels for MCX: June 19th

An important US Fed policy meet decision is due today which can cause high volatility in the markets. Therefore we recommend our investors to stay highly cautious in today’s session and wait for further clarity of direction before entering a trade.

On the technical front, precious metals look week in the international markets but weakness in the Indian rupee is likely to support the domestic commodity prices. We continue to hold our bearish stance in base metals. Crude oil prices are gaining strength on supply concerns from the Middle-East. The crude inventories report is due at 8:00 pm IST today.

Source: Finvasia India

-

06-20-2013 11:04 AM

Intraday Tips and Technical Levels for MCX: June 20th

An important US central bank decision was awaited yesterday which caused the sentiment to stay cautious in the entire trading session. As the Fed chairperson stated that the US asset purchase program would be scaled back by the year end, there was sell off in commodity markets seen across the board. The statement is negative for all the commodities but the Indian Rupee has weakened further against the US dollar which would limit the downside to the Indian commodity markets.

We have a bearish call in all precious and base metals. The crude futures in the international markets trade weak on Fed’s announcement and weak inventories report. Stay cautious in natural gas ahead of inventories due today at 8:00 pm IST.

We gave 2 intraday calls in the previous session of which we booked “FULL PROFITS” in copper.

Source: Finvasia India

-

06-21-2013 10:54 AM

Intraday Tips and Technical Levels for MCX: June 21st

We saw an aggressive sell on rally coming in gold and silver yesterday with the gold and silver contracts losing over 1140 and 2649 rupees respectively. The sentiment is completely bearish for commodities across the board. After Fed stated to taper with its easing program by the year end, we expected the rally to come in yesterday as an immediate reaction to the macro event. If rupee gets stronger from its current levels, we recommend further selling into the rallies.

We gave 4 calls yesterday of which one was a positional call in gold which came in favor by Rs 850 in just one day. We booked “FULL PROFITS” in gold intraday call as well. While the remaining two calls also ended in our favor.

Source: Finvasia India

-

06-24-2013 11:01 AM

Intraday Tips and Technical Levels for MCX: June 24th

Currently, the commodities are trading with a strong bearish sentiment. In the international markets, the commodity prices are pointing towards a lower opening in the domestic markets. However, the further price direction would be guided by the movements in the Indian Rupee. We are strongly bearish in crude oil and recommend selling gold and silver on rallies.

Source: Finvasia India

-

06-25-2013 11:01 AM

Intraday Tips and Technical Levels for MCX: June 25th

Precious metals continue to trade in the bearish territory as we saw gold and silver losing further strength in the previous trading session. Appreciation in the Indian Rupee is likely to add further bearishness to the commodity prices. Crude oil prices take support from supply concerns. We hold our bearish outlook on base metals and recommend selling into rallies.

Source: Finvasia Research

-

06-26-2013 10:57 AM

Intraday Tips and Technical Levels for MCX: June 26th

Gold and silver prices fell dramatically in the international markets today witnessing the positive US data and also as the Fed’s plan to taper the stimulus plan, diminished the safe-haven status of precious metals.

We recommend selling precious metals into the rally. Stay cautious in crude oil ahead of the inventories report due at 8:00 pm IST today. Our outlook continues to stay bearish in base metals as well.

Source: Finvasia Research

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply