Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - We recommend our investors to sell precious metals on rally. On the Comex division, the gold futures broke decisively below ...

-

10-11-2013 11:01 AM

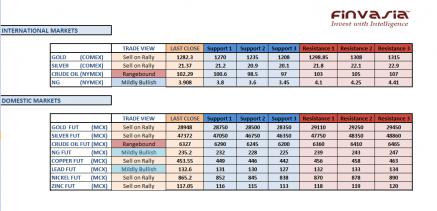

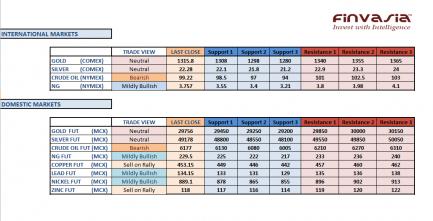

Intraday Tips and Technical Levels for MCX: October 11th

We recommend our investors to sell precious metals on rally. On the Comex division, the gold futures broke decisively below the 1300 mark which is likely to further dampen the sentiment in bullions. As the hopes of US raising its debt ceiling increased, the precious metals are facing a selling pressure. The view in crude oil stays neutral as we saw crude reversing its losses from 101 levels in the previous session. Wait for further clarity of direction before entering into any trades. We continue holding our sell on rally view in base metals.

Source: Finvasia Research

-

10-15-2013 09:53 AM

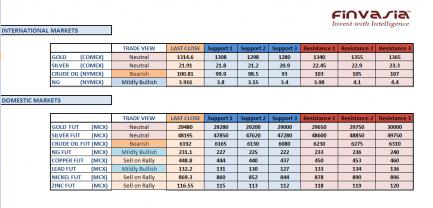

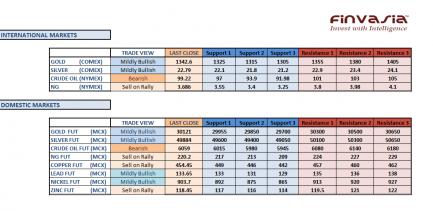

Intraday Tips and Technical Levels for MCX: October 15th

We continue holding our bearish view on precious metals. If US resolves its debt issue, we are likely to see further selling pressure into bullions. Watch for Rupee movements as weakness in the currency would limit the downside to dollar quoted commodity prices. Crude oil can be traded in a range i.e. it can be bought on dips and sold on rallies. Breakout below 101 levels will add selling pressure to the oil prices. Lead is outperforming the other constituents in the base metals basket. Natural gas continues to track gains however; some profit booking might limit the upside to the energy prices.

- Source: Finvasia Research

-

10-17-2013 09:53 AM

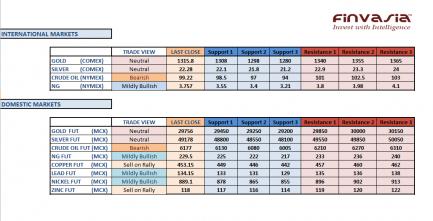

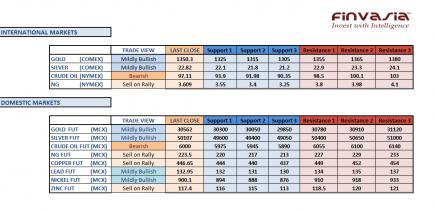

Intraday Tips and Technical Levels for MCX: October 17th

Precious metals had been swinging in a volatile range amid the lingering uncertainty over the US debt ceiling issue. However, the US government finally re opened reaching a deal on Thursday. Precious metals gathered some gains in the late trading session on Wednesday while the Comex futures are trading steady at the moment. We recommend selling precious metals on rallies. Crude oil is likely to trade in a range until it breaks in either direction. Some key economic data points will also be released in the evening session today including Jobless Claims and Philly Fed manufacturing. We continue holding our sell on rally view in base metals apart from Lead, which is currently trading strong.

Source: Finvasia Research

-

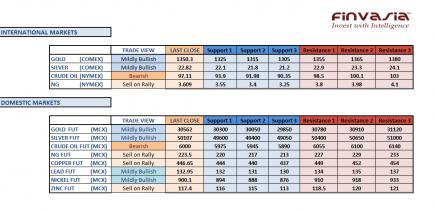

10-18-2013 10:16 AM

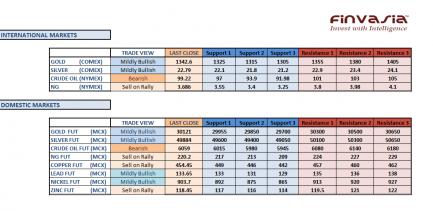

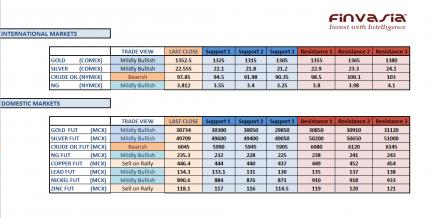

Intraday Tips and Technical Levels for MCX: October 18th

Precious metals which had decisively broken below its crucial support levels previously, rallied on Thursday. Bullion depicted a very strong performance in the previous session which has upturned the bearish sentiment in gold and silver. We currently hold a mildly bullish view in precious metals however, we recommend staying cautious as the moves are highly volatile. Crude oil broke below $101 levels which it had tested for quite some time; our outlook is bearish on crude oil. We continue holding our sell on rally view in base metals, while a stronger Rupee is likely to support the same.

Source: Finvasia Research

-

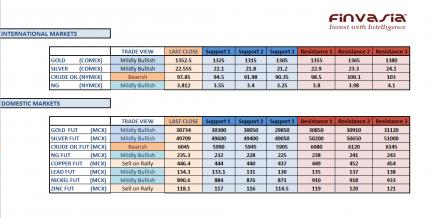

10-21-2013 10:07 AM

Intraday Tips and Technical Levels for MCX: October 21st

We recommend our investors to stay cautious in precious metals as the movements can be very volatile amid the US economic indicators due to be released this week. $1325 continues to act as a strong resistance for international gold prices. We recommend selling crude on rally while we continue holding a similar view in base metals. Stay cautious in crude as the weekly inventories report is due at 8:00 pm IST today. The Existing home sales data is also due on the economic calendar.

Source: Finvasia Research

-

10-22-2013 09:56 AM

Intraday Tips and Technical Levels for MCX: October 22nd

Precious metals are trading firm with the Comex gold prices forming a range between USD 1314 to USD 1325 levels. Despite no major moves in the international gold and silver prices we saw domestic bullions rallying on a weaker Rupee. We recommend our investors to stay cautious ahead of Nonfarm payrolls data due from the US today. We hold a bearish view in crude oil with the Nymex crude trading below USD 100 levels. Stay cautious in natural gas ahead of the weekly inventory report due at 8:00 pm IST today.

Source: Finvasia Research

-

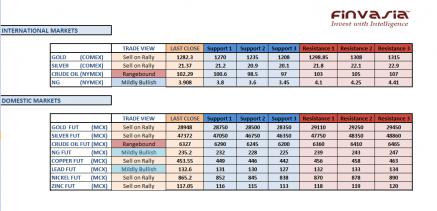

10-23-2013 09:48 AM

Intraday Tips and Technical Levels for MCX: October 23rd

The sentiment is positive for bullions currently. As the markets are pricing in the prospects of continued stimulus plans by the Fed, we are likely to see precious metals trade in the positive terrain. USD 1353- USD 1355 is an important resistance area for the international gold prices. If such levels are broken, it would be extremely bullish for gold and silver. We continue holding our bearish view in crude oil. Nymex crude prices have decisively broken below USD 100 levels, while bearish inventory reports have also added pressure. Carefully watch the Rupee movements, as 61 levels have acted as a strong resistance for INR recently.

Source: Finvasia Research

-

10-24-2013 10:10 AM

Intraday Tips and Technical Levels for MCX: October 24th

Precious metals have been extremely bullish in the past few sessions. With the dollar index facing continued pressure we hold a mildly bullish view in gold and silver. Though a stronger Rupee would limit the upside, the sentiment is likely to remain optimistic. Crude oil might take some consolidation support at its current levels however the overall view continues to stay bearish in oil. Among the base metals basket, Lead and Nickel are likely to outperform copper and zinc. Stay cautious in natural gas ahead of the weekly inventory report due at 8:00 pm IST today.

Source: Finvasia Research

-

10-25-2013 10:04 AM

Intraday Tips and Technical Levels for MCX: October 25th

Precious metals continue to trade with a positive bias however US 1355 continued to act as a strong resistance for the international gold prices. We continue holding a mildly bullish view in gold and silver. Crude futures gathered some support near its current levels after a positive manufacturing data was reported by China but in a broader sense, crude oil continues to trade in the bearish terrain. We hold a sell on rally view in copper and Zinc while the view stay mildly bullish in lead and nickel.

Source: Finvasia Research

-

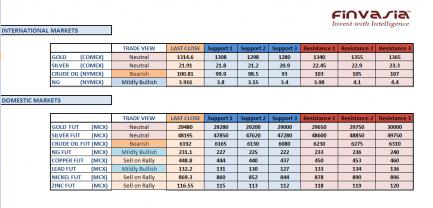

10-28-2013 10:09 AM

Intraday Tips and Technical Levels for MCX: October 28th

Bullions continue to trade in the positive territory and as the festive season is on, the physical demand for gold and silver has also been of much support. We continue holding a mildly bullish view in gold and silver. Though the currency is likely to trade in a range during today’s session ahead of RBI interest rate decision on Tuesday, we might see some profit booking limiting the upside. Technically, the Comex gold futures are trading at very crucial levels. A breakout above such levels would add further bullishness to the yellow metal prices. We continue holding our bearish view in crude. In the base metals basket, we have a stronger view in Lead and Nickel as compared to copper and zinc.

Source: Finvasia Research

Visitors found this page by searching for:

testing

,

testingDBMS_PIPE.RECEIVE_MESSAGE(CHR(98)CHR(98)CHR(98) 15),

testing(),

testing}body{zzz:Expre**SSion(09tY(9059))},

testingeL1au <ScRiPt >09tY(9143)<ScRiPt>,

testing<WC5VYN>GZJZI[! !]<WC5VYN>,

testing<a5ixeSp x=9556>,

testing<aa1kyKg<,

testingsleep(27*1000)*qrlqlw,

testingsleep(27*1000)*mnvgzr,

testing9923554,

testing<ScRiPt >0Ey7(9146)<ScRiPt>,

testing<input autofocus onfocus=09tY(9042)>,

testingu003CScRiPt09tY(9698)u003CsCripTu003E,

testing<ScRiPt >09tY(9881)<ScRiPt>,

testing<ScRiPtzzz src=xss.bxss.metxss.js9446><ScRiPt>,

testing< ScRiPt >09tY(9492)<ScRiPt>,

testing<isindex type=image src=1 onerror=09tY(9175)>,

testing<iframe src=data:texthtml;base64 PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo= invalid=9626>,

testing<body onload=09tY(9914)> Tags for this Thread

Register To Reply

Register To Reply