Options - Bullish Spread Strategies - Explained in Derivatives - Bull Call Spread Strategy

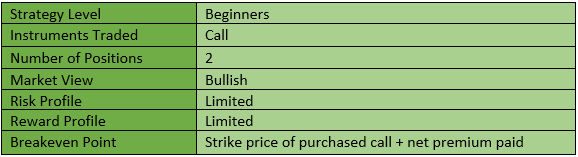

The bull call spread strategy is one of the simplest option strategies that an option trader ...

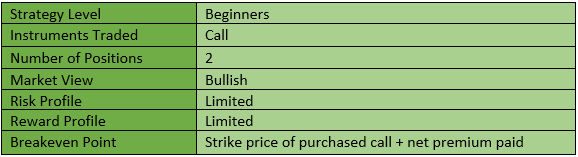

-

09-09-2021 08:42 PM

Bullish Spread Strategies - Explained

Bull Call Spread Strategy

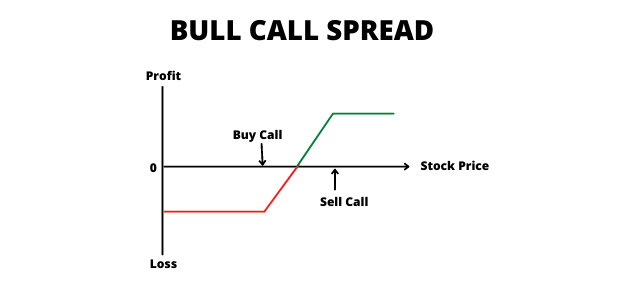

The bull call spread strategy is one of the simplest option strategies that an option trader can use when trading in options. Spread Strategies are multi-leg strategies that involve more than one option. When the trader has an outlook of moderate bullish on a stock or an index, then the spread strategy like Bull Call Spread can be implemented. To implement this strategy, the trader should have an outlook of moderately bullish.

Bullish strategy built using

Call options and it is a

Spread –

Bull Call Spread What is Bull Call Spread Strategy?

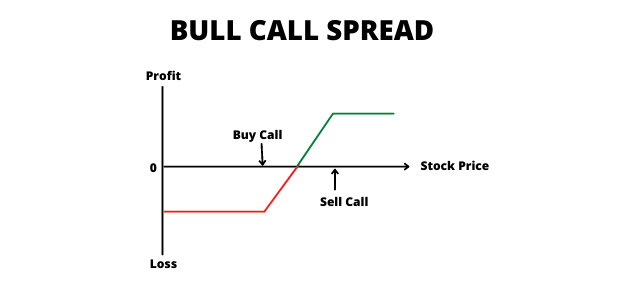

A Bull Call Spread (or Bull Call Debit Spread) strategy is meant for investors who are moderately bullish of the market and are expecting mild rise in the price of underlying. The strategy involves taking two positions of buying a Call Option and selling of a Call Option. The risk and reward in this strategy is limited.

A Bull Call Spread strategy involves Buy ITM Call Option and Sell OTM Call Option.

For example, if you are of the view that Nifty will rise moderately in near future then you can Buy Nifty ITM Call Option and Sell Nifty OTM Call Option.

When to Use:

1. All strikes belong to the same underlying

2. Belong to the same expiry series

3. Each leg involves the same number of options

Risk: Limited to any initial premium paid in establishing the position. Maximum loss occurs where the underlying falls to the level of the lower strike or below.

Reward: Limited to the difference between the two strikes minus net premium cost. Maximum profit occurs where the underlying rises to the level of the higher strike or above.

Break-Even Point (BEP): Strike Price of Purchased call + Net Debit Paid.

Example

Someone buys a Nifty Call at Strike Price 17300 at a premium of Rs. 150 and he sells a Nifty Call at strike price 17600 at a premium of Rs. 25. The net debit here is Rs. 125, which is also his maximum loss.

Strategy: Buy a call with a lower strike (ITM) + Sell a Call with a higher strike (OTM)

The Bull Call Spread Strategy has brought the breakeven point down (if only the 17300 strike price Call was purchased the breakeven point would have been 17450), reduced the cost of the trade (if only the 17300 strike price Call was purchased, the cost of the trade would have been Rs. 150), reduced the loss on the trade (if only the 17300 strike price Call was purchased, the maximum loss would have been Rs. 150 i.e., the premium of the Call purchased). However, the strategy also has limited gains and is therefore ideal when markets are moderately bullish.

Advantage of Bull Call Spread

Instead of straightaway buying a Call Option, this strategy allows you to reduce cost and risk of your investments.

Disadvantage of Bull Call Spread

Profit potential is limited.

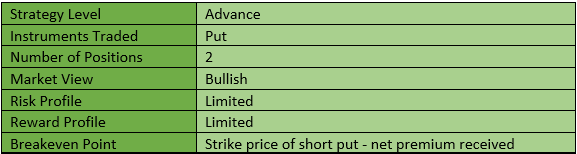

Bull Put Spread Strategy

What is Bull Put Spread Strategy?

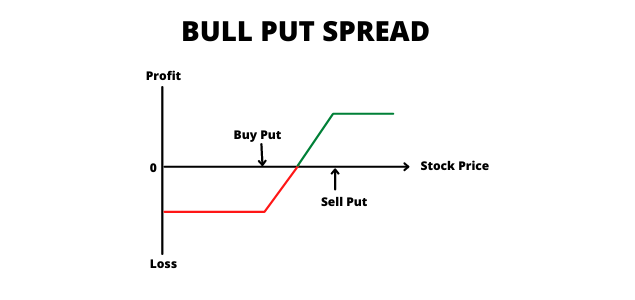

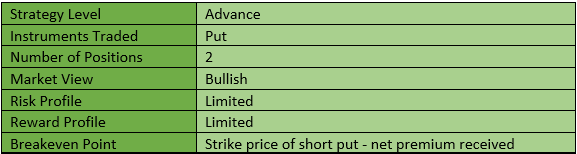

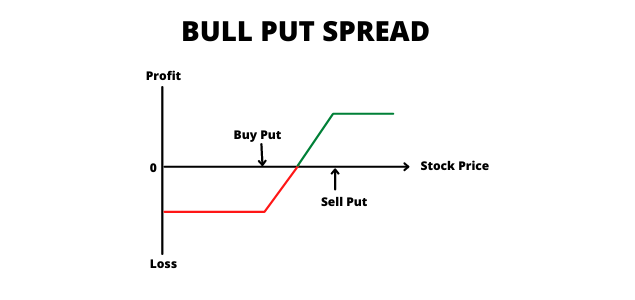

A Bull Put Spread (or Bull Put Credit Spread) strategy is a Bullish strategy to be used when you're expecting the price of the underlying instrument to mildly rise or be less volatile. The strategy involves buying a Put Option and selling a Put Option at different strike prices. The risk and reward for this strategy is limited.

A Bull Put Strategy involves Buy OTM Put Option and Sell ITM Put Option. For example, If you are of the view that Nifty will moderately gain or drop its volatility in near future. If Nifty is currently trading at 17300 then you will buy an OTM Put Option at 17000 and a sell an ITM Put Option at 17300. You will make a profit when, at expiry, Nifty closes above 17300 level and incur losses if the prices fall down below 17300 (net off premium).

Bullish strategy built using

Put options and it is a

Spread –

Bull Put Spread

When to use?

1. All strikes belong to the same underlying

2. Belong to the same expiry series

3. Each leg involves the same number of options

Risk: Limited. Maximum loss occurs where the underlying falls to the level of the lower strike or below.

Reward: Limited to the net premium credit. Maximum profit occurs where underlying rises to the level of the higher strike or above.

Break-Even Point (BEP): Strike Price of Short Put — Net Premium Received.

Example

Someone sells a Nifty Put option at strike price of 17300 at a premium of Rs. 100 and buys a further OTM Nifty Put option at strike price 17000 at a premium of Rs. 30 when the current Nifty is at 17280, with both options expiring on same date.

Strategy: Sell an ITM Put + Buy an OTM Put

Advantage of Bull Put Spread

Allows you to benefit from time decay in profit situations. Helps you profit from 3 scenarios: rise, sideway movements and marginal fall of the underlying.

Disadvantage of Bull Put Spread

Limited profit as it is restricted to premium collected.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply