Options - Types of Options in Derivatives - Call Options

When you buy a call option, you’re buying the right to purchase shares from the seller of that ...

-

08-18-2021 10:39 AM

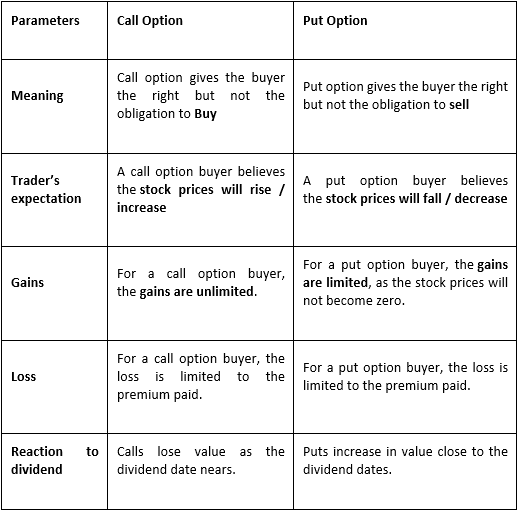

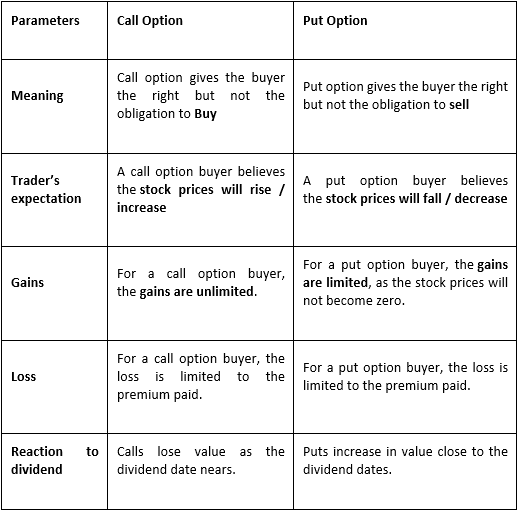

Types of Options

Call Options

When you buy a call option, you’re buying the right to purchase shares from the seller of that option, at a predetermined price, which is called the “strike price”. To purchase a call option, you pay the seller of the call a fee, known as a “premium.” When you hold a call option, you hope the market price of the stock associated with it will increase in the near future. Why? If the stock price increases enough to exceed the strike price, you can exercise your call and buy that stock from the call’s seller at the strike price, or in other words, at a price below the stock’s market value. Then you can either keep the shares (which you obtained at a bargain price) or sell them for a profit. But what happens if the price of the stock goes down, rather than up? You let the call option expire and your loss is limited to the cost of the premium.

Put Options

When you buy a put option, you’re buying the right to force the person who sells you the put to purchase stock from you at the strike price. When you hold put options, you want the stock price to drop below the strike price. If it does, the seller of the put will have to buy shares from you at the strike price, which will be higher than the market price. Because you can force the seller of the option to buy your shares at a price above market value, the put option is like an insurance policy against your shares losing too much value. If the market price instead goes up rather than down, your shares will have increased in value and you can simply let the option expire because all you’ll lose is the cost of the premium you paid for the put.

How are Options Contract Priced?

The options contracts enable you to purchase an underlying asset at only a fraction of the actual price of the asset by paying an upfront premium. Premium is the cost of the options contract paid upfront to the seller before entering an options contract. Let us understand the below terms before we learn about the factors which determine the premium of the options contract.

• In-the-money (ITM): For Call option, when Spot price > Strike price. Opposite for put option

• Out-of-the-money (OTM): For Call option, when Spot price < Strike price. Opposite for put option

• At-the-money (ATM): When Spot price is almost same as Strike price.

Example of how Options in trading Work

Let us understand how to trade in options with an example.

For instance, let us assume the strike price of a call option of Tata Motors stock is Rs. 300 which has an expiration period of three months. The Spot price of the stock is Rs. 260. According to the options contract, you have the right to buy Tata Motors stock at Rs.300 at expiry. If the spot price rises above Rs. 300 on expiry, you can exercise your call option and buy the stock at Rs. 300 only. This way you can yield profit as the call option comes under in-the-money.

Similarly, the value of the call option increases when the spot price is closer to the strike price. For instance, the stock mentioned above which has a spot price of Rs. 260. The value of the option with a strike price of Rs. 280 will be higher than the option with the strike price of Rs. 300. This is because the probability of the stock price becoming Rs. 280 is higher than Rs. 300.

Hope the options trading example makes options trading clearer. Let us discuss the factors affecting the options premium.

Factors Affecting the Options Premium

• Intrinsic Value

The difference between the market price and the strike price of an option is called intrinsic value. This value can be either positive (if you are in-the-money) or zero (if you are either at-the-money or out-of-the-money). Keep in mind that an asset cannot have negative intrinsic value.

• Time Value

When the factor to determine the premium is dependent upon the time left to exercise the option it is called time value. For instance, if the time left between the current date and the expiration date for contract A is longer as compared to contract B, then contract A has a higher time value than contract B.

Conclusion

Options trading can make you quick money if done with wisely and with due diligence. The capital required is much less for buying options but many factors are working against an option buyer. The buyer needs to be very accurate and disciplined to make money in options trading.

Smart traders in the market mostly sell options. With selling options, although your profits are limited but the time decay works in your favour. Even if the stock remains stagnant at a price for days, option seller makes money while option buyer loses.

Thus, always take your options trade after adequate homework and research. Never get caught in the allure of trading big with small money in a hope to make a fortune in short span of time with options trading.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply