Options - Strangle and Straddle Option Strategies - Explained in Derivatives - Beauty of trading options is that, without knowing the direction of the market or on a sideways market, one can ...

-

09-21-2021 08:24 PM

Strangle and Straddle Option Strategies - Explained

Beauty of trading options is that, without knowing the direction of the market or on a sideways market, one can take a trade and still can make money. This is not possible on cash or futures trading.

Strangle and Straddle strategies are the most commonly used direction neutral strategies. Personally I have used Short Strangle for years on Nifty50. In this article, let's discuss the basics of these strategies.

A strangle is an options strategy in which the Trader holds a position in both a call and a put option with different strike prices, but with the same expiration date and underlying asset. Mostly the difference between spot to the strike traded will be same on both call and put.

A strangle is similar to a straddle but uses options at different strike prices, while a straddle uses a call and put at the same strike price.

YouTube: https://www.youtube.com/watch?v=MJ7gqaID_gI

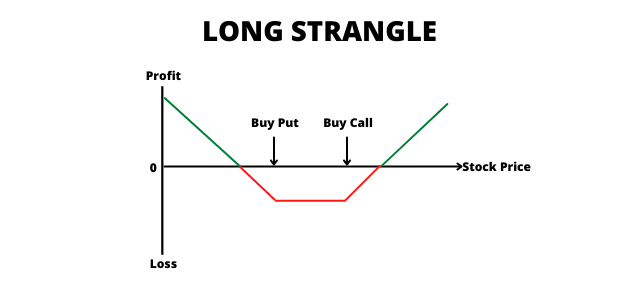

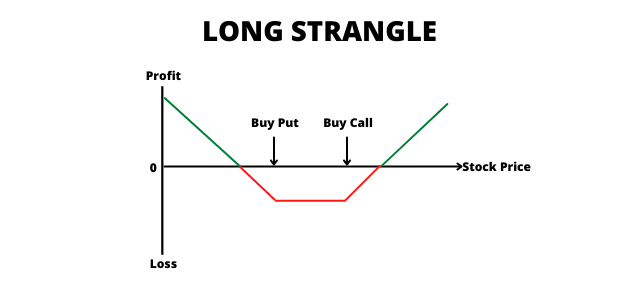

A Long strangle is a good strategy if you think the underlying security will experience a large price movement in the near future but are unsure of the direction. However, it is profitable mainly if the asset does swing sharply in price.

This strategy involves buying an “Out-of-the-Money Call Option” and buying an “Out-of-the-Money Put Option”. Both options must have the same underlying security and expiry, also equal distance from spot.

Long Strangle is a slight modification to the Long Straddle to make it cheaper to execute.

The Trader makes profit when the underlying makes significant movement on the upside or downside. The strategy has limited downside.

Trader's view: Neutral on direction but bullish on volatility of the Stock/ Index.

Risk: Limited to net premium paid.

Reward: High.

Upper breakeven: Buy Call Strike price + net premium paid.

Lower breakeven: Buy Put Strike price – net premium paid

Probability of making profit: Low

To be done during big events that can swing markets big like Union Budget or Union Govt election results etc

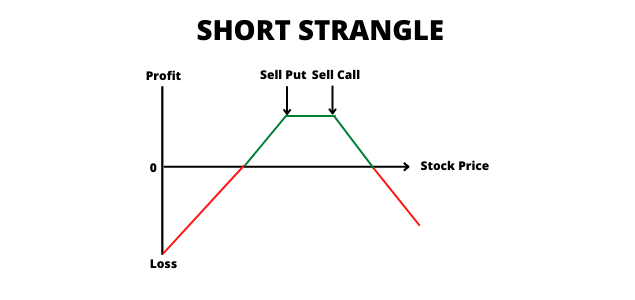

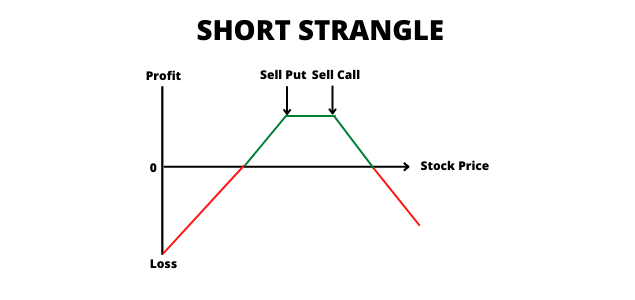

A Short strangle is a good strategy if you think the underlying security will be stuck in a range in the near future without making any big moves. However, it is dangerous set up when underlying moves big and can lead to bigger losses. This is one of the mostly used strategies of option writers.

Short Strangle is a strategy to be used when the Trader is Neutral on the market direction and bearish on volatility expecting markets to trade in a narrow range.

This strategy involves selling an “Out-of-the-Money Call Option” and selling an “Out-of-the-Money Put Option”. Both options must have the same underlying security and expiration month.

Short Strangle is a slight modification to the Short Straddle. The profit payoff region is much wider as compared to Short Straddle.

If the underlying stock does not show much of a movement, the Trader of the Short Strangle gets to keep the premium.

Trader view: Neutral on direction and bearish on volatility of the Stock/Index.

Risk: Unlimited.

Reward: Limited to net premium received.

Upper breakeven: Sell Call Strike price + net premium received.

Lower breakeven: Sell Put Strike price – net premium received.

Probability of making profit: High

To be done during low volatile markets and when there isn't any scheduled big events. One just need to know to manage the risk and this is one of the commonly used option writing strategies

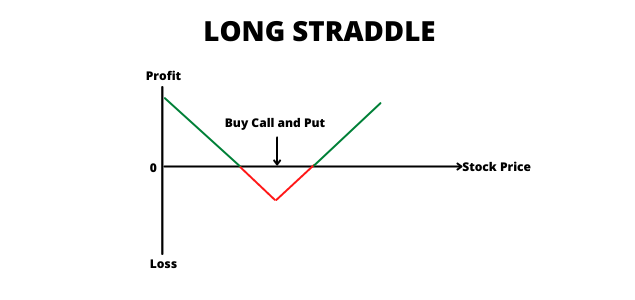

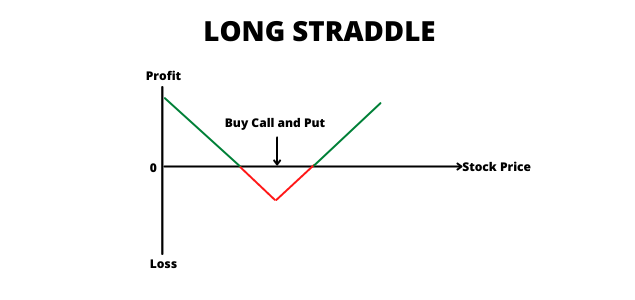

A straddle is a options strategy that involves simultaneously trading on both put option and call option for the underlying security with the same strike price and the same expiration date.

A trader will profit from a long straddle when the price of the security rises or falls from the strike price by an amount more than the total cost of the premium paid. Profit potential is virtually unlimited, so long as the price of the underlying security moves very sharply.

This strategy involves Buying a Call as well as Put on the same underlying for the same expiry and Strike Price. This strategy gives the Trader an advantage of a movement in either direction — a soaring or plummeting value of the underlying.

Profits can be made in either direction if the underlying shows volatility to cover the cost of the trade. Loss is limited to the premium paid in buying the options.

All that the Trader is looking out for is the underlying to break out exponentially in either direction.

Trader View: Neutral direction but expecting significant volatility in underlying movement.

Risk: Limited to the premium paid.

Reward: High

Lower Breakeven: Strike Price - net premium paid.

Higher Breakeven: Strike Price + net premium paid.

Probability of making profit: Low

To be done during big events that can swing markets big like Union Budget or Union Govt election results etc

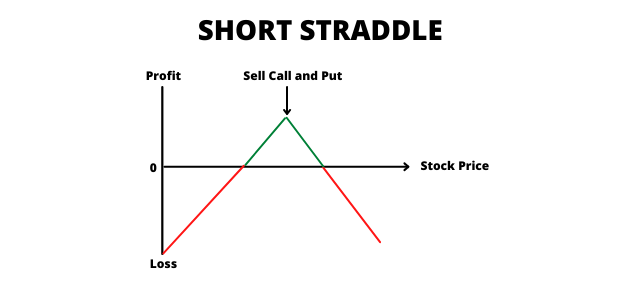

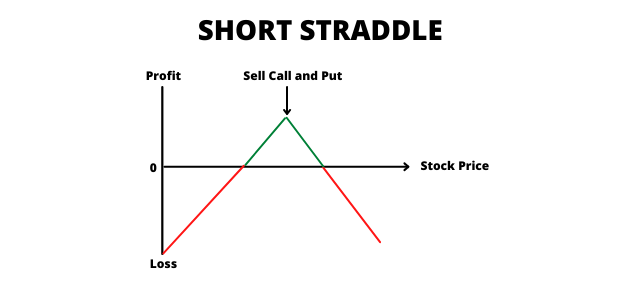

Short Straddle is the opposite of long Straddle. It is used when the Trader is expecting underlying to show no large movement. Trader expects the underlying to show little volatility Upside or Downside.

This strategy involves Selling a Call as well as Put on the same underlying for the same maturity and Strike Price. It creates a net income for the Trader.

If the underlying does not move much in either direction, the Trader retains the Premium as neither the Call nor the Put will be exercised. However, in case the underlying moves in either direction, up or down significantly, the Trader’s loss can be unlimited.

This is a risky strategy and should be carefully adopted only when the expected volatility in the market is limited.

Trader View: Neutral direction but expecting little volatility in underlying movement.

Risk: Unlimited.

Reward: Limited to the premium received.

Lower Breakeven: Strike Price - net premium received.

Higher Breakeven: Strike Price + net premium received.

Probability of making profit: High as long as no spike in Volatility

Very risky strategy and should not be done without risk management in place

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply