Options - Bearish Spread Strategies - Explained in Derivatives - Bear Call Spread

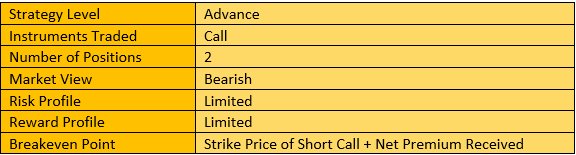

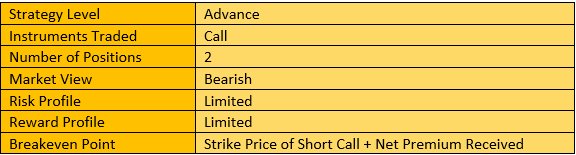

The Bear Call Spread strategy can be adopted when the trader feels that the stock/index is either ...

-

09-15-2021 06:00 PM

Bearish Spread Strategies - Explained

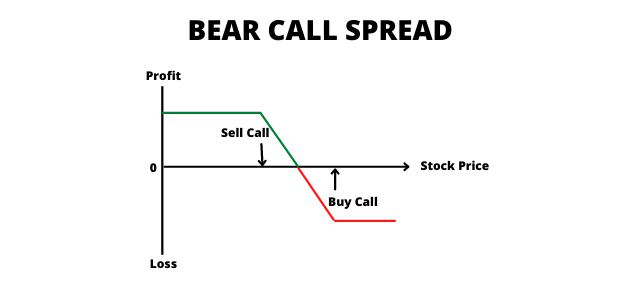

Bear Call Spread

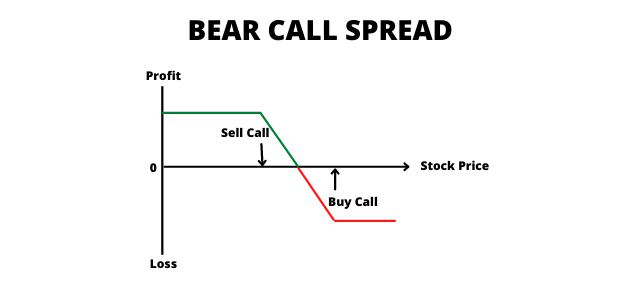

The Bear Call Spread strategy can be adopted when the trader feels that the stock/index is either range bound or falling. The concept is to protect the downside of a Call Sold by buying a Call of a higher strike price to ensure the Call sold doesn’t get into unlimited loss. This is a fairly complex strategy and should be used by advanced traders. In this strategy the trader receives a net credit because the Call he buys is of a higher strike price than the Call sold.

The strategy requires the trader to buy out-of-the-money (OTM) call options while simultaneously selling in-the-money (ITM) call options on the same underlying stock or index. This strategy can also be done with both OTM calls with the Call purchased being higher OTM strike than the Call sold. If the stock/index falls both Calls will expire worthless and the trader can retain the net credit. If the stock/index rises then the breakeven is the lower strike plus the net credit. Provided the stock/index remains below that level, the trader makes a profit. Otherwise, the trader could generate a loss. The maximum loss is the difference in strikes less than the net credit received.

When to Use: When the trader is mildly bearish on market.

Risk: Limited to the difference between the two strikes minus the net premium.

Reward: Limited to the net premium received for the position i.e., premium received for the short call minus the premium paid for the long call.

Breakeven Point: Lower Strike + Net credit

Strategy: Sell a call with a lower strike price (ITM) + Buy a Call with a higher strike (OTM).

When is a Bear Call Spread Strategy Useful?

Now that we understand what is a bear call spread, here are some situations where this strategy might prove useful:

• Modest Decline Anticipated: If the trader expects a modest decline rather than a big plunge in the performance of a stock or index, a bear call spread strategy is ideal. This is because the potential gains from a relatively minimal decline are less and are restricted to one’s option premiums. If the decline were more extreme, the potential gains would be larger. Hence, it would be more appropriate to implement a bear put spread, short sale, or buying puts as trading strategies.

• High Volatility: Even though the long and short legs of the bear call spread tend to offset the shock value of volatility, this strategy pays off better when the market is volatile. This is because when implied volatility is high, one can generate more income from premiums.

• Managing Risk: Selling a call option exacts an obligation from the seller to deliver the security at its pre decided strike price. There is a huge potential for loss if the spot price moves way ahead of the strike sold before the call option expires. A bear call spread strategy puts a limit on the potentially massive loss on the uncovered short sale of one’s call option. Although the long leg in this strategy reduces the premium amount the call seller can acquire, it substantially mitigates risk, which justifies its cost.

Advantage of Bear Call Spread

It allows you to profit in a flat market scenario when you're expecting the underlying to mildly drop, be range bound or marginally rise.

Disadvantage of Bear Call Spread

Limited profit potential.

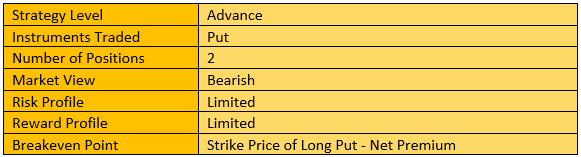

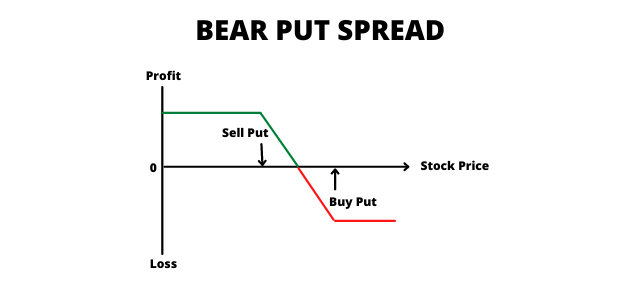

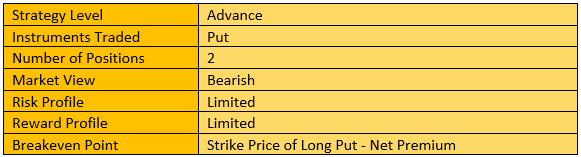

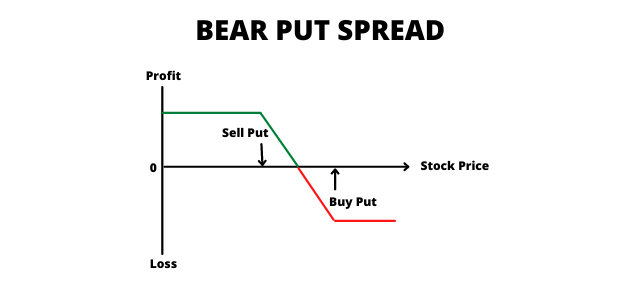

Bear Put Spread

The Bear Put strategy involves selling a Put Option while simultaneously buying a Put option. Contrary to Bear Call Spread, here you pay the higher premium and receive the lower premium. So there is a net debit in premium. Your risk is capped at the difference in premiums while your profit will be limited to the difference in strike prices of Put Option minus net premiums.

This strategy is used when the trader believes that the price of underlying asset will go down moderately. This strategy is also known as the bear put debit spread as a net debit is taken upon entering the trade.

This strategy has a limited risk as well as limited rewards.

When to Use: The bear call spread options strategy is used when you are bearish in market view. The strategy minimizes your risk in the event of price movements going against your expectations.

Risk: Limited to the net amount paid for the spread i.e., the premium paid for long position less premium received for short position.

Break Even Point: Strike Price of Long Put—Net Premium Paid

Strategy: Buy a Put with a higher strike (ITM) + Sell a Put with a lower strike (OTM)

Advantage of Bear Put Spread

Risk is limited. It reduces the cost of investment.

Disadvantage of Bear Put Spread

The profit is limited.

Similar Threads

-

-

-

Fundamental / Technical Analysis

-

-

Visitors found this page by searching for:

bse2nse

,

https:bse2nse.comoptions10808-bearish-spread-strategies-explained.html Tags for this Thread

Register To Reply

Register To Reply