Options - Options – The way to trade them in Derivatives - In this thread, I’ll be explaining about various aspects to be considered in options trading and how Sensibull can play ...

-

03-03-2020 06:50 PM

Options – The way to trade them

In this thread, I’ll be explaining about various aspects to be considered in options trading and how Sensibull can play a part in it.

Many of the amateur traders enter into trading options without understanding much of the concepts/reasons for premium moves thinking it to be just like a stock and end up losing good amount of capital with option long positions. Some traders who wants to learn and then venture into option trading will take long time due to lack of understanding/fear of losing capital.

By default, most are “bulls” and very few are “bears”. So people will end up buying options rather than selling options. When market doesn’t move in the good in the expected direction of the option buy, then premium will erode 20-40% in no time. When market moves big for any news/event, option sellers will lose big when they don’t know how to manage their position. Again, buying and selling need to be done at correct market dynamics to make profits. Will post later on the differences between buying and selling options.

There is content (videos and articles) on option trading at this link http://bit.ly/326ZE0d

There are different stages in coming being a successful trader.

1. Creating a trading plan

2. Paper trading them for a while to find out obvious issues

3. Real trading with minimal quantity

a. experience from this won’t come from Paper Trading

b. testing of one’s discipline in sticking to trading plan

4. Scaling up trading capital

5. Trade log & it’s review

6. Maintaining checklist

Creating a trading plan

This is the foundation of any successful trader. There are many strategies out there used by many traders. To start with, one can explore different strategies but need to understand the strength/weakness of self-nature while arriving at the one needed for them. A person who have no control on greed, can’t be successful as “option buyer”. A person who has little/no patience can’t make money by selling options positional trades. Self-realization is must for all traders. Changing one’s nature is not an easy and quick process. One can attempt this, but I prefer to pick strategies based on existing nature of the individual.

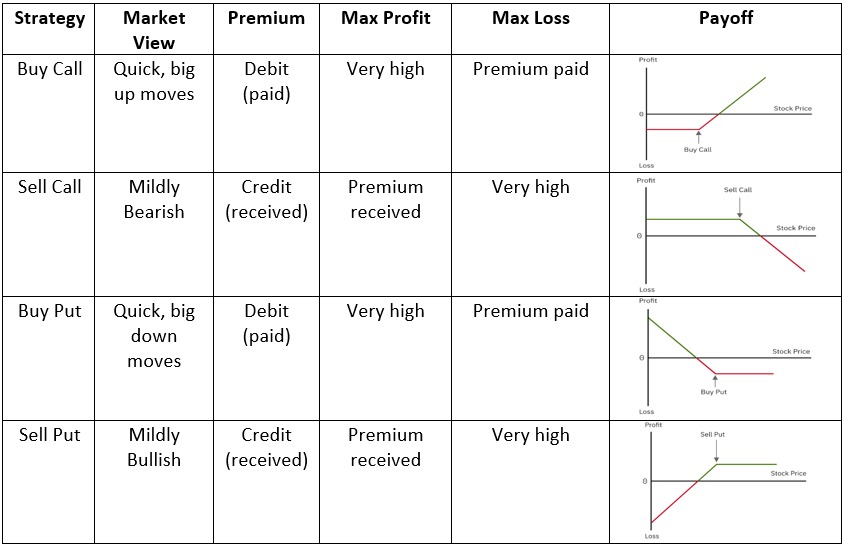

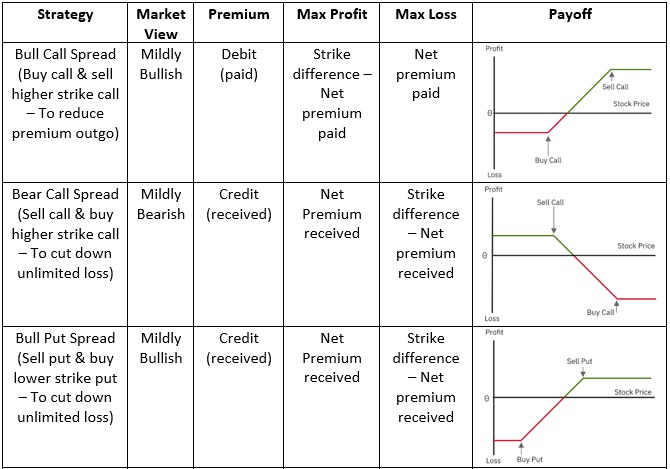

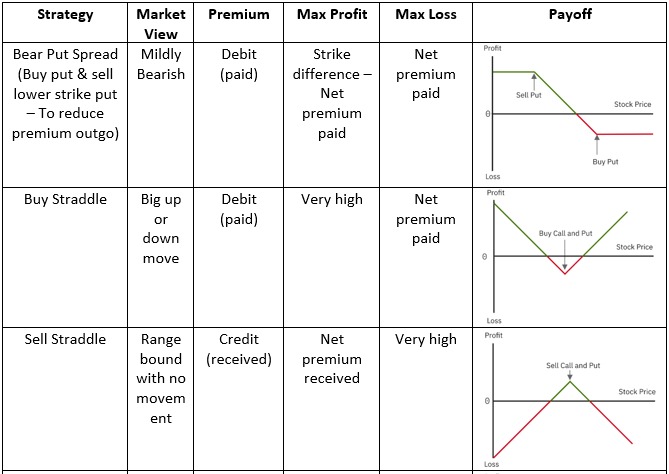

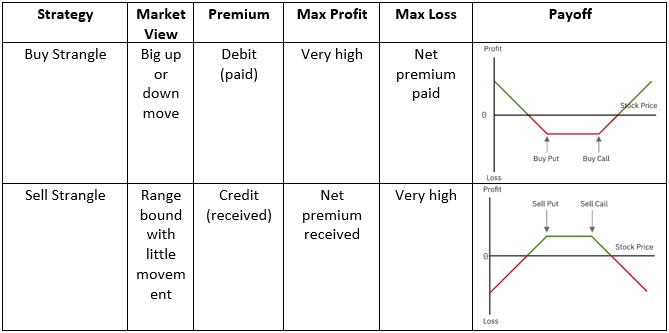

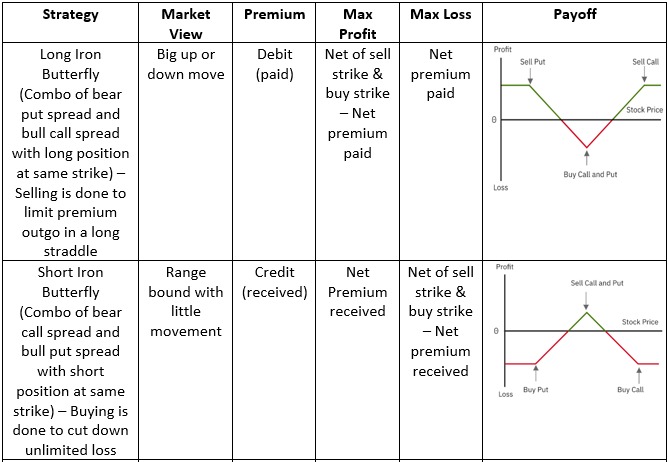

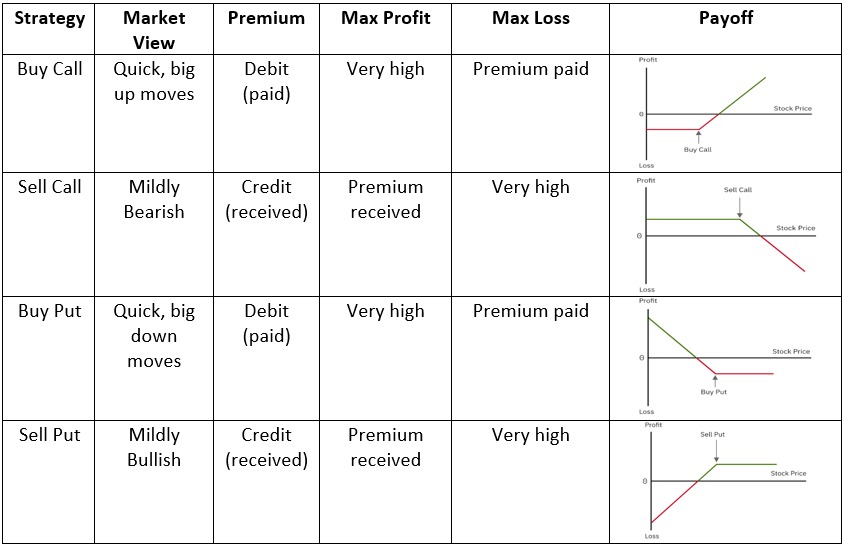

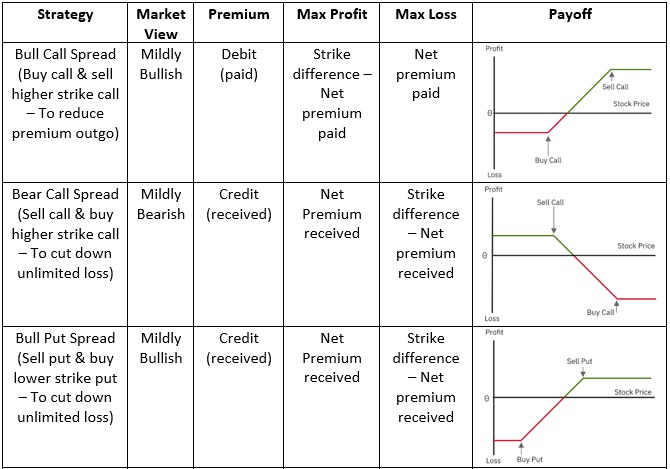

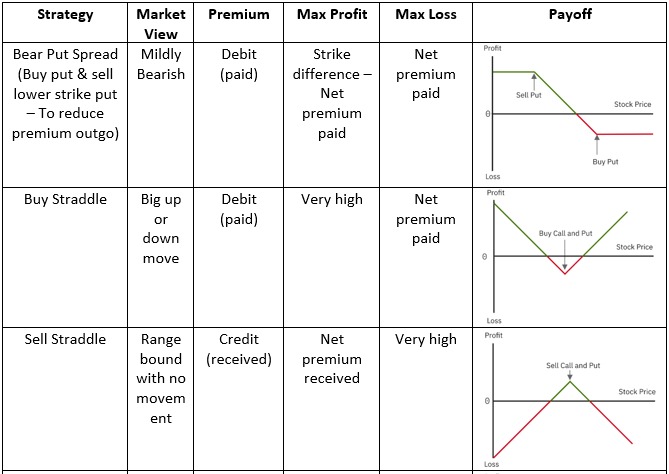

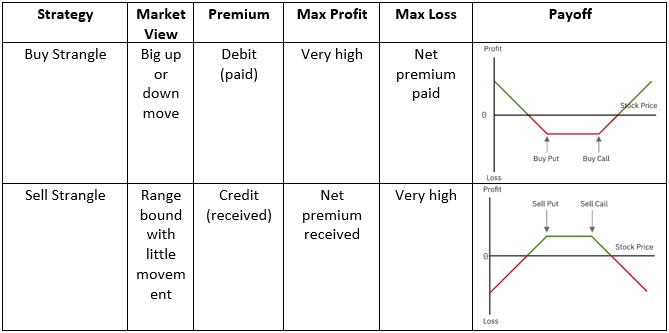

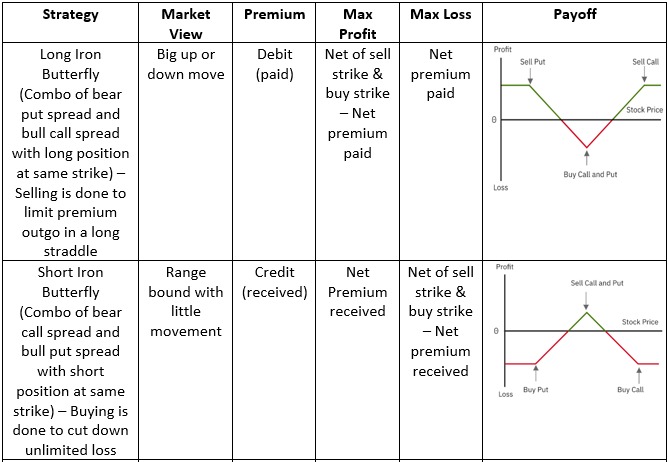

In options trading, following are most commonly used strategies.

Simple one leg Strategies

Two leg Strategies

Multi-leg Strategies

Above list is what one will find most commonly when searching online/books in option strategies. For those who are new, it will take a while to get hold of terms used.

More details of these are available at http://bit.ly/2uQvDWo

It is not like one has to trade picking one of these. Also the profit/loss depends on time of entry of each leg and exit price of each leg. There are traders who enter/exit multi leg strategies at different time. One should do so only if they know exactly what they are doing, else it is prudent to enter/exit all at same time.

These strategies are basic set ups based on one’s view on the market. One should know how to adjust their trade when market moves against one’s view. This can be achieved only through experience.

If you have a view on Nifty/Bank Nifty, you can see the suggested trades at http://bit.ly/2P7wHvL. This is basic one. For those who are looking for such strategies created for a view, can make use of Strategies Wizard at http://bit.ly/38HTrds.

Paper/Virtual trading of the identified strategy

Any trading plan need to be put to test either in paper trading or virtual trading (when there is a platform) before using real money. I agree that experience from paper/virtual trading is nothing when compared to trading with real money. But this phase is required to identify any obvious issues in trading strategy and fix those before deploying real money.

This can be done in three ways

• Writing down in a notebook

• Entering data in Microsoft Excel sheet

• Using any virtual trading platform

First two ways has the flexibility to have any type of data we want to track that will help during the review process. But the third one will have predefined set of parameters. Also, need to check if third option has options to maintain historical trades for review.

But, most of the traders feel lazy to do things on their own and look for a ready-made solution. In this case, virtual trading platform helps. Another advantage of this is, trades will be taken using real market data (though it can be done in paper/excel ways as well but it is more convenient to do in virtual trading platform).

A good virtual trading platform is one that has following features

• Allows real time market data as in live trading platform to take trades

• Maintains historical trades with P&L in a database

• Has exhaustive list of parameters to track in every trade and allows traders to pick and choose what they want to track

• Screenshots of chart highlighting the entry and exit points of trade

Objective here is to review the trades done (paper/virtual), to prepare a checklist for entry and exit criteria and evolving the same based on trades taken. As much as fine tuning need to happen here.

Once the consistency is more than 60-70%, one can then move on to deploy the strategy using real money.

Sensibull supports virtual trading in F&O using real market data. One can explore this at http://bit.ly/2P78kOT. (Note: This is a paid feature and not free)

Real Trading with minimal quantity

Once one is able to make profits in paper/virtual trading consistently and most of the obvious errors in the trade plan are rectified, real trading can be done for the strategy. Please note that, only when someone trades using real money, the understanding will be better.

There is a saying ‘Plan the Trade. Trade the Plan’. Apart from having a good trading strategy, execution of the strategy is equally important. Only while doing trade in real money, one’s discipline will be put to test.

In paper/virtual trading, one will hold on to loss without any fear, but in real trading, one will panic and exit. Decisions made in paper/virtual trading and decisions made while trading in real money will be different. So one shouldn’t get into over confidence on trading just by doing paper/virtual trading.

Without taking any risk, there won’t be any reward. There will be many traders who will spot the trade, but won’t enter due to fear of losing money in case market moves against their position. So one need to enter trade based on the view and keep a stop loss and target in place. Initial trades need to be taken with minimal quantity. In case of equity, one can just trade with 1 (one) quantity. But in F&O, minimum is one lot. So do real trade using one lot. DO NOT increase lot size even if you are consistently making profits. Trade with one lot for at least a year. One year is a decent timeframe to witness different market conditions. When one increases the lots traded prematurely, one bad trade can make a huge dent in trading capital as the trader wouldn’t have had experience in handling such situation earlier.

In options trading, one must know what is at stake in any trade taken. Trading options is not same as trading stocks. As an option buyer, one need to be aware of the fact that chances of capital erosion to the tune of 30-50% is possible when spot goes in opposite direction of the trade taken. As an option seller, one need to know how to manage the trade when there is big move in spot against their position as losses can grow very big in no time. Managing gap up or down is difficult for option sellers when there isn’t any risk cover. So before taking any trade, one need to know the maximum loss/profit that can be incurred along with potential profit/loss at various levels of spot or changes in option greeks like vega.

In options, many will look for a “payoff” diagram which will represent the breakeven point, max loss, max profit etc. Those who are well versed in MS Excel, can create this in few minutes and doesn’t need any software to do this. But most look for a tested system that will present these facts just be entering the trades. This feature is available at http://bit.ly/2SHLsb4.

-

03-03-2020 06:53 PM

Scaling up trading capital

I personally prefer to sell Nifty strangles (will cover the differences between buying and selling options in a different thread). Those who wanted to sell options, I would say to target for 1% return a month and do this with just one lot for one full year. When this is done comfortably, one can try to make 2% return a month in next year. When this is done comfortably in a year, then one can try to make 3% return a month in subsequent year. When return expectations increase, risks in trade also goes up. Some positions will cause stress to the trader while some might end up in loss. When this happens, one need to take a step back. Example, when targeting 3% returns a month things go wrong, then in next year one should go back to 2%. If that is achieved without much issue, it means, based on the trader’s mentality (decision making abilities) and style, 2% a month is the realistically possible returns for the trader. During this phase, one can increase the number of lot to two and do this for a year. Next year, it can be increased further. This will eventually take 4 to 5 years to settle down in a trading style. By then, one would have had really good experience in market and will be able to make good trading calls.

Also, decisions will be made differently when capital at risk is high. So it is always better to scale up trading capital step by step and not in one go. Example: In a trading strategy, assume 2% is the SL. When trading capital is 1L, 2K is the maximum loss and one would wait for the SL to be triggered. When the trading capital is 10L, 20K is the maximum loss (2% of 10L). But the same person might panic when loss goes to 10K and exit prematurely.

It is always best to see the numbers in “percentage” terms rather than “absolute” terms. Only when this is done, scaling of trading capital will be easy.

Trade log & it’s review

Logging every trade is a must for anyone who want to bring in discipline. Apart from trade log, I also prefer to take screenshot of the chart marking trade entry and exit points. I would save the screenshot in with a name like (Ex: 20200227_Short_NiftyFut). One can have their own way that is convenient to them to quickly recall the trade.

In the trade log, I prefer to have following attributes

• Serial Number

• Trade Date

• Script

• Position (Long/Short)

• Checklist (Yes/No) – This is just to ensure I verify the checklist before taking the trade

• Entry Time

• Entry Price

• Quantity

• Target

• Stoploss

• Order Type (BO/CO/MIS/NRML)

• Exit (Target/SL/Manual)

• Exit Price

• Exit Time

• Time in trade (Exit time – Entry time) – In the long run, this should go down

• Profit

• Entry Review (Good/Bad)

• Exit Review (Good/Bad)

• Charges incurred for this trade

• Net Profit

• ROI

• Remarks

Maintaining a trade log is one thing, reviewing the same is another thing. Without reviewing, just maintaining won’t be of much use. Reviews can be done on same day post market hours or on weekend for the trades taken in the week.

One also need to be remember that, markets are dynamic. So a strategy working today might not work tomorrow. One shouldn’t get complacent in trading style and should be flexible to change it based on market conditions.

Maintaining checklist

One need to have checklist for making an entry into a trade, exit from a trade and managing the active trade. This can be evolved only by reviewing the trade log in periodic manner.

Having a checklist is easy but checking against it before actually taking a trade is difficult. But making it a practice will help in long run as one will by heart remember the checklist and can quickly confirm without actually going through the checklist manually.

Personally, I need to improve in this area as I check my trade only later to see if it is as per checklist or not.

The steps explained in this thread is just my view on how one should evolve as a trader and in specific, options. It is not necessary that only those who follow this will become successful trader. One need to understand that all the odds in trading is against the retail trader, so one need to be prepared well to compete against institutions.

-

03-03-2020 06:54 PM

Scaling up trading capital

I personally prefer to sell Nifty strangles (will cover the differences between buying and selling options in a different thread). Those who wanted to sell options, I would say to target for 1% return a month and do this with just one lot for one full year. When this is done comfortably, one can try to make 2% return a month in next year. When this is done comfortably in a year, then one can try to make 3% return a month in subsequent year. When return expectations increase, risks in trade also goes up. Some positions will cause stress to the trader while some might end up in loss. When this happens, one need to take a step back. Example, when targeting 3% returns a month things go wrong, then in next year one should go back to 2%. If that is achieved without much issue, it means, based on the trader’s mentality (decision making abilities) and style, 2% a month is the realistically possible returns for the trader. During this phase, one can increase the number of lot to two and do this for a year. Next year, it can be increased further. This will eventually take 4 to 5 years to settle down in a trading style. By then, one would have had really good experience in market and will be able to make good trading calls.

Also, decisions will be made differently when capital at risk is high. So it is always better to scale up trading capital step by step and not in one go. Example: In a trading strategy, assume 2% is the SL. When trading capital is 1L, 2K is the maximum loss and one would wait for the SL to be triggered. When the trading capital is 10L, 20K is the maximum loss (2% of 10L). But the same person might panic when loss goes to 10K and exit prematurely.

It is always best to see the numbers in “percentage” terms rather than “absolute” terms. Only when this is done, scaling of trading capital will be easy.

Trade log & it’s review

Logging every trade is a must for anyone who want to bring in discipline. Apart from trade log, I also prefer to take screenshot of the chart marking trade entry and exit points. I would save the screenshot in with a name like (Ex: 20200227_Short_NiftyFut). One can have their own way that is convenient to them to quickly recall the trade.

In the trade log, I prefer to have following attributes

• Serial Number

• Trade Date

• Script

• Position (Long/Short)

• Checklist (Yes/No) – This is just to ensure I verify the checklist before taking the trade

• Entry Time

• Entry Price

• Quantity

• Target

• Stoploss

• Order Type (BO/CO/MIS/NRML)

• Exit (Target/SL/Manual)

• Exit Price

• Exit Time

• Time in trade (Exit time – Entry time) – In the long run, this should go down

• Profit

• Entry Review (Good/Bad)

• Exit Review (Good/Bad)

• Charges incurred for this trade

• Net Profit

• ROI

• Remarks

Maintaining a trade log is one thing, reviewing the same is another thing. Without reviewing, just maintaining won’t be of much use. Reviews can be done on same day post market hours or on weekend for the trades taken in the week.

One also need to be remember that, markets are dynamic. So a strategy working today might not work tomorrow. One shouldn’t get complacent in trading style and should be flexible to change it based on market conditions.

Maintaining checklist

One need to have checklist for making an entry into a trade, exit from a trade and managing the active trade. This can be evolved only by reviewing the trade log in periodic manner.

Having a checklist is easy but checking against it before actually taking a trade is difficult. But making it a practice will help in long run as one will by heart remember the checklist and can quickly confirm without actually going through the checklist manually.

Personally, I need to improve in this area as I check my trade only later to see if it is as per checklist or not.

The steps explained in this thread is just my view on how one should evolve as a trader and in specific, options. It is not necessary that only those who follow this will become successful trader. One need to understand that all the odds in trading is against the retail trader, so one need to be prepared well to compete against institutions.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply