IPO - Initial Public Offers - Zomato IPO in IPO's & MF's - Zomato’s IPO is indeed a very big moment for start-ups, as the listing would mark the first meaningful Internet listing ...

-

07-13-2021 01:50 PM

Zomato IPO

Zomato’s IPO is indeed a very big moment for start-ups, as the listing would mark the first meaningful Internet listing in India. The company started operations in 2008, as an online food aggregator. It is the first Indian internet-based start-up to go public. The company initially started as a Restaurant Discovery Platform. The main business model was advertising, as it provided visibility to other restaurants.

Due to a heavy rise in competition, Zomato added other functionalities such as table booking and payments during dine-out. Finally in 2015, Zomato entered the food delivery business which acts as a restaurant aggregator, and this has emerged as a major growth driver for the company in the last few years (>80% of its FY20 revenues). Today, Zomato is one of the leading food aggregators in India.

Zomato offers a platform to search and discover restaurants, order food delivery, book a table, read and write customer-generated reviews and view and upload photos, and make payments while dining out at restaurants. Zomato is a one-stop procurement solution. In 2019, it acquired Hyperpure. As of Dec'20, Hyperpure was supplying 6,000 restaurants across six cities in India. It has helped Zomato increase engagement and thereby drive retention of restaurant on-board.

As of December 31, 2020, Zomato has established a strong footprint across 23 countries with 131,233 active food delivery restaurants, 161,637 active delivery partners, and an average monthly food order of 10.7 million customers.

Objects of the Issue

The net proceeds from the IPO will be utilized towards the following objectives;

• Funding organic and inorganic growth initiatives.

• Meet general corporate purposes.

How big is Zomato?

• Zomato had a monthly active user (MAU) base of more than 4 crore, and monthly transacting users (MTU) of 1.07 crore in FY20.

• More than 80% of its revenues come from food delivery, and the balance is from B2B supplies, dine-out, etc.

• Zomato, as of March, 20 had more than 140,000 active delivery restaurants which catered to an annual delivery volume of 400 million orders.

• Zomato is the highest across the six biggest aggregator platforms around the world in terms of the number of orders per day per active delivery restaurant.

• Gross order value has more than doubled in FY20 to Rs 11,220 crore.

• 15 lakh Zomato Pro members and 25,443 Pro restaurant subscribers.

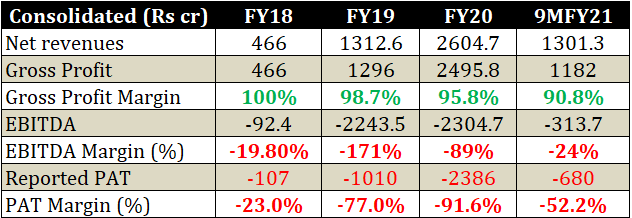

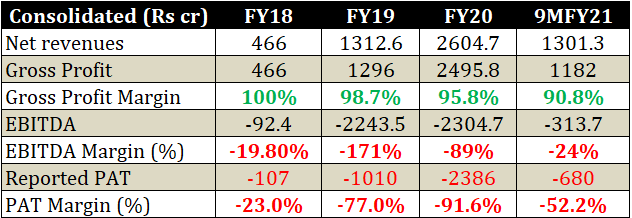

Company Financials

• Zomato's consolidated revenues have grown 5.6x over FY18-20, largely led by its delivery business. The revenue in FY18 was Rs 490 crore, and in FY20, it increased to Rs 2,740 crore.

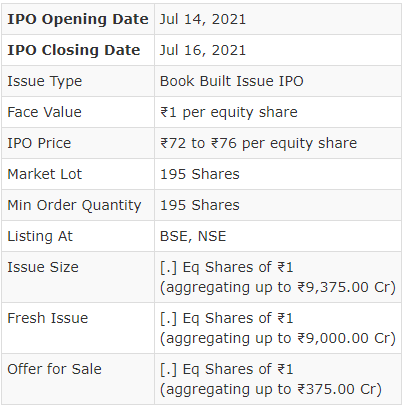

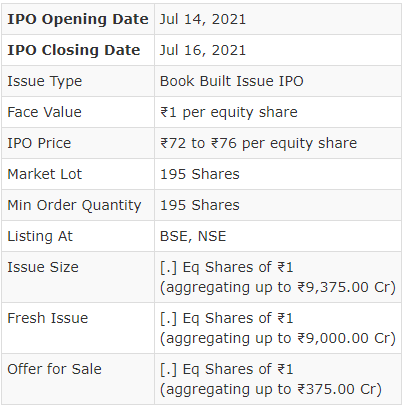

Zomato IPO Details

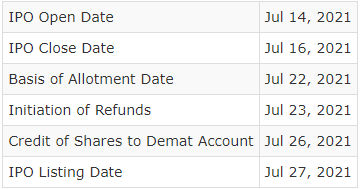

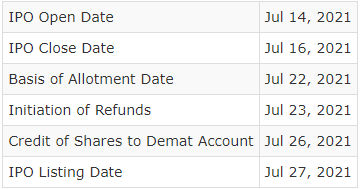

Zomato IPO Tentative Timetable

The Zomato IPO open date is Jul 14, 2021, and the close date is Jul 16, 2021. The issue may list on Jul 27, 2021.

Zomato IPO Lot Size

The Zomato IPO market lot size is 195 shares. A retail-individual investor can apply for up to 13 lots (2,535 shares or ₹192,660).

Similar Threads

-

IPO - Initial Public Offers

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply