IPO - Initial Public Offers - Ipo fpo ofs in IPO's & MF's - Initial Public Offering (IPO)

IPO means Initial Public Offering. It is a process by which a privately held company becomes ...

-

07-15-2021 05:20 PM

Ipo fpo ofs

Initial Public Offering (IPO)

IPO means Initial Public Offering. It is a process by which a privately held company becomes a publicly traded company by offering its shares to the public for the first time. A private company with a handful of shareholders shares the ownership by going public by trading its shares. Through the IPO, the company gets its name listed on the stock exchange.

Types of IPOs

If you are a new investor, you may find all the jargon around an initial public offering a little baffling. To clear your confusion, there are two major categories of IPOs offered by companies.

Fixed Price Offering

Fixed price offering is pretty straightforward. The company announces the price of the initial public offering in advance. So, when you partake in a fixed price initial public offering, you agree to pay in full.

Book Building Offering

The stock price is offered in a 20 percent band in book building offering, and interested investors place their bid. The lower level of the price band is called the floor price, and the upper limit, cap price. Investors bid for the number of shares and the price they want to pay. It allows the company to test interest for the initial public offering among investors before the final price is declared.

Things you should know before investing in an IPO

If you invested in an IPO, your investments are directly linked to the fortunes of that company.

This type of investment carries a higher risk and can offer huge returns too.

You should be aware that a company that offers its shares to the public is not indebted to reimburse the capital.

Usually, it is good to have some experience before investing in an IPO. Taking advice from a personal finance manager before investing may help you avoid trouble.

You require a Demat account to invest in an IPO. Click here to open a Demat account and start investing.

IPO can be applied through internet banking and also through UPI

Follow on Public Offer (FPO)

FPO (Follow on Public Offer) is a process by which a company already listed on exchange issues new shares to the investors. Companies use FPO to diversify their equity base. A company uses FPO after it has gone through the process of an IPO and decides to make more of its shares available to the public to raise capital to expand or pay off debt.

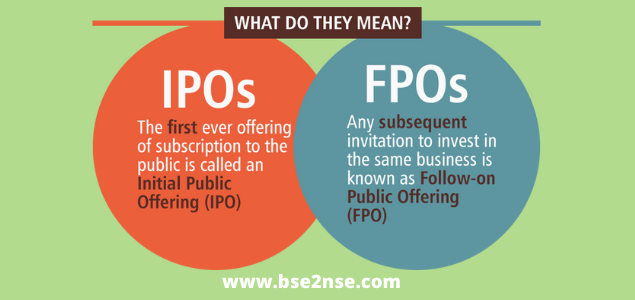

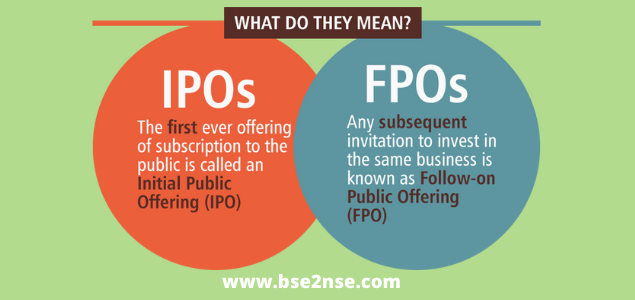

Key Difference: IPO vs. FPO

IPO is the first public issue of the shares of a private company going public, whereas FPO is the second or subsequent public issue of the shares of an already listed public company.

IPO is released with an intention to raise capital through public investment, whereas FPO is offered with an aim to inflow subsequent public investment.

An IPO is generally riskier than FPO as in IPO, an individual investor does not know about what may happen with the company in the future. On the other hand, in FPO, the investors are aware as the company is already listed on the stock exchange. Therefore, the investors can study past performance and make assumptions about the company's future growth prospects.

Now you can earn through IPOs in any one of the below ways:

Listing Gains: The listing gain you get when the stock lists on the exchanges. Many people only buy IPOs for this listing gain. You buy in IPO and sell it off on the listing day.

Long term Wealth Creation: You buy in IPO and hold it for the longer term for long term if you believe that company fundamentals are good.

Offer For Sale (OFS)

Offer for Sale (OFS) is when the promoters (owner) of a listed company sell their shares to the general public. It is a transparent process which takes place on the stock exchange. Only the top 200 companies as per market capitalisation can initiate an OFS

OFS is extremely popular among Public Sector Units (PSUs). It helps government meet its disinvestment targets. An OFS by PSUs is generally provided at a discount to retail investors. Unlike IPOs or FPOs, the concept of OFS is fairly new for Indian investors. The Securities and Exchange Board of India (SEBI) introduced OFS in February 2012. This was following a guideline issued by SEBI that promoters cannot hold more than 75% stake in listed companies.

Earlier only promoters could participate in an OFS. But now, any shareholder holding more than 10% shares can offer their shares for sale. The best thing about OFS is that usually shares are offered to investors at 5% discount. However, providing a discount is not a rule. It is strictly at managements discretion.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply