Personal Finance - Inflation - Impact on the Economy and the Stock Market in IPO's & MF's - What is Inflation?

Inflation is an economic term describing the sustained increase in prices of goods and services within a ...

-

06-17-2021 08:23 PM

Inflation - Impact on the Economy and the Stock Market

What is Inflation?

Inflation is an economic term describing the sustained increase in prices of goods and services within a period. To some, inflation signifies a struggling economy, whereas others see it as a sign of a prospering economy. When the inflation rate increases, the cost of living increases too, which leads to a lower purchasing power.

For example,

If Orange sold at Rs.100 per kilo in 2010, then in an inflating economy, they would cost more in 2020. Letís say that Oranges sell at Rs.200 per kilo in 2020. Therefore, in 2010, you could buy 10kg Oranges for Rs.1000 but in 2020, your purchasing power will drop and you would be able to buy only 5kg of Oranges for the same amount.

Causes of Inflation

1. Demand > Supply

2. Increase in the cost of Production

Impact of Inflation on Stock market in India

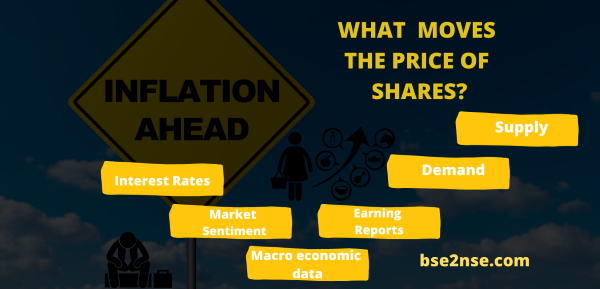

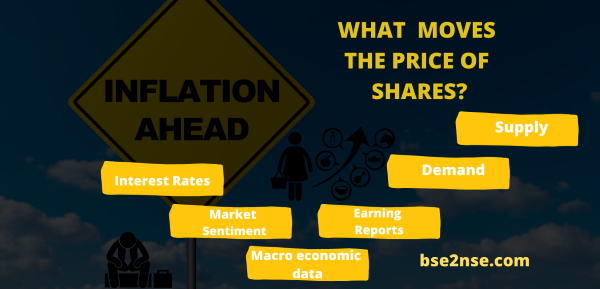

The price of a share in the stock market is determined by its demand and supply, which is affected by a range of factors like social, political, economic, cultural, etc. Anything that affects the investor can have an impact on the demand and supply of stocks and inflation is no different. Here is a quick look at the impact of inflation on stock markets

How does rising inflation affect the stock market?

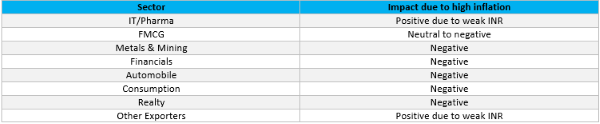

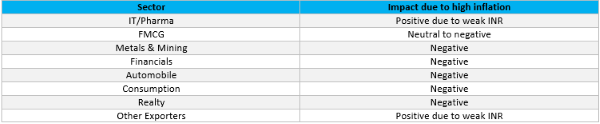

To tame inflation, the government usually hikes interest rates. This tends to make debt instruments attractive relative to equities as the former carry a lower risk (small savings instruments are risk free as they are guaranteed by the government). This results in some amount of investments shifting from equity to debt. However, high inflation is not always bad and low inflation need not always be good for equity markets, as the impact will differ for companies and sectors across different time horizons. The first thing to consider is the items where prices are rising. For example a rise in oil prices will impact a wide range of items from food products to those that require transportation.

How are companies affected by rising inflation and how does an investor view the impact?

A rise in prices of several items means that the input prices for production of various goods and services are rising. In these cases market analysts and fund managers will always consider the net impact on the margin of the entity that they are tracking.

While there might be an increase in the input prices, it has to be considered in the backdrop of the companyís ability to pass on the price hike to the end-user. If a company is able to sustain its profit margin despite high inflation, the stock price is likely to hold. If the high inflation sustains, at some stage it will lead to a chain reaction across the economy, pushing up interest rates and even affecting demand. An increase in interest rates will push up borrowing costs for corporates while lower demand will hurt growth in revenues. This is likely to impact sentiment for the stock market as a whole.

Similar Threads

-

-

Fundamental / Technical Analysis

-

Fundamental / Technical Analysis

-

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply