News - Daily Nifty Technical Outlook by Finvasia in COMMUNITY CENTER - Nifty fifty broke the key psychological level of 5600 and closed the bearish trading session at 5590.25. Witnessing the global ...

-

06-25-2013 10:15 AM

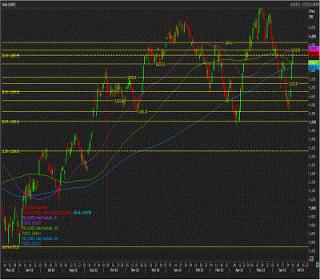

NIFTY Outlook and Trading Levels for June 25th

Nifty fifty broke the key psychological level of 5600 and closed the bearish trading session at 5590.25. Witnessing the global sentiments, we may see the bearishness to continue and test the immediate support at 5560 and breaching of this level will take nifty towards 5530 levels. Any rebound in nifty will see immediate resistance at 5620 and crossover that will take it towards 5680 levels. If Nifty breaks the 5730 levels decisively, we may see a bull run in the market.

Source: Finvasia Research

-

06-26-2013 10:21 AM

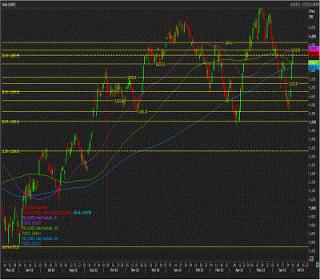

NIFTY Outlook and Trading Levels for June 26th

CNX Nifty closed above the key mark of 5600 at 5609.10 after the volatile trading session. The benchmark index showed a pullback from the recent downtrend but this might not sustain for long and we will see Nifty testing 5560 level as immediate support. However if the buying continues, we will see nifty testing the immediate resistance at 5620 and above that it will see resistance at 5680. If the weakness in the market will persist, we will see index taking support at 5530 and on the upside if it breaks the 5730 levels decisively, we may see a bull run in the market.

Source: Finvasia Research

-

06-27-2013 10:31 AM

NIFTY Outlook and Trading Levels for June 27th

Nifty fifty closed the session 36 basis points down at 5588.70. The continued weakness in rupee as well as Asian markets is likely to keep the index under the encumbrance and we may see nifty testing 5560 levels as immediate support and busting below that, it may see 5500 levels as key support. On the upside, the benchmark index can test 5620 levels on improved sentiments. Further buying in the Indian markets may take index towards the resistance of 5680.

Source: Finvasia India

-

06-28-2013 10:22 AM

NIFTY Outlook and Trading Levels for June 28th

CNX Nifty in yesterday’s session broke the major resistance levels and closed at 5682.35. Going ahead, 5690 will act as the major resistance and if bulls manage to cross that decisively, we may see next resistance at 5720 and 5760 levels, respectively. If nifty witnesses selloff in the coming sessions, we may see it taking immediate support at 5630 and breaching that level will take the benchmark index towards the support zone of 5580-5570.

Source: Finvasia Research

-

07-01-2013 10:17 AM

NIFTY Outlook and Trading Levels for July 1st

On Friday, nifty fifty broke the major resistances and closed at 5842.20. Going ahead, we may see the 50 share index to take immediate support near 5820 and below that it can take support at 5760. On the upside, the benchmark index may take resistance near 5850 but if the index manages to cross this mark, we will see the index testing 5890 and 5920 levels, respectively.

Source: Finvasia Research

-

07-02-2013 10:18 AM

NIFTY Outlook and Trading Levels for July 2nd

After surging nearly one percent, CNX Nifty ended the session below the key psychological mark of 5900 at 5898.85. If the benchmark index continues the upward trend on foreign inflow and global cues, we will see nifty taking immediate resistance at 5920 which is 50 DMA as well and if the equity index manages to break this level it will see further resistance at 5960. On the downside, any weakness in the fifty share index can take nifty back to 5840 levels and a breach below that can take the index to 5750 levels.

Source: Finvasia Research

-

07-03-2013 10:22 AM

NIFTY Outlook and Trading Levels for July 3rd

NSE Nifty plunged in yesterday’s session and closed 0.7% lower at 5857.55. If selling in the equity markets continues, we will see the benchmark index testing the immediate support at 5840 and a breach below that will bring more weakness in the market with nifty testing 5750 levels. Any optimism in the global and Asian markets can lead nifty to test 5900 levels and further, the strong momentum in the 50 share index can take it to 5960 levels.

Source: Finvasia Research

-

07-04-2013 10:07 AM

NIFTY Outlook and Trading Levels for July 4th

NSE Nifty languished in yesterday’s session and closed 1.48% lower at 5770.90. Nifty can take immediate support at 5760 and if the equity markets extend losses, we will see the NSE index testing 5700 levels on the downside. However, on the upside nifty has the major resistance at 5820 which is its 200 DMA as well and any further break on the upside can take it to 5850 levels.

Source: Finvasia Research

-

07-05-2013 10:23 AM

NIFTY Outlook and Trading Levels for July 5th

NSE Nifty in yesterday’s session strengthened and closed 1.14% higher at 5836.95. Nifty can take immediate resistance at 5900 and a break on the upside can take nifty to 5960 levels. However, on the downside nifty has support at 5790 and if the equity markets move below this levels then we will see the NSE index testing 5760.

Source: Finvasia Research

-

07-08-2013 10:32 AM

NIFTY Outlook and Trading Levels for July 8th

NSE Nifty in Friday’s session strengthened and closed 0.5% higher at 5867.90. Nifty can take the immediate support at 5790 and if the equity markets extend losses, we will see the NSE index testing 5700 levels on the downside. However, on the upside nifty has the major resistance at 5890 and any further break on the upside can take it to 5960 levels.

Resource: Finvasia Research

Visitors found this page by searching for:

bse2nse

,

daily market technical outlook for nifty,

nifty outlook on feb 10 2014 Tags for this Thread

Register To Reply

Register To Reply