Will it be the End of intraday trading ?

The Answer is No

The new SEBI peak margin rule will NOT end the intraday trading in Indian stock markets - There is still leverage of up-to 30 times in some cases

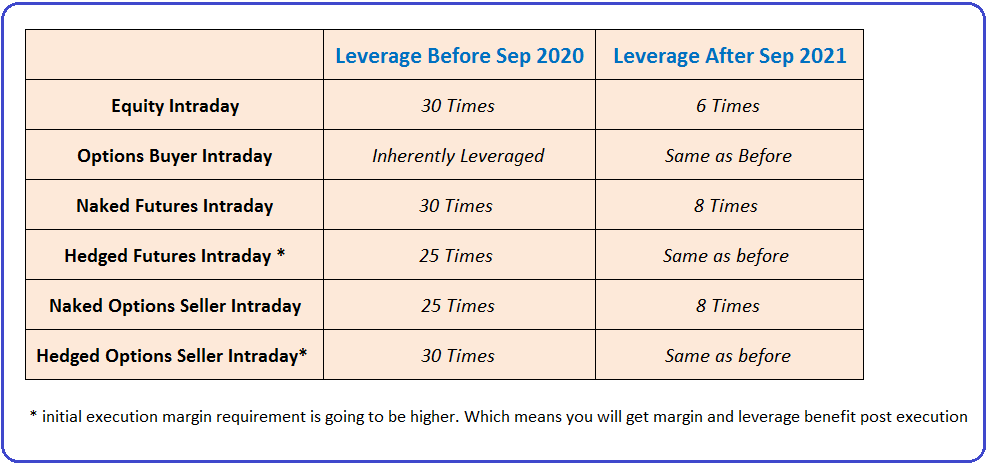

The below table will quickly summarize the change in Leverage across products (This is an approximate number just to give you a rough idea)

Why was this Change Necessary - Possible ReasonsMany Traders confuse that there is going to be no more leverage after Sep 2021 - Thats Wrong. Leverage is going to be there, but it is going to be reduced and defined unlike before where Brokers had free hand on Intraday Leverage

- More Retail Participation - Number of new Demat Accounts spiked during COVID

- Crude crashed to minus 40 USD which was unforeseen and Brokers had to bear a loss

- Its good for the overall system - Lesser Risk on the Brokers and may improve overall Retail Market Participation in the long run

Will it be Rolled back

- Historically - Margin requirement has seen changes in the past

- In-case volumes drop - we may see a roll back. But more participation could offset the volume drop initially

- A roll back or relaxation may come, but its going to take time as the changes have been slowly spread out over a year and so far - it doesnt look like volumes have dropped

Below is the detail of what is mentioned in the table above

Equity Intraday: Earlier Intraday Equity leverage used to be as high as around 30 times across most brokers. Post Sep 2021 - its going to be max 5X or 6X (5 times or 6 times)

Options Buyer: No change - Options buyer will have to pay full premium (Intraday or Positional) and inherently it has lot of leverage. Traders will still continue to use it for jackpot trades, intraday scalping and so on

Naked Futures Intraday: Earlier Futures Intraday leverage could have been as high as 30 times (On bracket order, SL orders and so on). Post Sep 2021 - its going to be around 8 times - So leverage is still there but reduced

Hedged Futures Intraday: Leverage is going to be the same as before for hedged trades. But, initial execution margin requirement is going to be higher. Which means you will get margin and leverage benefit post execution. So as long as you have some surplus margins - you can execute multiple hedged trades

Options Seller Intraday: Earlier Options Seller Intraday leverage could have been as high as 30 times (On bracket order, SL orders and so on). Post Sep 2021 - its going to be around 8 times - So leverage is still there but reduced

Hedged Options Seller Intraday: Leverage is going to be the same as before for hedged trades. But, initial execution margin requirement is going to be higher. Which means you will get margin and leverage benefit post execution. So as long as you have some surplus margins - you can execute multiple hedged trades

Register To Reply

Register To Reply