What is Term Insurance?

Term insurance is the purest form of life insurance policy that offers comprehensive financial protection to your family members against life’s uncertainties. Depending on the term insurance plan you buy, your family will get life cover or sum assured in case of your untimely demise within the policy period. A must have for every earning member.

Here are five reasons why a term plan is essential:

• It will protect your family when you are not around.

• It will provide financial stability and assistance for your family needs.

• The payout will help your family live a comfortable life.

• Your family can clear all your existing debts.

• A term plan provides high cover at the cost of affordable premium.

Who should buy?

Those who are earning member of a family MUST have a term insurance policy. Most of the salaried class will have a group policy coverage from employer. If this is the case or not, one MUST take a personal policy.

What should be the sum assured and coverage period?

Most of us go wrong in this area, selecting an inadequate sum assured and shorter policy term. This defeats the entire purpose of having the policy. Term policy is mainly to eliminate the financial risk to the dependent family members due to one’s untimely demise. Therefore, the sum assured should be ATLEAST 10 times one’s gross annual pay/income. This should adequately cover the financial need of the family. Average retirement age is 60 years. So policy should cover ATLEAST TILL 60 YERAS of age.

What should be avoided while buying a term policy?

One need not include critical cover as it increases the premium and health insurance policy will take of that. Avoid all “add-on” or “riders” in the term policy, as their main objective is to increase the premium. NEVER select a policy that offers any returns. NEVER mix investments and insurance. Many sales agents might push you explaining that the premium you pay will go waste if you select a pure term policy. NEVER fall for that trap.

Check this video on the issues of mixing investments and insurance.

Factors that affects Term Insurance premium:

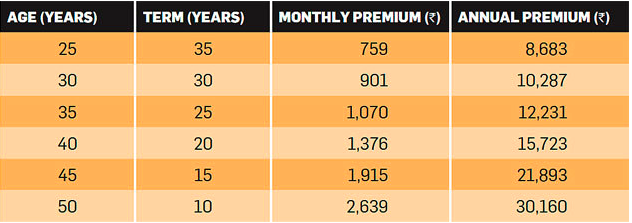

Approximate premium for a healthy individual:

One need not go to any comparison websites to buy a policy. Pure term policy premium will be almost same for similar sum assured and coverage period. Better to buy from large insurance companies or the group company of the bank where you hold savings account for the sake of convenience.

Register To Reply

Register To Reply