Books & Training - Money Control Pro Interview - Manikandan Ramalingam (bse2nse) in MARKETS - Thanks to Traders Carnival invite as a speaker, met Shishir from Moneycontrol and i was recently covered by Money Control ...

-

02-15-2020 01:45 PM

Money Control Pro Interview - Manikandan Ramalingam (bse2nse)

Thanks to Traders Carnival invite as a speaker, met Shishir from Moneycontrol and i was recently covered by Money Control Pro (Access only to Premium users).

https://www.moneycontrol.com/news/business/markets/guruspeak-manikandan-ramalingam-a-trader-who-excelled-by-teaching-others-4943221.html

As the above link is restricted to paid premium users - sharing the article content here. As you teach, you learn, is an old proverb, but one that has helped Manikandan Ramalingam (Mani as he is commonly known) become a successful trader. Son of a nuclear scientist, he dabbled with shares in the 2007 market boom. But his biggest learning came when he started the now commonly used site www.bse2nse.com and a YouTube channel by the same name.

What started as a discussion board led Mani to take a deep dive into what makes a market work. Mani is an investor as well as an options trader – largely an expiry day trader. He effectively leverages his portfolio to generate alpha by trading options.

When he is not involved with the many activities he has around markets, Mani loves playing badminton and table tennis, though his daughter says he loves sleeping. Working on bringing his weight down, Mani has plans to list his portfolio based on his screener on Smallcase.com, hoping that someday it will be a fund in itself.

In this interaction with Moneycontrol post a meeting at Traders Carnival, Mani opens up on his strategies of investing and trading.

Q: Can you talk about your education and family background and when was the first time you heard about stock markets? A: The first time I heard about the stock market was when my family visited my father's friend in Chennai who used to deal in stocks fulltime. My father retired from Indira Gandhi Centre for Atomic Research (IGCAR), Kalpakkam as a Group Director. My schooling was in Kalpakkam (Central Govt Township) and Electrical Engineering from Guindy, Tamil Nadu.

I liked playing with the numbers. As a kid, one of the games that I loved playing was Tambola (Housie). Though it is a game of luck it requires quick thinking. I

played it every year day-in-day-out in Kalpakkam Carnival which used to happen for a week every August. You need a little skill for spotting quick patterns in numbers on a ticket even though the numbers are randomly called out.

Towards the end, they start going fast with the numbers so one needs to be sharp to claim the prize as soon as you have the winning pattern. Taking quick decisions and recognizing patterns is a common skill in both Tambola and Trading. I later found an immediate liking to the stock market when I heard that it can be done online.

During my 3rd year of college (back in 2005), my college mate shared his excitement of buying his first share in Infosys. I immediately jumped in to open an online account with my pocket money and tried out all kinds of trades possible.

I informed my father about my stock market experiments only in 2007 – six months after getting a job in HP. My father shared his experience of buying L&T back in 1996 and how he could not handle the emotions of ups and downs of the markets and eventually exited any form of stock market investments for good. He told me not to lose myself in the stock market and cautioned that scores of his friends have bet and lost way too much.

Immediately after this incident, my father put me on a home loan (joint loan) which meant that I never had too much money to play around in my first 10 years. This turned out to be a blessing in disguise. I could not lose big even if I wanted to during my early years.

In 2007, IPOs caught my eye. I took an interest-free loan from my company – HP-- and went for listing gains on IPOs. I milked IPOs for listing gains of nearly Rs 2 Lakhs over 2 years till 2008 when the market crashed.

Here I would like to add that from day one I liked my journey in the market. I have felt happy in my early years even though I made losses. I was happy about how much I had learnt by practically testing out and experimenting. I always believed that one way or other I was going to find a way.

At one point, I thought my book sales will be a breakthrough. Website Google Ad revenues and Youtube Ad revenues added more faith. My home loan was over by 2014 and I started building my long term equity portfolio. With each passing year I felt more and more confident that I will be consistent and make it big.

My wife has known more about my journey as an Investor/Trader - she has stood by me through my losses and tough times and has always backed me to go for it.

Q: Post the financial market meltdown what did you do in the markets?

A: I moved into equity as I was always inspired by Warren Buffet. There was an element of trading too where I mainly dabbled with options buying during my initial days.

In these formative days, my college mate urged me to write a blog for the sake of tracking more stocks. That was the start of bse2nse.com and YouTube channel https://www.youtube.com/user/bse2nse later.

This interaction with a much wider audience spiked up my learning curve and perspective of the stock market. One of the forum users asked me to suggest a book on the stock market. Most of the books then were just a dictionary of terms and were not specific to the Indian context. I ended up writing a book myself-- "Art of Stock Investing".

My approach to picking stocks is explained in my book – Art of Stock Investing - which is available free of cost in PDF format. There are 4 basic thumb rules - Debt, Brand Value, Consistent Revenue / Profit Growth and Peer Analysis with examples of 10 companies. It hardly takes an hour to complete the book and I hope it will help someone reduce the learning curve and start building a portfolio directly in stocks.

Apart from this, we look at some technical parameters. On www.bse2nse.com we have a dashboard which filters companies which have done well in the last five years. The core logic of this dashboard is to find companies which went up consistently on an upward channel of 30 or 45 degrees on a monthly chart over the last 5 years. We calculated Bullish percentage of a company as a percentage of time – which is the percentage of time the company’s share price stayed above its 200 days SMA over the last 5 years.

Companies which did well in the last five years tend to do well in the next five years as well. Of course, there are some failures - but the hit ratio is good and the ones which go weak are not a total disaster. An example of a stock which went wrong is Lupin in the pharma sector.

If Virat Kohli was a stock traded on the bourses I would like to have him in my portfolio as he did well in the last 5 years and he has 5 more years left before retirement. He is a good bet in one's portfolio--we try to find Virat Kohlis in the stock market in this dashboard.

The dashboard is also filtered to only show index-based stocks (Nifty 50, Nifty next 50, Nifty Midcap and sector indices). Non-index based stocks are not shown as they are prone to management issues and manipulations. Currently, the most bullish stock as per this logic as on date is Bajaj Finance with 96 percent Bullish

percent – in the last 5 years, its share price has been above its own 200 days SMA 96 percent of the days on a closing price basis.

Q: Initial trading strategies and evolution as a trader

A: I started with plain vanilla one-sided option buying, which later evolved into Strangle – buying out-of-the-money (OTM) call and put options. Years later I ventured into selling a naked option and then selling options with a cover.

Now I have evolved into mixing all up by buying at-the-money (ATM) options and selling OTM options but with an insurance cover or a stop loss.

My process has evolved with my experiences in the market. The longer we play in the market and if we are willing to accept mistakes and learn from it - we will evolve. With more and more data points to work with and changing market dynamics, you sharpen your skills – mastering trading is an ongoing process.

I am constantly experimenting in the live market with new strategies. My worst trade was a result of such an experiment where I shorted twice the options needed to cover my portfolio ending in a loss despite a strong move in the market.

But constant experimentation on live markets is the path to evolution as a trader. You just need to ensure that you don’t lose too much in the process. Self-assess your overall Net Asset Value and ensure you don’t lose too much.

Rest of the article continued below - keep scrolling down

-

02-15-2020 01:47 PM

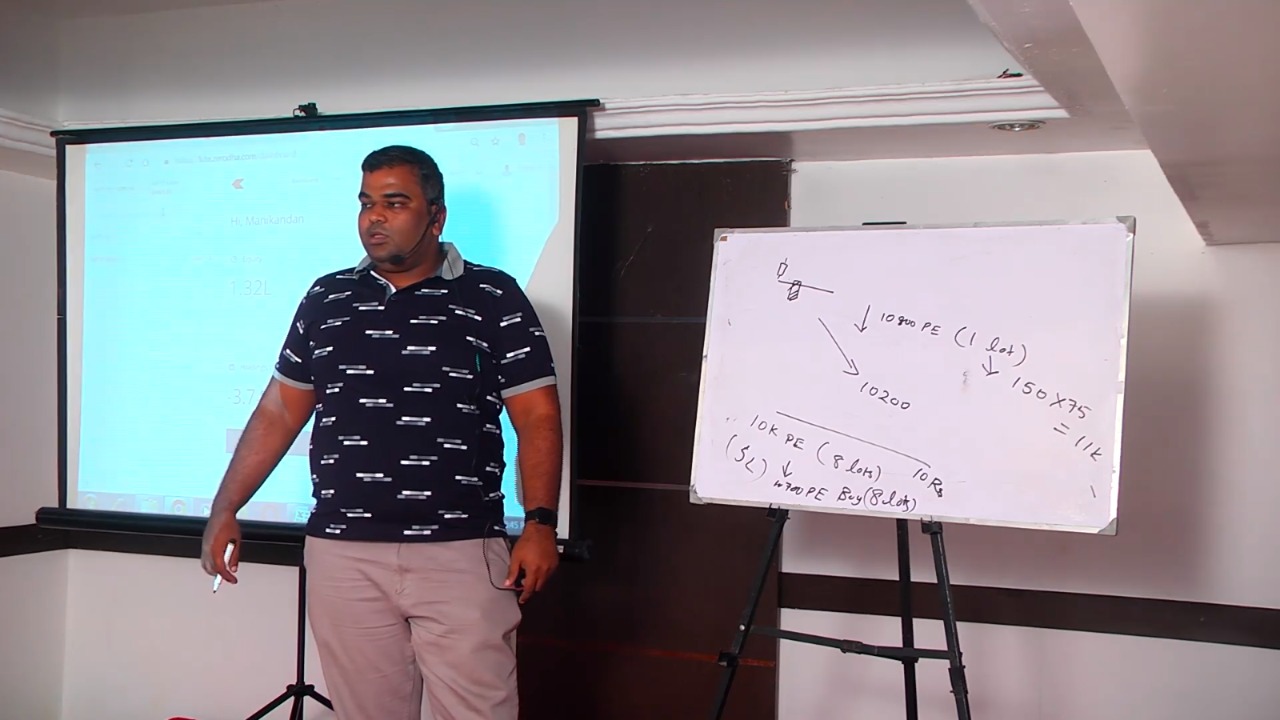

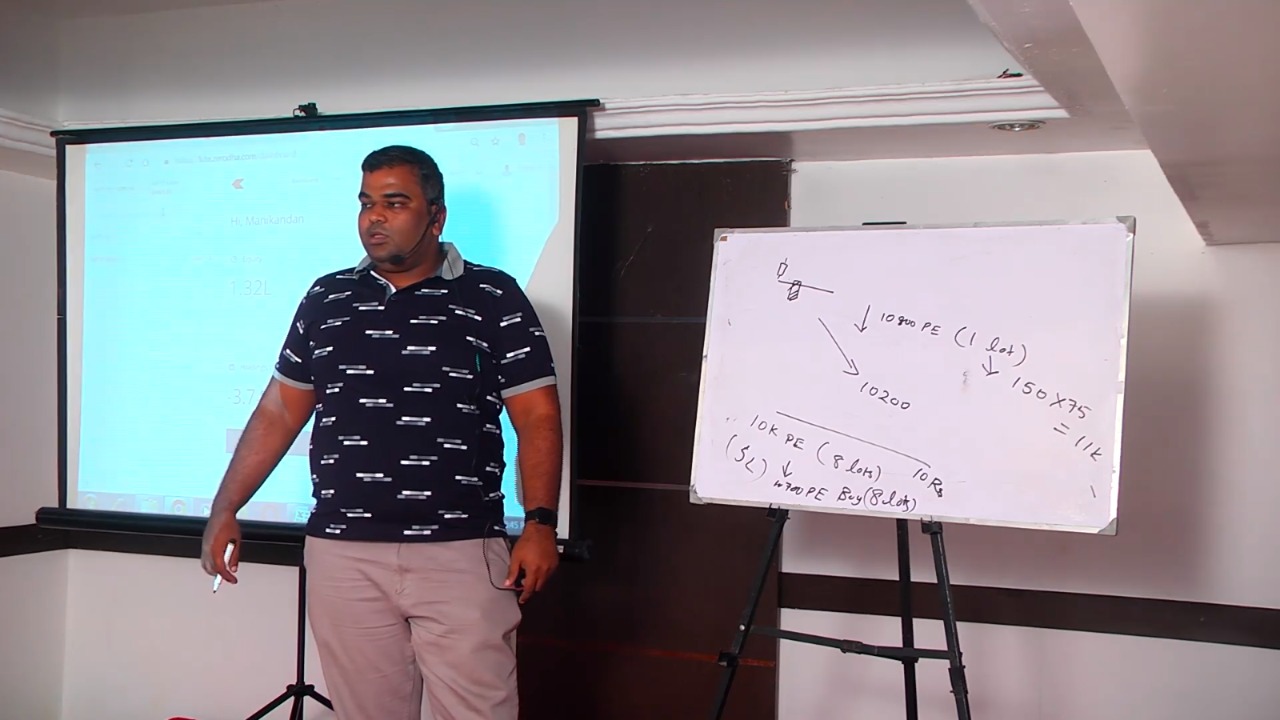

Q: Currently how do you trade – a brief description of the strategies A: I have a long term Equity Portfolio. I pledge it to get limits to trade on expiry day. The Thursday expiry day trades are my bread and butter trades and have worked consistently over the last 2 to 3 years.

Here is how I work towards executing the trade on expiry day:

I note down the first 15-minute range on Monday – high and low made in the first 15 minutes in Nifty. If Nifty is above it - bulls are in charge and below it then bears are in control. If the market is between the range then it’s in a neutral zone. For me, this reflects the week’s trend. The price movement till Wednesday will give me an idea of what kind of market we are in – a strong or choppy trend.

On Thursday I also track the Bank Nifty. I track the square values of Bank Nifty – like 176 X 176 = 30976 and the next square value is 31329 and so on. These act as support/resistance zones. I write down the 3 or 4 relevant square values for the day around 9 am on Thursday.

The idea of using squares came to me from reading about WD Gann and some of his books. I use both square and cube values and have found them to be very useful.

Again on Thursday, I will note the first 15-minute range for both Nifty and Bank Nifty. The same rule of bullishness above the range, bearishness below it and neutral if the market is between the range applies. I start applying my trade only after 09:30.

The ratio of buying versus selling options contracts is an integral part of my strategy. I always maintain a ratio of say buying 1 lot of ITM (in-the-money) option buy versus selling 10 to 20 lots of OTM options. The strike price of the OTM option will depend on the volatility as represented by India VIX. I am constantly watching India VIX on the expiry day.

The nearest OTM strike is at least 100 points away no matter how low the VIX is. My stop loss for the OTM option is 6 – 10 times the price at which they were sold. I shift the stop loss sharply lower just before 3 pm when spikes tend to happen. I may even choose to exit if my overall position is in good profits for the day.

Here’s an example of the strategy I just spoke about.

Let's say on a Thursday - Nifty spot is at 12,050 by 10 am and I am sensing a bullish sentiment for the day – that is the market is above Monday’s 1st 15 min range as well as it is above Thursday 1st 15 min Range.

Assuming I have a trading margin of Rs 50 Lakhs, I will buy 6 lots (450 quantity) of 12000 call at say Rs 70 – (ITM Buy).

I will then sell 60 lots (4500 quantity) of 12200 call at say Rs 3 with a stop loss at Rs 18 – (OTM Sell).

I have a provision of selling 9000 more quantity of margins to short later in the day if need be.

The third leg of the transaction is I buy 60 lots (4500 quantity) of 12300 call at say 30 paise.

This acts as a cover to 12200 Call short position so that max loss is restricted to 100 per lot in case of a Black Swan event.

Now let's assume that the market moves to 12200 and my stop loss for the calls sold is hit. Here is the maximum loss my trade will incur.

Net Loss = [450 * (200 - 70)] - [4500 * (18 - 3)] = 58500 - 67500 = Rs 9,500 Loss (Minus 0.2% loss on a trading margin of 50 Lakhs)

Assuming spot moves to 12,150 and the stop loss is not taken out.

Net Profit = [450 * (150 - 70)] + [4500 * (3 - 0.20)] = 36000 + 12600 = 48,600 Net Profit (1% profit on trading margin of Rs 50 Lakhs)

The above profit and loss is just used to explain the best and worst case scenario. Variations on trades and volatility will make it a little more complex. I may add the remaining 9000 quantity in OTM shorts later in the day depending on if markets go down or not. I may bring the OTM shorts closer if needed, although this is not too efficient considering the added risk. I may also start by only buying ITM option and add OTM shorts (Defence) only if needed or later in the day.

Numerous variations can be played around this - based on the conditions on that day. Unlike this example, I mostly buy ITM options in Bank Nifty and OTM Shorts in Nifty mostly (gave ITM buy here in Nifty for easy understanding).

My focus always is on the overall risk – that is the OTM selling part and how to reduce it if the market move is threatening.

Profits tend to take care of themselves as the play is solid. I don’t focus on how much profits I can make on the day. If I am in profits by 1 pm, I tend to finish the day well. I start cautiously and try to be in decent gains by 1 pm. I feel 0.5 percent return on the overall margin for a day’s work is a good return for me, especially since it is generated on virtual margins – that is from the equity portfolio pledge and not from incremental cash.

I have had days when 99 percent of a Thursday is going well when OTM options hit SL on a freak spike - even though spot price is not close (mostly in OTM PE) and I end up with a net loss of max 2%. I have also had many Thursdays when I make 1% - which is big for me and has been the most satisfying days.

Q: What are your trading statistics? A: In the current financial year 24 Thursdays out of 29 were profitable. In FY19 28 out of 35 expiry days were profitable while in FY18 out of 25 days traded 18 were profitable.

Q: Apart from expiry day trading are there any other strategies you trade? A: I keep on experimenting with various strategies and discuss them on my YouTube channel. The ideas I share on YouTube are meant to kindle thinking of the traders and I believe one should experiment and paper trade and take baby steps at trading.

Like one can trade the range breakout of Monday by buying a Bank Nifty Call option if at 3:15 pm on Monday the Bank Nifty is above its 15 min high range. Exit the trade if spot breaks below Monday 1st 15 min range low. Similarly buy a Bank Nifty Put option if at 3:15 pm on Monday the spot price is below its 15 min low range and exit the trade is spot rises above Monday 1st 15 min range high. The above strategy has a good risk-reward ratio, but can still have minor variations.

I believe that any trader should have various kinds of strategies for various kinds of markets. A strategy which works now or over the next 2 years need not always work.

A strategy which works when VIX is below 20 need not work when VIX is at 30. One should realise this and quickly tweak or play a different strategy altogether.

When I think of combining options buying with Options Selling OTM (Intraday / Positional), I can be overweight as a buyer or neutral or defensive. This may need to change according to market conditions. For this reason, I don’t want to pursue Algos and want to trade manually. Someone who takes Manual trades is in constant touch with the markets and can adapt and evolve.

Q: Any advice to new traders A: One should realise that the first five years will go in learning and understanding the markets. The problem is most traders I interact with are unrealistic in their early years (I was too) and look to make profits way too soon and think too much about profits and the end result.

When one is learning to swim they do not go and jump in 15 feet deep water, but when it comes to trading we are ready to jump into a 15 feet deep pool when it comes to markets and trading. One should start at a very low capital, which can be refilled every month if it is completely wiped out. One can be the world’s richest man by earning 5 percent a month over 40 years starting with just Rs 1 Lakh as capital. But, when one witnesses the day’s low and low range of options we tend to think that making 30% a month should be easy.

For someone who wants to start options trading work on strategies which can make 1 percent returns a month or even less, begin with by trading options spreads. The risk involved in this strategy is also less. Then try and push to 2% a month kind of trades by tweaking and later push for 3% and 4% and so on. Gradually you will reach 5 percent in a month. As you try to increase returns made per month you will be taking more risk. It would be difficult as uncertainty increases and you begin to sweat. At this point, fall back to a lower return and keep practicing and once you are comfortable at a return of say 2 percent a month - push forward again for 3 percent. I also keep experimenting to make jackpot trades but that is on capital of say Rs 5,000 as compared to my trading margin of Rs 50 Lakh for expiry trades

Similar Threads

-

Success Stories, Brands and USP

-

-

-

Chit Chat / Off Topic Discussions

-

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply