Beginners Guide - Stock Market Indices in NEW TO TRADING & INVESTMENTS? - What Are Stock Indices?

There are thousands of companies listed on stock markets, making it almost impossible to monitor each ...

-

07-15-2021 09:30 PM

Stock Market Indices

What Are Stock Indices?

There are thousands of companies listed on stock markets, making it almost impossible to monitor each company. This is why stock market indices are created. Market indices bring together a select group of company stocks and regularly measures them to show the performance of the overall market or a certain segment of the market. In short, an index helps investors understand the health of the stock market, enables them to study the market sentiment and makes it easy to compare the performance of an individual stock.

The Sensex and Nifty-50 are two popular benchmark indices that largely reflect the performance of Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). To understand how each sector of the stock market is doing, there are sectoral indices such as Nifty Bank. Nifty Auto etc. It means an index.

In this way, a stock index reflects overall market sentiment and direction of price movements of products in the financial, commodities or any other markets.

Some of the notable indices in India are as follows:

• Benchmark indices like NSE Nifty and BSE Sensex

• Broad-based indices like Nifty 50 and BSE 100

• Indices based on market capitalization like the BSE Small cap and BSE Midcap

• Sectoral indices like Nifty FMCG Index and CNX IT

Why are stock indices required?

The stock market index acts like a barometer which shows the overall conditions of the market. They facilitate the investors in identifying the general pattern of the market. Investors take the stock market as a reference to decide about which stocks to go for investing.

Why do we need Stock Indices?

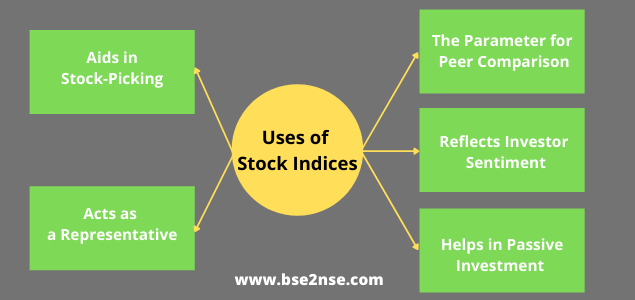

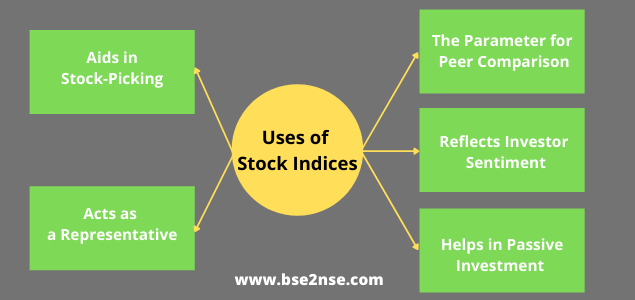

Indices are an important part of the stock market. Here’s why we need stock indices:

• Sorting: In a share market, there are thousands of companies listed. How do you differentiate between all of those and pick one or two to buy? How do you sort them out? It is a classic case of a pin in a stack of hay. This is where indices come into the picture. Companies and their shares are classified into indices based on key characteristics like size of company, sector or industry they belong to, and so on.

• Reflection Investor sentiment is a very important aspect of stock market movements. This is because, if sentiment is positive, there will be demand for a stock. This will subsequently lead to a rise in prices. It is very difficult to gauge investor sentiment correctly. Indices help reflect investor’s mood – not just for the overall market, but even sector-wise and across company sizes. You can simply compare an index with a benchmark to see if has underperformed or outperformed. This will, in turn, reflect investor sentiment.

• Representation Indices act as a representative of the entire market or a certain segment of the market. In India, the BSE Sensex and the NSE Nifty are considered the benchmark indices. They are considered to represent the overall market performance. Similarly, an index formed of IT stocks is supposed to represent all stocks of companies from the industry.

• Passive investment Many investors prefer to invest in a portfolio of securities that closely resembles an index. This is called passive investment. An index portfolio helps investors cut down cost of research and stock selection. They rely on the index for stock selection. As a result, portfolio returns will match that of the index. For example, if Sensex gave 8% returns in one month, an investor’s portfolio that resembles the Sensex is also likely to give the same amount of returns. Indices are also used to construct mutual funds and exchange-traded funds (ETFs).

• Comparison An index makes it easy for an investor to compare performance. An index can be used as a benchmark to compare against. For example, in India the Sensex is often used as a benchmark. So, to find if a stock has outperformed the market, you simply compare the price trends of the index and the stock.

Weighted indexes

Every stock has a different price. So, a 1% change in one stock may not equal a similar change in another stock’s price. So, the index value cannot be a simple total of the prices of all the stocks. Here is where the concept of stock weightage comes into play. Each stock in an index has a particular weightage depending on its price or market capitalization. This is the amount of impact a change in the stock’s price has on index value.

The two most commonly used stock market indices are as follows:

1.Market-cap weightage

Market capitalization refers to the total market value of the stock of a company. It is calculated by multiplying the total number of outstanding stocks floated by the company with the share price of a stock. It, therefore, considers both the price as well as the size of the stock. In an index which uses market-cap weightage, the stocks are assigned weightage based on their market capitalization as compared to the total market capitalization of the index.

Suppose a stock has a market capitalization of Rs. 50,000 whereas the underlying index has a total market-cap of Rs. 1,00,000. Thus, the weightage given to the stock will be 50%.

It is important to note that market capitalization of a stock changes every day with the fluctuation in its price. Due to this reason, weightage of the stock would change daily. But usually such a change is marginal in nature. Moreover, the companies with higher market-caps get more importance in this method.

In India, free-float market capitalization is used by most of the indices. Here, the total number of shares listed by a company is not used to compute market capitalization. Instead, use only the number of shares available for trading publicly. Consequently, it gives a smaller number than the market capitalization.

2.Price weightage

In this method, the value of an index value is computed based on the stock price of a company rather than the market capitalization. Thus, the stocks which have higher prices receive greater weightages in the index as compared to the stocks which have lower prices. This method has been used in The Dow Jones Industrial Average in the US and the Nikkei 225 in Japan.

Conclusion

Stock market indices are the bread and butter of the investment milieu. It is not just an added advantage but a necessity. In its absence, the investment world would have been mayhem of investors flocking around for good stocks to invest in. The importance of stock market indices rests in making investment easy.

Having indices reduces your load and makes at least the first step in stock market investment easy. This is not the end. You do need to do the rest of the work for yourself when it comes to investing. Sensex may have the 30 best companies but it does not necessarily mean that they are the 30 best companies for you. You may have a low-risk appetite and a stock listed on Sensex may have a high-risk value.

Most prefer to invest in index ETF like Nifty BeES, JuniorBeES, BankBeES, MON100, MAFANG etc rather than individual stocks. Even MF will try to beat index returns. But that's active investing and involves higher expense ratio.

Visitors found this page by searching for:

bse2nse

,

https:bse2nse.combeginners-guide10768-stock-market-indices.html Tags for this Thread

Register To Reply

Register To Reply