Personal Finance - Know about Credit Score in IPO's & MF's - What is Credit Score?

A credit score is an indicator of a person’s creditworthiness, or their ability to repay debt. ...

-

07-12-2021 03:34 PM

Know about Credit Score

What is Credit Score?

A credit score is an indicator of a person’s creditworthiness, or their ability to repay debt. It is usually expressed as a number based on the person’s repayment history and credit files across different loan types and credit institutions. Credit score is also known as a credit rating.

Credit scores in India

In India, there are four credit information companies licensed by Reserve Bank of India. These are Credit Information Bureau (India) Limited (CIBIL), Experian, Equifax and Highmark. The most popular credit score in India is the CIBIL rating. The CIBIL credit score is a three-digit number, which ranges from 300 to 900, with 900 being the best score.

Why you need a good credit score?

A good CIBIL credit score is considered to be 750 or higher. Banks and lending institutions use credit scores to assess whether you are worthy of credit. The better your credit score, the higher are the chances of getting your loan approved. You are also likely to get additional benefits, such as low interest rates, better repayment terms and quicker loan approval process.

Credit score calculation

Your credit score is calculated by an algorithm than takes into account several factors. Each factor gets a different weightage in the calculation. The factors under consideration include the following:

• Your repayment history across debt categories (such as loans and credit cards)

• Your total credit balances

• Balance between secured and unsecured loans

• Number of loans and credit cards you have

• Credit utilization

How to check your credit score?

• You should ideally check your credit score before applying for a loan or credit card.

• Place an online request to receive your credit score on the credit rating company’s website.

• The credit rating agency may charge you for this service.

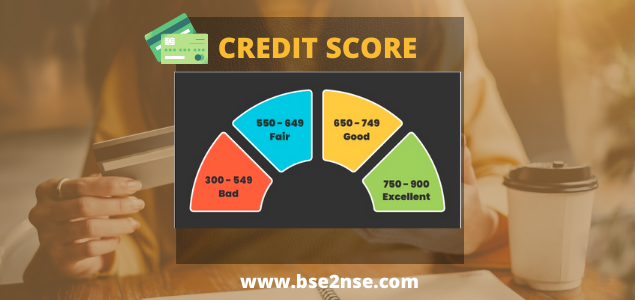

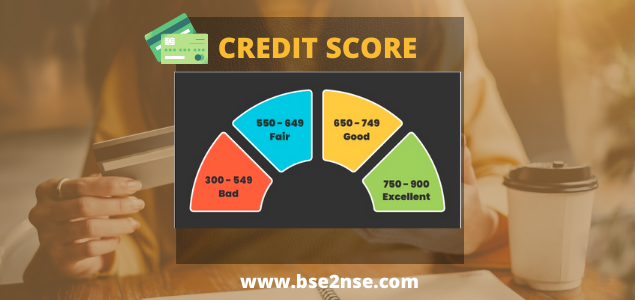

Credit Score Range and Its Significance

As mentioned earlier, an individual’s credit score can range from 300 to 900 points. The higher the credit score, the better the chances of getting a loan.

Here are the different credit score ranges and their significance:

NA/NH: If the individual does not have a prior credit history, the credit score is displayed as Not applicable (NA)/ No History (NH).

300 – 549: Individuals falling in this range are considered to have a bad credit score. It implies that the individual has defaulted on payments and have unpaid dues.

550 – 649: Individuals in this range is considered average and would need to improve their credit score.

650 – 749: This range is regarded as a good score and lender will be willing to offer loans and credit cards. Although the individual still will not be able to negotiate a deal with the lender.

750 – 900: Individuals in this range are considered to have an excellent credit score. Individuals in this range will be offered loans and can negotiate interest rates and credit cards with better rewards.

Practices Which Affect Credit Score

A person’s credit score is affected by several factors:

• Delay in credit card payments

• Missing your loan dues and credit card bills

• Account charged off due to non-payment of dues on credit card.

• Account being sent to collections due to non-payment of credit card dues.

• Filing for bankruptcy.

• Maxing out the credit card.

• Closing a credit card with an outstanding balance.

• Closing old credit cards thereby shortening the credit history.

• Having multiple credit cards at the same time.

• Homogeneity of credit account.

• Irregular check on credit reports.

• Applying for loans too many times in a short period.

How to Improve your Credit Score?

There are a few ways of fixing or improving one’s credit score:

1. Keep a regular check on Credit Report: Checking the credit report regularly will help you identify any discrepancies that are on the report. Once the discrepancy has been detected, steps to rectification need to be taken immediately. Any such discrepancies can have a drastic effect on the credit score.

2. Settle outstanding bills: It is always best to settle any credit dues as soon as possible. Delaying outstanding dues can lower the credit score. It is advisable to set an auto-debit facility to ensure that the dues are always paid on time. It is wise to avoid paying just the minimum amount due, always make sure to pay off the full bill.

3. Credit Utilisation: Credit utilisation is a significant factor while calculating a credit score. Credit utilisation means the amount of credit the person uses in a given period. Ideally, one should utilise only up to 40% of the available credit. If an individual has multiple credit cards, they should keep a regular check on their credit utilisation.

4. Maintain old accounts: Sometimes, individuals deactivate or remove accounts due to negative history in the hope that it will improve the credit score. This is not advisable, even if negative history can affect the credit score, as it will be removed from the credit report after a specific period. Losing credit history can harm one’s credit score.

5. Credit Planning: Most lapses in credit payment happen due to the lack of planning. It is always advised to stick to a financial plan. A lack of a financial plan can lead to excessive use of credit facilities or even the lapse in payment of credit dues. In both cases, one’s credit score will be affected negatively.

Similar Threads

-

-

IPO - Initial Public Offers

-

-

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply