Personal Finance - InvITs (Infrastructure Investment Trust) in IPO's & MF's - InvIT s, Infrastructure Investment Trusts are regulated by SEBI. InvITs are primarily set up to facilitate direct investment from investors ...

-

07-08-2021 05:55 PM

InvITs (Infrastructure Investment Trust)

InvITs, Infrastructure Investment Trusts are regulated by SEBI. InvITs are primarily set up to facilitate direct investment from investors in infrastructure. The money that these trusts raise from investors is invested in income-generating infrastructure projects and investors are issued units in these trusts. Thereafter, InvITs are responsible for the projects' operations and maintenance.

High capital expenditure is required for infrastructure projects, such as transmission lines. Companies mostly meet the expenditure through debts. However, these projects tend to take time to generate substantial cash flows. Precisely, this is where InvITs help such companies monetize their assets, thereby enabling them to repay their outstanding debt obligations or fund their future expansion plans. In exchange, unitholders of these trusts get access to a regular stream of cash flows generated from assets in the forms of dividends and interest income.

Structure of InvIT

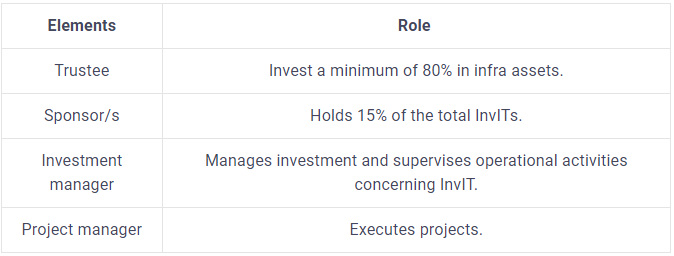

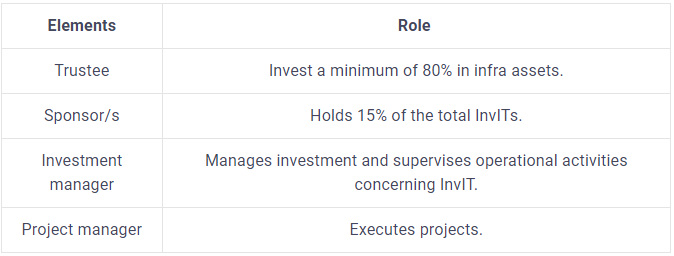

InvITs can be established as a trust and registered with SEBI. An InvIT consists of four elements:

1) Trustee,

2) Sponsor(s),

3) Investment Manager and

4) Project Manager

Types of InvITs

The InvITs are classified into two types as follows:

One type of InviTs invests mainly in completed and revenue-generating infrastructure projects

Another type of InviTs has the flexibility to invest in completed or under-construction infrastructure projects.

The InvIT is designed as a tiered structure with Sponsor setting up the InvIT which in turn invests into the infrastructure projects either directly or via special purpose vehicles (SPVs).

Eligibility to Invest

The minimum investment amount is Rs.10 lakh in IPO. InvITs are listed on exchanges just like stocks. After listing, the investment amount is Rs.5 lakh.

The following persons can invest in InvIT:

High net worth individuals

Institutional and non-institutional investors like foreign portfolio investors, pension funds, mutual funds, banks and insurance firms.

Benefit to Investors

There are certain rules that the InvIT issuers have to follow to safeguard the investor.

The sponsor has to hold a minimum of 15 % of the InvIT units with a lock-in period of three years.

InvIT has to distribute 90 % of its net cash flows to investors.

InvIT VS REIT

Most investors consider InvIT and REIT to be similar investment options but there are several factors that differentiates the two.

InvIT is created to pool money from investors to invest it in assets generating cash flow. They invest in projects like roadways, highways and other high-value infrastructural units.

REIT serves as an investment tool that helps own and operate income-generating real estate properties. Such properties serve as a stream of annual revenue and mostly include warehouses, commercial buildings, malls, etc.

The pointers below elaborate the differences between the two in detail.

Liquidity

Ticket size for InvIT is large when compared to that of REIT. Most small investors cant afford to invest in InvIT. On the other hand, the lower unit price and trading size of REIT make it a viable option for small investors.

Income stability

Income for InvIT depends mainly on the scalability of tariffs. Hence, in most cases, income is quite uncertain. When compared to InvIT, REIT tend to provide a steady flow of income mostly because their income yielding properties come with extensive rental contracts.

Growth prospect

When it comes to InvIT, their growth prospect depends mainly on the success of acquisition and concession of assets. Whereas, the growth prospects of REITs rely on the redevelopment or acquisition of assets, new construction, etc.

Associated risks

The infrastructure sector is prone to react to regulatory policies and political interference. Thus, parking funds in infrastructure investment trusts often prove risky. On the other hand, REITs tend to hold properties that are either leased or owned on a freehold basis.

Conclusion

Both REIT and InvIT are new to our markets. So one has to understand these investment avenues in details before deciding to invest.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply