IPO - Initial Public Offers - Rishabh Instruments IPO Details in IPO's & MF's - About Company

Founded in 1982

Specializes in Test and Measuring Instruments and Industrial Control Products

Offers cost-effective solutions for energy ...

-

08-30-2023 02:16 PM

Rishabh Instruments IPO Details

About Company

- Founded in 1982

- Specializes in Test and Measuring Instruments and Industrial Control Products

- Offers cost-effective solutions for energy and process management

- Provides aluminum high-pressure die-casting services

- Acquired Lumel Alucast in 2011, expanding its global presence

- Offers services like mould design, EMI/EMC testing, and software solutions

- Operates in 4 segments: Electrical Automation Devices, Metering & Control Devices, Portable Test Instruments, Solar String Inverters

- 3 manufacturing units and 270+ global dealers

Company Financials

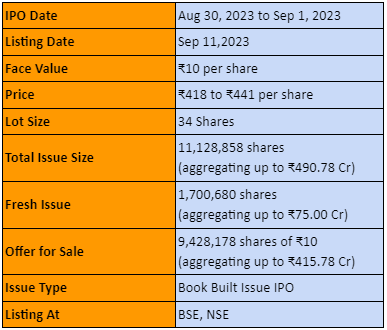

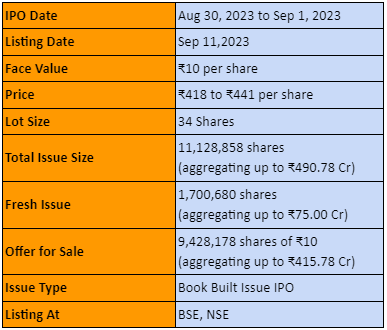

IPO Details

IPO Timetable

IPO Lot Size

To participate in the Rishabh Instruments IPO, one will need to buy a minimum of 34 shares, which will cost ₹14,994.

Promoter Holding

- Pre-Issue Share Holding: The promoters currently hold 80.67% of the shares.

- Post-Issue Share Holding: After the IPO, the promoter holding will be reduced to 70.68%.

Similar Threads

-

IPO - Initial Public Offers

-

IPO - Initial Public Offers

-

IPO - Initial Public Offers

-

IPO - Initial Public Offers

-

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply