IPO - Initial Public Offers - Abans Holdings Limited IPO in IPO's & MF's - Abans Holding Ltd operates a diversified global financial services business, providing Non-Banking Financial Company (NBFC) services, global institutional trading in ...

-

12-13-2022 02:51 PM

Abans Holdings Limited IPO

Abans Holding Ltd operates a diversified global financial services business, providing Non-Banking Financial Company (NBFC) services, global institutional trading in equities, commodities, and foreign exchange, private client stockbroking, depositary services, asset management services, investment advisory services, and wealth management services to corporates, institutional and high net worth individual clients.

It currently has active businesses across six countries including UK, Singapore, UAE, China, Mauritius, and India.

The company is primarily a holding company and operates all its businesses through the eighteen (18) subsidiaries (including three (3) direct subsidiaries and fifteen (15) indirect / step-down subsidiaries).

Objects of the Issue

- Future capital requirements for investments of Abans Holdings

- General Corporate Purpose

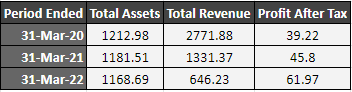

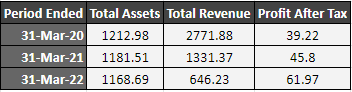

Company Financials

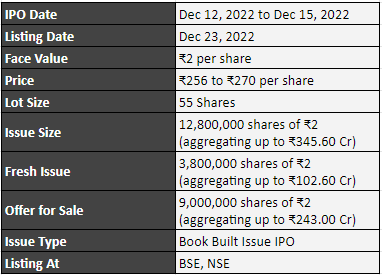

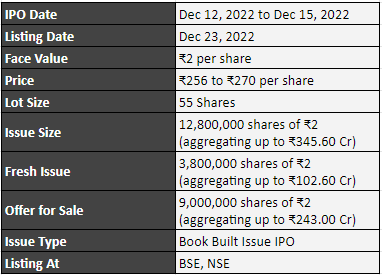

IPO Details

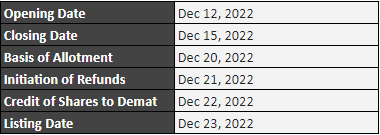

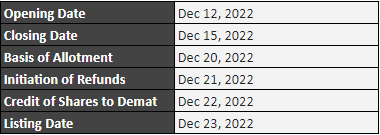

IPO Tentative Timetable

Abans Holdings IPO opens on Dec 12, 2022, and closes on Dec 15, 2022.

IPO Lot Size

The Abans Holdings IPO lot size is 55 shares. A retail-individual investor can apply for up to 13 lots (715 shares or ₹193,050).

Promoter Holding

Pre-Issue Share Holding - 97.42%

Post-Issue Share Holding - 72.09%

Similar Threads

-

-

-

-

IPO - Initial Public Offers

-

Fundamental / Technical Analysis

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply