Equity / Stocks - PSU banks on fire as stocks at fresh 52-week high; Do you own it? in MARKETS - The shares of Bank of Baroda, Bank of India, and Canara Bank hit their fresh 52-week high in the early ...

-

11-25-2022 01:58 PM

PSU banks on fire as stocks at fresh 52-week high; Do you own it?

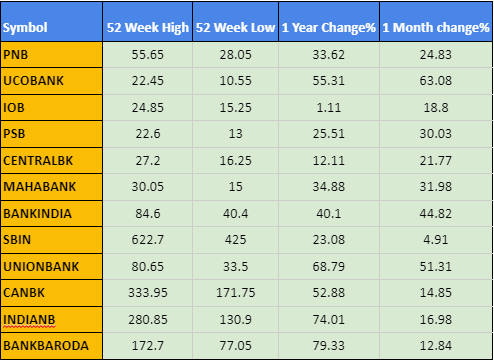

The shares of Bank of Baroda, Bank of India, and Canara Bank hit their fresh 52-week high in the early hours of trading on 23 November. The index of state-run lenders has gained nearly 63 percent so far this year, its best annual performance since 2014.

Among those that hit new 52-week highs were Bank of Baroda at ₹170.30, Bank of India ( ₹81), Canara Bank ( ₹326.55), Indian Bank ( ₹279.45), PNB (50.85). SBI also ended the session just 2.6% away from its 52 week high of ₹622.7 hit on November 7.

Yesterday Nifty Bank hits a fresh closing lifetime high. The strong buying in PSU bank stocks lifted the Nifty Bank index, comprising 12 stocks, to close at a new high of 43,075. From the Nifty PSU Bank index, as many as six stocks hit a fresh 52-week high price.

- Union Bank Rs 79.20,

- Bank of India Rs 83.25,

- Bank of Baroda at Rs 171.90,

- Canara Bank Rs 329.75,

- PNB Rs 51.20

- Indian Bank Rs 280.85.

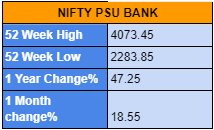

Nifty PSU Bank Performance:

Nifty PSU Bank index has gained more than 6 %in the last 5 sessions and 18 % in one month. In the 6 months, the index has rallied more than 60 %.

Look at the index monthly chart of last 8 years. It has reached the peak made in 2017. Index is at either make or break levels.

Disclaimer: This is NOT a recommendation to invest/buy. Persoanlly I avoid all PSU as their objective is to provide service to public at large and not to enhance share holder returns.

Visitors found this page by searching for:

Tags for this Thread

Register To Reply

Register To Reply