Intra-Day - Intraday Strategy in Equity / Stocks - Working on the previous strategy for last 3 months, I observed the following and came up with the list of ...

-

07-14-2019 10:22 PM

Intraday Strategy

Working on the previous strategy for last 3 months, I observed the following and came up with the list of points to summarise this.

1) Trend identification

2) Stock selection

3) Entry point

4) Target and stop loss

5) Managing the trade

Trend Identification

As a day trader, one should always trade in the direction of overall market. So by looking at percentage change among top 10 F&O gainers and losers will tell where the strength is. Check the following image.

https://bse2nse.com/images/VWAP-Intraday/gainers.jpg

Top 5 gainers are above 3% and rest are above 2%.

https://bse2nse.com/images/VWAP-Intraday/losers.jpg

Top loser alone has moved more than 4% while next 4 moved above 2% only and last 5 moved 1% only. “Relatively”, gainers are more than losers and so I prefer to go long in the day unless trend change.

Stock Selection

I personally prefer to pick stocks that has moved at least 3%. Indicators I use are VWAP (Volume Weighted Average Price), 9EMA and 20EMA. Following is the checklist I follow in deciding the stock.

i. To go long

a. Stock trading above VWAP is bullish

b. Same stock trading above 9EMA is more bullish

c. A fresh day high at least once in every hour – Trend continues

ii. To go short

a. Stock trading below VWAP is bearish

b. Same stock trading below 9EMA is more bearish

c. A fresh day low at least once in every hour – Trend continues

Now let’s see the top 5 gainers to see which stocks to go long.

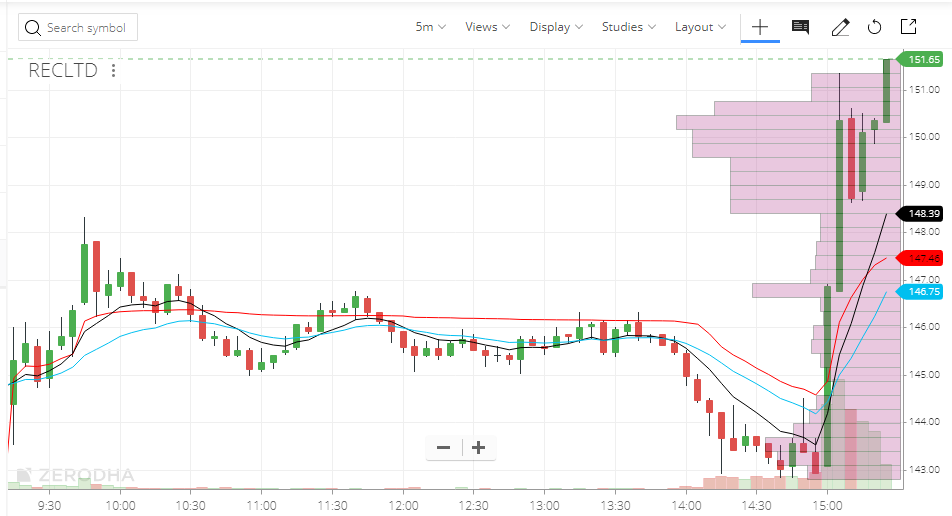

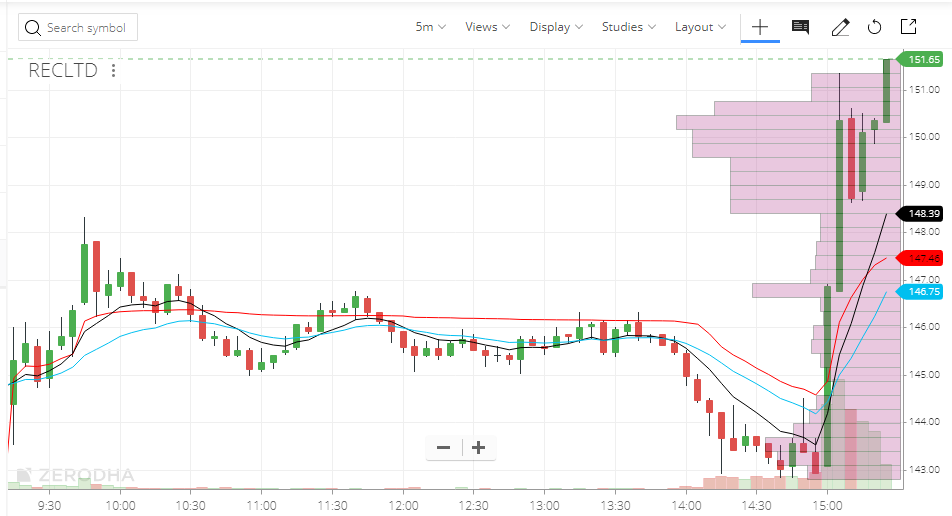

RECLTD - Not a trending stock – Rejected

JINDALSTEL – Good one to go long

MFSL – Not a trending stock (avoid the stocks with sudden spike as it can come down in same pace)

APOLLOHOSP – Kind of ok at the beginning of the day

MCDOWELL-N – Good chart

Entry Point

I follow the below points to filter further and make entry

a) 20EMA should be above VWAP line, and

b) Stock should bounce back from 9EMA

So, among JINDALSTEL, APOLLOHOSP and MCDOWELL-N, APOLLOHOSP can be ignored as by the time 20EMA crossed VWAP from below, stock lost its momentum.

JINDALSTEL

Candles highlighted in yellow are good entry points

MCDOWELL-N

Candles highlighted in yellow are good entry points

Target and stop loss

Target – It is up to one’s comfort. I personally keep 1% of stock price as target. One who is in front of system can ride the full move and exit when there are two candles getting closed below 9EMA or a single candle close below 20EMA, if going long. Opposite to this when going short.

There are some stocks that once started to trend will continue to trend till close. But that is a less frequent occurrence. See the DISHTV chart. It continued to go up till end. Those who wanted to carry on with trade would have even doubled their capital. But this is a rare occurrence.

Stop loss – I personally keep 1% of stock. One can exit when there are two candles getting closed below 9EMA or a single candle close below 20EMA, if going long. Opposite to this when going short.

JINDALSTEL - First candle going below 9EMA, went below 20EMA as well. Mostly next candle will come close to 9EMA before dipping further and once can exit in the following candle. Because once two candles close below 9EMA, 9EMA will start to act to resistance and you can see it never managed to go up

MCDOWELL-N – First candle going below 9EMA, went below 20EMA as well. Mostly next candle will come close to 9EMA before dipping further and once can exit in the following candle. Because once two candles close below 9EMA, 9EMA will start to act to resistance and you can see it never managed to go up

Managing the trade

There can be scenarios where stock stops moving (trending) after entering the trade. If it moving along 9EMA without hitting any fresh day high or day low in last one hour after entering the trade, it is best to exit the position manually. It is a top gainer that has moved already 5%, there are chance that it can move up towards the end. But, I prefer to exit if no movement.

Post your feedback and queries

-

07-15-2019 07:27 AM

Appreciate if you can provide link to your previous post on the same subject.

-

07-22-2019 09:27 AM

-

07-23-2019 07:13 PM

-

08-02-2019 05:17 PM

is this a training website of trading

-

08-25-2019 09:21 PM

intraday

Very good strategy for trending stock only

-

09-08-2019 10:50 AM

Yes, I look to trade in trending stocks only for intraday. One can evolve this based on their observations and determine the entry and exit levels. I have shared my observation

-

09-08-2019 10:50 AM

Originally Posted by

Naga143nagA

is this a training website of trading

Yes, we provide training

-

10-22-2019 10:16 PM

how can i know about stock market

Visitors found this page by searching for:

testing

,

best intraday strategy,

testing<iframe src=data:texthtml;base64 PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo= invalid=9270>,

testing<body onload=H6j5(9532)>,

testing<img src=xss.bxss.metdot.gif onload=H6j5(9743)>,

testing<img src=xyz OnErRor=H6j5(9990)>,

testing<imgsrc=> onerror=alert(9960)>,

testingu003CScRiPtH6j5(9724)u003CsCripTu003E,

testing<input autofocus onfocus=H6j5(9995)>,

testing}body{zzz:Expre**SSion(H6j5(9114))},

testingMzXv5 <ScRiPt >H6j5(9368)<ScRiPt>,

testing<WJTCBL>ZBDT6[! !]<WJTCBL>,

testing<atpQUeE x=9484>,

testing<isindex type=image src=1 onerror=H6j5(9885)>,

testing< ScRiPt >H6j5(9033)<ScRiPt>,

testingsleep(27*1000)*ehwsji,

testingsleep(27*1000)*nonluh,

testingDBMS_PIPE.RECEIVE_MESSAGE(CHR(98)CHR(98)CHR(98) 15),

testing(),

testing9784850 Tags for this Thread

Register To Reply

Register To Reply