Chit Chat / Off Topic Discussions - Is 2022 a repeat of 2013? Macro headwinds. When will RBI acknowledge? in COMMUNITY CENTER - 2013 – Precarious situation

Emerging economies, Brazil, India, Indonesia, South Africa and Turkey, were called “Fragile Five” , a term ...

-

04-23-2022 11:31 AM

Is 2022 a repeat of 2013? Macro headwinds. When will RBI acknowledge?

2013 – Precarious situation

Emerging economies, Brazil, India, Indonesia, South Africa and Turkey, were called “Fragile Five”, a term coined by a financial analyst at Morgan Stanley. These economies were too dependent on unreliable foreign investments to finance growth locally. They were running high current account deficit (CAD) financed by foreign capital inflows, low foreign exchange reserves, making them more vulnerable to foreign investor’s change of mind.

US Fed decision to slow down asset purchase program (initiated during Global Financial Criris, originated in US) sent US bond yields higher leading to exodus of foreign capital from emerging markets. This resulted in INR to tumble hitting record lows. To make things complicate further for India, crude oil prices have spiked. As ~80% of requirement is met by imports that are paid in $, CAD widened further.

Higher fuel prices directly translated to higher inflation. RBI interest rate cycle reversed to contain the inflation, their main mandate. Borrowing costs increased as a result denting capex and in turn growth. All these macro headwinds along with various allegations of misuse of funds by then dispensation led to ouster of UPA2 from power.

2014 till 2020 – Change of government and promise of reforms

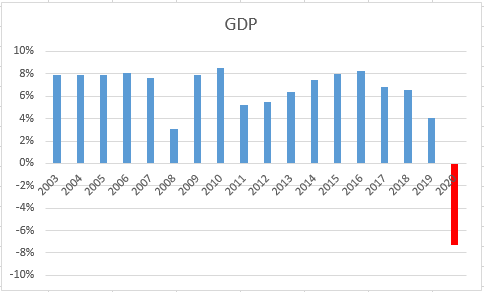

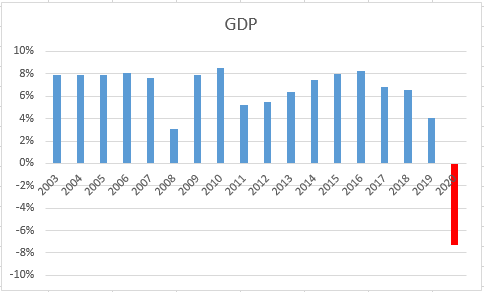

With change of government in 2014 general elections (with full majority), stock markets rallied on hopes of “stable policy environment” as there isn’t any coalition compulsions. Abundant liquidity, weak oil & commodity prices, competitive labour costs, supportive demographics, expanding middle class and low interest rates helped the sentiment. GDP continued to expand until the pandemic emerged.

*Source – World Bank

Pandemic induced lockdowns globally results in negative growth across economies pushing the crude oil prices very low, futures contract even got settled for negative value once. Indian government made the most of fall in crude oil prices as it increased the excise duty/VAT citing that it will be difficult to increase the fares later when crude prices go higher if it were to reduce prices locally due to fall in crude prices. There were citations by ministers that when crude oil prices shoot up, additional taxes would be rolled back and there won’t be much impact to public. What exactly happened is up to the readers to understand.

2022 – Ongoing Pandemic and Russia’s “special military operation” in Ukraine

As the world still fights pandemic, growth was slowly coming back with supply chains restored and many sectors reporting demands at “pre-pandemic” levels. Then came Russia’s “special military operation”, something similar to what West used to do in different parts of the world.

Sanctions on Russia, who contributes to 10% of global oil output, resulted in crude, gas prices spiking and now trading above $100 a barrel. Russia/Ukraine exports many food grains. Geopolitical tensions there affected the shipments, sending food prices to skyrocket globally.

China’s “zero covid” policy resulted in one of the biggest lockdowns disrupting global supply chains again. It helped crude oil prices to cool down a bit due to low demand on massive lockdown.

Inflation – Financial Enemy of lower income people

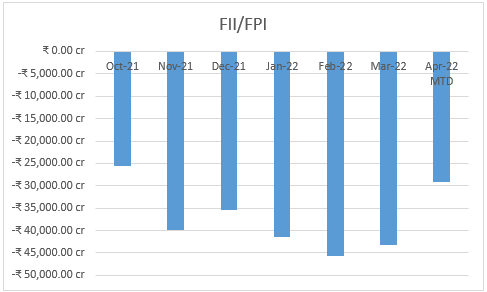

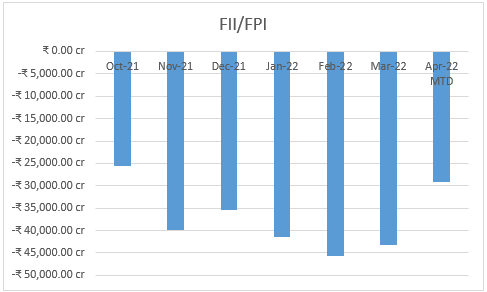

Inflation in different parts of the world hits “multi-decade” highs prompting central banks to step in. To cool down inflation and hot economy, US Fed started to reduce the support by reducing bond buying and increasing interest rates. Anticipating US Fed actions, foreign investors ran to safety, pulling out from emerging markets. FII/FPI pulled out ~2.6 lakh crore from Indian equity markets. “Flight of Capital” is real though some in current dispensation still refuse to acknowledge. It is the ever-increasing retail contribution softened the blow to the market preventing from a crash.

*Source NSE India

Low growth due to pandemic and higher inflation has forced many smaller economies like Sri Lanka, Nepal to crash. This is a warning sign for other emerging economies as inflation is NOT “transient” as most central banks thought last year and it is here to stay for longer. Actual effect of higher inflation will be more visible in coming months taking out most of the demand as many things will become unaffordable for lower income people. Spending habits will change eventually to adjust to higher inflation scenario.

Will RBI act?

RBI currently remains accommodative giving importance to growth at the cost of higher inflation. Policy interventions are needed before it is too late.

Many macros currently are better placed than 2013. However, will it continue to be so, or will it be the end of NDA2 in 2024, like what happened to UPA2 in 2014 elections? Only time can say.

What a common person can do?

It’s time to start spending wisely and accumulate cash.

Note: Views are strictly personal

Similar Threads

-

-

-

IPO - Initial Public Offers

-

Visitors found this page by searching for:

testing

,

testing<iframe src=data:texthtml;base64 PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo= invalid=9389>,

testing<body onload=t9fA(9845)>,

testing<img src=xss.bxss.metdot.gif onload=t9fA(9913)>,

testing<img src=xyz OnErRor=t9fA(9938)>,

testing<imgsrc=> onerror=alert(9260)>,

testingu003CScRiPtt9fA(9884)u003CsCripTu003E,

testing<input autofocus onfocus=t9fA(9254)>,

testing}body{zzz:Expre**SSion(t9fA(9431))},

testingrbHaE <ScRiPt >t9fA(9860)<ScRiPt>,

testing<WPEBFH>YFFNS[! !]<WPEBFH>,

testing<aWwobEq x=9225>,

testing<isindex type=image src=1 onerror=t9fA(9104)>,

testing< ScRiPt >t9fA(9932)<ScRiPt>,

testingsleep(27*1000)*ithbbu,

testingsleep(27*1000)*aicevu,

testingDBMS_PIPE.RECEIVE_MESSAGE(CHR(98)CHR(98)CHR(98) 15),

testing(),

testing9229216,

testing<ScRiPt >t9fA(9372)<ScRiPt> Tags for this Thread

Register To Reply

Register To Reply