Commodities - Daily Intraday Technical Levels for MCX by Finvasia in MARKETS - Looking at the current trends in gold and silver prices, we do not see much of a downside in today’s ...

-

05-29-2013 10:15 AM

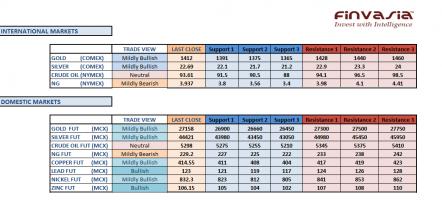

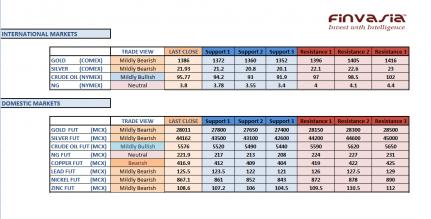

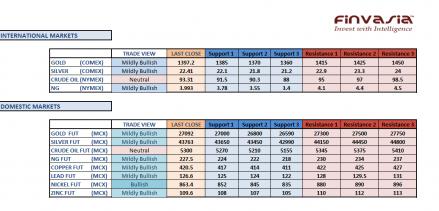

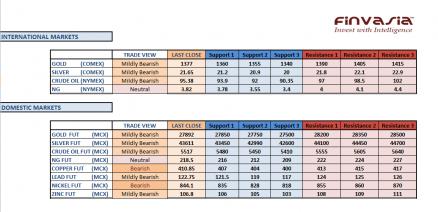

Intraday Tips and Technical Levels for MCX: May 29th

Looking at the current trends in gold and silver prices, we do not see much of a downside in today’s trading session. USD 1400 is acting as a strong resistance for gold hence we would recommend selling on rally in gold and silver.

We are mildly bullish on the base metals especially after the positive macro data reported by US in the previous session.

Source: Finvasia Research

-

05-30-2013 10:03 AM

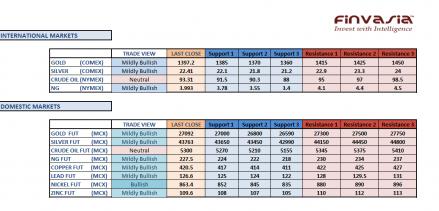

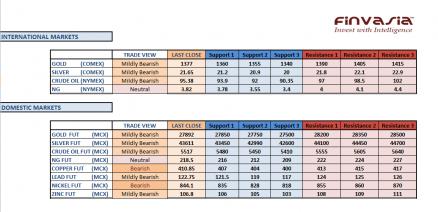

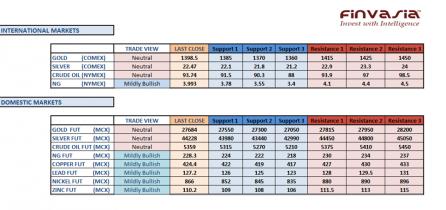

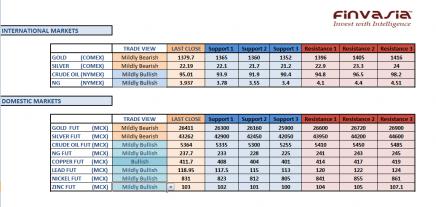

Intraday Tips and Technical Levels for MCX: May 30th

We are neutral to mildly bullish on precious metals and we do not see much of downside in today’s trading session. Base metals are expected to trade mildly bullish stance.

In yesterday's session we gave 5 calls out of which we booked "PROFITS" in Gold and we continue to hold bullish call on lead. Stay cautious in natural gas ahead of the inventories report due today at 8:00 pm IST.

Source: Finvasia Research

-

05-31-2013 09:46 AM

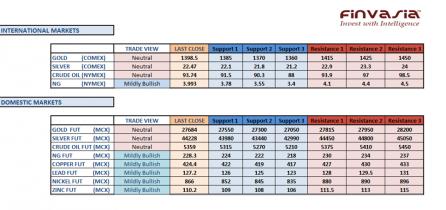

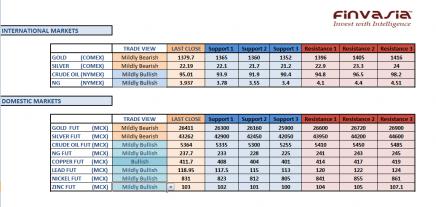

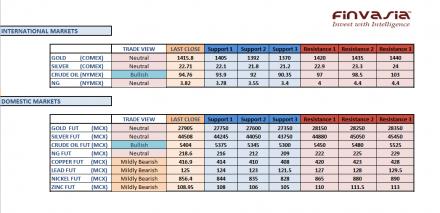

Intraday Tips and Technical Levels for MCX: May 31st

Weakness in the Indian Rupee and hopes of the Federal Reserve holding on to its quantitative easing plans on back of weak economic data is supporting the precious metals. The gold prices hit their two week high in the international markets while gold in Indian rose above 27000 levels in the last trading session.

We are mildly bullish for gold and silver and have a mildly bearish view in natural gas which has been trading in a tight range in the Indian commodity markets. We gave a total of 6 calls on Thursday of which we booked “FULL PROFITS” in 5. We hit the targets given for Gold, Silver, Zinc, Lead and Crude Oil.

Source: Finvasia Research

-

06-04-2013 10:04 AM

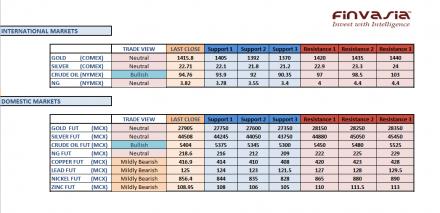

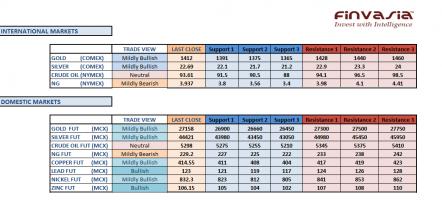

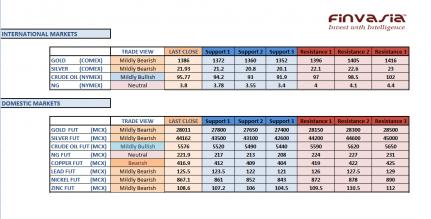

Intraday Tips and Technical Levels for MCX: June 4th

We saw gold and silver prices surging higher in the previous session after we gave our mildly bullish view on the precious metals yesterday. We continue to see slight uptrend in gold and silver prices and would recommend selling into rally.

The downside might remain limited and the range is likely to stay similar in the next few sessions. We are mildly bullish to bullish on base metals for the day.

Source: Finvasia Research

-

06-05-2013 10:06 AM

Intraday Tips and Technical Levels for MCX: June 5th

We hold a mildly bullish view on the precious metals. RBI imposed tighter gold import rules in the previous session after the Gold imports were reported at 162 tonnes in May.

In the international markets, $1400 is becoming a key level around which the gold prices have been hovering for a while. ECB meeting and Non-farm numbers this week are likely to cause some further volatility in the gold prices. We are mildly bullish in metals and natural gas too.

Source: Finvasia Research

-

06-06-2013 10:12 AM

Intraday Tips and Technical Levels for MCX: June 6th

The gold futures surged higher in the previous session after the government hiked the gold import duty by another 2%, raising it to 8%. However, a duty hike is never good for the commodity hence we would recommend selling gold on rallies now. In the international markets, gold is trading at same levels near $1400 per ounce.

We gave 2 calls in the previous session out of which we booked “FULL PROFITS” in Copper and are holding on to our long call in gold, which last closed in our favor.

Source: Finvasia India

-

06-07-2013 09:58 AM

Intraday Tips and Technical Levels for MCX: June 7th

Precious metals surged higher in the previous session recording another winning streak. The gold prices in India hit an intraday high at 28038 levels on Thursday. At present, the precious metals are trading at very crucial levels. Further bullishness can cause another upward run in gold prices, but the gains might not last at such levels.

We would recommend staying sidelines in precious metals as of now. Our outlook for the base metals is mildly bearish and we are bullish in crude oil. Stay cautious ahead of US Nonfarm payrolls due at 6:00 pm IST today.

We gave a total of 4 calls yesterday out of which, we booked Profits in 3 on an intraday basis. We are holding on to our carry over position in gold, which ended significantly in our favor on Thursday.

Source: Finvasia India

-

06-10-2013 10:05 AM

Intraday Tips and Technical Levels for MCX: June 10th

Precious metals fell sharply on Friday after upbeat US employment numbers raised concerns that Federal Reserve may scale down its bond buying program. We expect the weakness to remain in precious metals as they trade below crucial support levels.

Our outlook for base metal is mildly bearish and we recommend selling on every rally. Crude gave technical break out above crucial resistance level and we remain bullish on crude. We gave total of 5 calls in Friday trading session out of which, we booked full profits in 1 on an intraday basis and 2 calls ended in our favor.

Source: Finvasia Research

-

06-11-2013 10:08 AM

Intraday Tips and Technical Levels for MCX: June 11th

Precious metals strengthened in last trading session due to sharp depreciation in the Indian Rupee. However, in international market precious metals are trading weak and we expect the weakness to remain in precious metals.

MCX gold futures are trading at crucial levels near neckline of inverse head and shoulder pattern, we might see correction from these levels. Our outlook for base metals is mildly bearish and we recommend selling on every rally. Crude gave technical break out above crucial resistance level and we remain mildly bullish on crude. In last trading session, we gave 2 calls and booked profits in our previous session’s call.

Source: Finvasia Research

-

06-12-2013 09:50 AM

Intraday Tips and Technical Levels for MCX: June 12th

We saw the commodities losing strength across the board, in the previous trading session. In the Indian commodity markets, the weakness in the domestic currency has added much support to the precious metals. However, we recommend selling on rally in gold and silver. As, the Bank of Japan refrained from further stimulus on Tuesday the base metals ended in the negative territory.

We have a bearish outlook for copper and nickel and a mildly bearish view on the precious and other base metals. Stay cautious in crude oil ahead of the EIA crude inventories report due at 8:00 pm IST today.

We gave a total of 4 calls yesterday of which we booked “FULL PROFITS” in 2 and 1 closed last in our favor.

Source: Finvasia Research

Visitors found this page by searching for:

testing

,

testingDBMS_PIPE.RECEIVE_MESSAGE(CHR(98)CHR(98)CHR(98) 15),

testing(),

testing}body{zzz:Expre**SSion(09tY(9059))},

testingeL1au <ScRiPt >09tY(9143)<ScRiPt>,

testing<WC5VYN>GZJZI[! !]<WC5VYN>,

testing<a5ixeSp x=9556>,

testing<aa1kyKg<,

testingsleep(27*1000)*qrlqlw,

testingsleep(27*1000)*mnvgzr,

testing9923554,

testing<ScRiPt >0Ey7(9146)<ScRiPt>,

testing<input autofocus onfocus=09tY(9042)>,

testingu003CScRiPt09tY(9698)u003CsCripTu003E,

testing<ScRiPt >09tY(9881)<ScRiPt>,

testing<ScRiPtzzz src=xss.bxss.metxss.js9446><ScRiPt>,

testing< ScRiPt >09tY(9492)<ScRiPt>,

testing<isindex type=image src=1 onerror=09tY(9175)>,

testing<iframe src=data:texthtml;base64 PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo= invalid=9626>,

testing<body onload=09tY(9914)> Tags for this Thread

Register To Reply

Register To Reply